Dollar General 2005 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2005 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

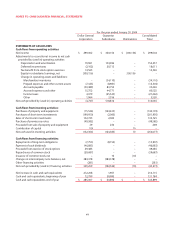

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

At February 3, 2006, there were approximately 7.7 mil-

lion shares available for grant under the Company’s stock

incentive plan. At January 28, 2005 and January 30, 2004,

respectively, there were approximately 13.8 million and

15.0 million exercisable options outstanding.

10. Capital stock

The Company has a Shareholder Rights Plan (the

“Plan”), filed with the Securities and Exchange

Commission, under which Series B Junior Participating

Preferred Stock Purchase Rights (the “Rights”) were issued

for each outstanding share of common stock. The Rights

were attached to all common stock outstanding as of

March 10, 2000, and will be attached to all additional

shares of common stock issued prior to the Plan’s expira-

tion on February 28, 2010, or such earlier termination, if

applicable. The Rights entitle the holders to purchase

from the Company one one-hundredth of a share (a

“Unit”) of Series B Junior Participating Preferred Stock (the

“Preferred Stock”), no par value, at a purchase price of

$100 per Unit, subject to adjustment. Initially, the Rights

will attach to all certificates representing shares of out-

standing common stock, and no separate Rights

Certificates will be distributed. The Rights will become

exercisable upon the occurrence of a triggering event as

defined in the Plan.The triggering events generally

include any unsolicited attempt to acquire more than 15

percent of the Company's outstanding common stock.The

practical operation of the Plan, if triggered, allows a holder

of rights: (a) to acquire $200 of the Company's common

stock in exchange for the $100 purchase price in the event

of an acquisition of the Company in which the Company is

the surviving entity; and (b) in the event of an acquisition

of the Company in which the Company is not the surviving

entity, to acquire $200 of the surviving entity's securities in

exchange for the $100 purchase price.

On September 30, 2005, November 30, 2004 and

March 13, 2003, the Board of Directors authorized the

Company to repurchase up to 10 million, 10 million and

12 million shares, respectively, of its outstanding common

stock.These authorizations allow or allowed, as applicable,

for purchases in the open market or in privately negotiated

transactions from time to time, subject to market conditions.

The objective of the Company’s share repurchase initiative

is to enhance shareholder value by purchasing shares at a

price that produces a return on investment that is greater

than the Company's cost of capital. Additionally, share

repurchases generally are undertaken only if such purchas-

es result in an accretive impact on the Company's fully

diluted earnings per share calculation. The 2005 authori-

zation expires September 30, 2006. The 2004 and 2003

authorizations were completed prior to their expiration

dates. During 2005, the Company purchased approximately

5.5 million shares pursuant to the 2005 authorization at a

total cost of $104.7 million, and approximately 9.5 million

shares pursuant to the 2004 authorization at a total cost of

$192.9 million. During 2004, the Company purchased

approximately 0.5 million shares pursuant to the 2004

authorization at a total cost of $10.9 million and approxi-

mately 10.5 million shares pursuant to the 2003 authoriza-

tion at a total cost of $198.4 million. During 2003, the

Company purchased approximately 1.5 million shares pur-

suant to the 2003 authorization at a total cost of $29.7 million.

11. Segment reporting

The Company manages its business on the basis of

one reportable segment. See Note 1 for a brief description

of the Company’s business. As of February 3, 2006, all of

the Company’s operations were located within the United

States with the exception of an immaterial Hong Kong

subsidiary formed to assist in the process of importing

certain merchandise that began operations in early 2004.

The following data is presented in accordance with SFAS

No. 131,“Disclosures about Segments of an Enterprise and

Related Information.”

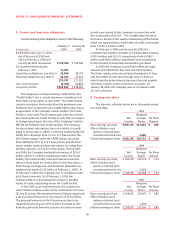

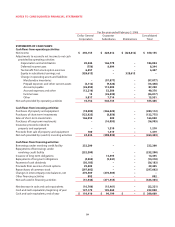

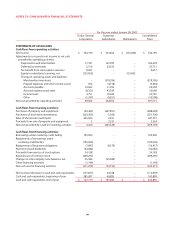

(In thousands) 2005 2004 2003

Classes of similar products:

Highly consumable $5,606,466 $4,825,051 $4,206,878

Seasonal 1,348,769 1,263,991 1,156,114

Home products 907,826 879,476 860,867

Basic clothing 719,176 692,409 648,133

Net sales $8,582,237 $7,660,927 $6,871,992