Dollar General 2005 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2005 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

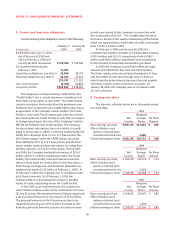

Beginning in fiscal year 2003, the Company began

investing in auction rate securities, which are debt instru-

ments having longer-dated (in some cases, many years)

legal maturities, but with interest rates that are generally

reset every 28-35 days under an auction system. Because

auction rate securities are frequently re-priced, they trade

in the market like short-term investments. As available-

for-sale securities, these investments are carried at fair

value, which approximates cost given that the average

duration of such securities held by the Company is less

than 40 days. Despite the liquid nature of these invest-

ments, the Company categorizes them as short-term

investments instead of cash and cash equivalents due to

the underlying legal maturities of such securities.

However, they have been classified as current assets as

they are generally available to support the Company’s

current operations.

In fiscal year 2005, the Company’s South Carolina-

based wholly owned captive insurance subsidiary, Ashley

River Insurance Company (“ARIC”), had investments in U.S.

Government securities, short and long-term corporate

obligations, and asset backed obligations. These invest-

ments are held pursuant to South Carolina regulatory

requirements to maintain 30% of ARIC’s liability for

insurance losses in the form of certain specified types of

assets and as such, these investments are not available for

general corporate purposes. At February 3, 2006, these

investments included the following amounts reflected in

the Company’s consolidated balance sheet: cash and cash

equivalents of $17.6 million, short-term investments of

$8.9 million and long-term investments included in other

assets of $16.9 million.

The Company’s investment in the secured promissory

notes issued by the third-party entity from which the

Company leases its DC in South Boston,Virginia, as

discussed in Note 7, has been classified as a held-to-

maturity security. Historical cost information pertaining

to investments in mutual funds by participants in the

Company’s supplemental retirement and compensation

deferral plans classified as trading securities is not readily

available to the Company.

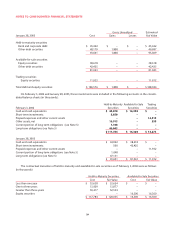

On February 3, 2006 and January 28, 2005, held-to-maturity, available-for-sale and trading securities consisted of the

following (in thousands):

Gross Unrealized Estimated

February 3, 2006 Cost Gains Losses Fair Value

Held-to-maturity securities

Bank and corporate debt $ 59,196 $ – $ 55 $ 59,141

U.S. Government securities 7,590 – 12 7,578

Asset-backed securities 3,847 5 6 3,846

Other debt securities 47,151 2,319 – 49,470

117,784 2,324 73 120,035

Available-for-sale securities

Equity securities 16,300 – – 16,300

Trading securities

Equity securities 14,873 – – 14,873

Total debt and equity securities $148,957 $2,324 $73 $151,208