Dollar General 2005 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2005 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

20

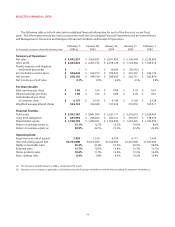

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Net Sales. Increases in 2005 net sales resulted primari-

ly from opening additional stores, including 609 net new

stores in 2005, and a same-store sales increase of 2.0% for

2005 compared to 2004. Same-store sales calculations for

2005 and prior include only those stores that were open

both at the end of that period and at the beginning of the

preceding fiscal year. Same-store sales increases are

calculated based on the comparable calendar weeks

in the prior year. Accordingly, the same store sales

percentage for 2005 discussed above excludes sales from

the 53rd week as there was no comparable week in 2004.

The increase in same-store sales accounted for $144.2

million of the increase in sales. Stores opened since the

beginning of 2004, as well as the $162.9 million impact of

the 53rd week of sales in fiscal year 2005 for all stores were

the primary contributors to the remaining $777.1 million

sales increase during 2005. The increase in same-store

sales is primarily attributable to an increase in average

customer purchase.

The Company has recently revised and published its

method for determining the stores that are included in the

Company’s publicly released same-store sales calculations.

Beginning in fiscal 2006, the Company now provides same-

store sales calculations for those stores that have been open

at least 13 full fiscal months and remain open at the end of

the reporting period. Using the revised methodology, the

same-store sales increase in 2005 was 2.2%.

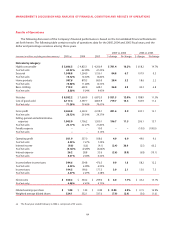

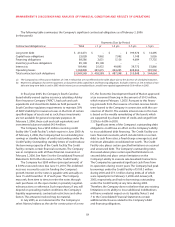

The Company monitors its sales internally by the four

major categories noted in the table above. The Company’s

merchandising mix in recent years has shifted to faster-

turning consumable products versus seasonal, home

products and clothing.This has been driven by customer

wants and needs in the marketplace. As a result, over the

past three years the highly consumable category has

become a greater percentage of the Company’s overall

sales mix while the percentages of the seasonal, home

products and basic clothing categories have declined.

Accordingly, the Company’s sales increase by merchandise

category in 2005 compared to 2004 was primarily attribut-

able to the highly consumable category, which increased

by $781.4 million, or 16.2%. The Company believes that

future sales growth is dependent upon an increase in the

number of customer transactions as well as an increase in

the dollar value of the average transaction. The Company

continually reviews its merchandise mix and strives to

adjust it when deemed necessary as a part of its ongoing

efforts to improve overall sales and gross profit.These

ongoing reviews may result in a shift in the Company’s

merchandising strategy which could increase permanent

markdowns in the future.

The Company’s sales increase in 2004 compared to

2003 resulted primarily from opening additional stores,

including 620 net new stores in 2004, and a same-store

sales increase of 3.2% for 2004 compared to 2003. The

increase in same-store sales accounted for $204.0 million

of the increase in sales while stores opened since the

beginning of 2003 were the primary contributors to the

remaining $585.0 million sales increase during 2004.The

Company’s sales increase in 2004 was primarily attributa-

ble to the highly consumable category, which increased by

$618.2 million, or 14.7%.

Gross Profit. The gross profit rate declined by 82 basis

points in 2005 as compared with 2004 due to a number of

factors, including but not limited to: lower sales (as a per-

centage of total sales) in the Company’s seasonal, home

products and basic clothing categories, which have higher

than average markups; an increase in markdowns as a

percentage of sales primarily as a result of the Company’s

initiative to reduce per-store inventory; higher transporta-

tion expenses primarily attributable to increased fuel

costs; an increase in the Company’s shrink rate; and an

estimated $5.2 million reduction resulting from the

expansion of the number of departments utilized for the

gross profit calculation from 10 to 23, as further described

below under “Critical Accounting Policies and Estimates.”

These factors were partially offset by higher average

mark-ups on the Company’s beginning inventory in

2005 as compared with 2004. In 2005 and 2004, the

Company experienced inventory shrinkage of 3.22%

and 3.05%, respectively.

The gross profit rate increased 17 basis points in 2004

as compared with 2003. Although the Company’s gross

profit rate was pressured by sales mix shifts to more highly

consumable items, which typically carry lower gross profit

rates, the Company was able to more than offset this

through increases in gross markups on all merchandise

categories in 2004. More specific factors include higher

initial mark-ups on merchandise received during 2004 as

compared with 2003, achieved primarily from the positive

impact of opportunistic purchasing, renegotiating product

costs with several key suppliers, selective price increases,

and an increase in various performance-based vendor

rebates; and higher average mark-ups on the Company’s

beginning inventory in 2004 as compared to 2003, which

represents the cumulative impact of higher margin pur-

chases over time. These components of gross profit, which

positively impacted the Company’s results, were partially

offset by an increase in transportation expenses as a per-

centage of sales, resulting primarily from higher fuel costs