Dollar General 2005 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2005 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

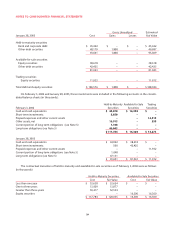

Basic earnings per share was computed by dividing

net income by the weighted average number of shares of

common stock outstanding during the year. Diluted earn-

ings per share was determined based on the dilutive effect

of stock options using the treasury stock method.

Options to purchase shares of common stock that

were outstanding at the end of the respective fiscal year,

but were not included in the computation of diluted earn-

ings per share because the options’ exercise prices were

greater than the average market price of the common

shares, were 7.9 million, 7.3 million and 5.1 million in 2005,

2004 and 2003, respectively.

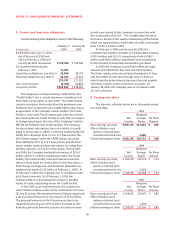

7. Commitments and contingencies

As of February 3, 2006, the Company was committed

under capital and operating lease agreements and financ-

ing obligations for most of its retail stores, four of its DCs,

and certain of its furniture, fixtures and equipment. The

majority of the Company’s stores are subject to short-term

leases (usually with initial or primary terms of three to five

years) with multiple renewal options when available. The

Company also has stores subject to build-to-suit arrange-

ments with landlords, which typically carry a primary lease

term of between 7 and 10 years with multiple renewal

options. Approximately half of the stores have provisions

for contingent rentals based upon a percentage of defined

sales volume. Certain leases contain restrictive covenants.

As of February 3, 2006, the Company is not aware of any

material violations of such covenants.

In January 1999 and April 1997, the Company sold its

DCs located in Ardmore, Oklahoma and South Boston,

Virginia, respectively, for 100% cash consideration.

Concurrent with the sale transactions, the Company leased

the properties back for periods of 23 and 25 years, respec-

tively. The transactions have been recorded as financing

obligations rather than sales as a result of, among other

things, the lessor’s ability to put the properties back to the

Company under certain circumstances. The property and

equipment, along with the related lease obligations, asso-

ciated with these transactions are recorded in the consoli-

dated balance sheets.

In May 2003, the Company purchased two secured

promissory notes (the “DC Notes”) from Principal Life

Insurance Company totaling $49.6 million. The DC Notes

represent debt issued by a third party entity from which

the Company leases its DC in South Boston,Virginia. The

DC Notes are being accounted for as “held to maturity”

debt securities in accordance with the provisions of SFAS

No. 115. However, by acquiring the DC Notes, the

Company is holding the debt instruments pertaining to its

lease financing obligation and, because a legal right of off-

set exists, has reflected the acquired DC Notes as a reduc-

tion of its outstanding financing obligations in its consoli-

dated financial statements in accordance with the provi-

sions of FASB Interpretation No. 39,“Offsetting of Amounts

Related to Certain Contracts – An Interpretation of APB

Opinion No. 10 and FASB Statement No. 105.” There was

no gain or loss recognized as a result of this transaction.

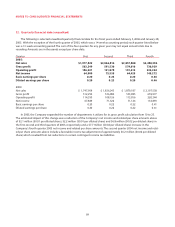

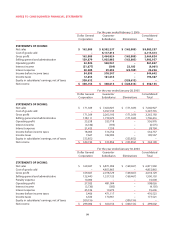

Future minimum payments as of February 3, 2006, for

capital leases, financing obligations and operating leases

are as follows:

Capital Financing Operating

(In thousands) Leases Obligations Leases

2006 $ 9,293 $ 9,283 $ 281,615

2007 5,895 9,564 235,959

2008 3,552 9,510 188,266

2009 1,302 8,915 149,196

2010 599 8,915 120,270

Thereafter 7,635 128,992 393,542

Total minimum payments 28,276 175,179 $1,368,848

Less: imputed interest (6,248) (85,593)

Present value of net

minimum lease payments 22,028 89,586

Less: purchased

promissory notes – (47,151)

22,028 42,435

Less: current portion, net (7,862) (923)

Long-term portion $ 14,166 $ 41,512

Capital leases were discounted at an effective interest

rate of approximately 7.9% at February 3, 2006. The gross

amount of property and equipment recorded under

capital leases and financing obligations at February 3,

2006 and January 28, 2005, was $150.2 million and $183.8

million, respectively. Accumulated depreciation on prop-

erty and equipment under capital leases and financing

obligations at February 3, 2006 and January 28, 2005, was

$70.5 million and $94.5 million, respectively.

Rent expense under all operating leases was as follows:

(In thousands) 2005 2004 2003

Minimum rentals $295,061 $253,364 $217,704

Contingent rentals 17,245 15,417 14,302

$312,306 $268,781 $232,006