Dollar General 2005 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2005 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

For Dollar General, 2005

proved to be a year of significant

accomplishments in positioning

the Company to meet its long-term

objectives. While it was a difficult

year for the Company in some

respects, we remain on target with

regard to our strategic plan.

In 2005, we saw the organiza-

tion grow and become stronger

and more competitive. We added

management expertise, drawing

both from inside and outside the

Company. We experienced the ini-

tial successes of our EZstore efforts

and Project Gold Standard and

learned how to make these projects

even more effective. In March

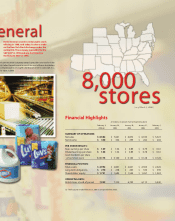

2006, we celebrated the opening

of our 8,000th store, strengthening

our claim as the leader in our sector

and the operator of more stores

than any other retailer in the US.

Some of our other accomplish-

ments for the year (a 53-week

fiscal year) include:

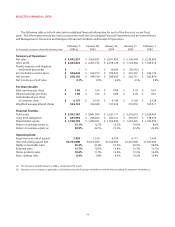

•We added $921 million of new

revenue, growing net sales by 12

percent to $8.6 billion, while same-

store sales increased 2.0 percent.

•We produced $350 million of net

income,or 4.1 percent of net

sales. Earnings per share were

$1.08, up 3.8 percent over 2004.

•We generated $251 million in

free cash flow.* We increased

our per share dividend by over

nine percent and paid cash

dividends to shareholders of

$56 million, or 17.5 cents per

share. We repurchased approxi-

mately 15 million shares of our

outstanding common stock.

•Standard and Poor’s raised the

Company’s credit rating to

investment grade.

•We opened 734 new stores,

including 29 new Dollar General

Markets.By fiscal year-end, we

operated 7,929 stores in 31

states,including 44 Dollar

General Markets.

•We opened our eighth distribu-

tion center in South Carolina in

June 2005 and began construc-

tion on our ninth distribution

center in Marion, Indiana.

•By fiscal year-end, 3,825 stores

were operating as EZstores, using

our newly engineered processes to

run more effectively and efficiently.

We saw our efforts during

2003 and 2004 begin to pay off

nicely during the first three quarters

of 2005. Illustrating that success:

through three quarters, the Company

posted same-store sales growth of

3.4 percent, which compared very

favorably with our competitors.

However, in the fourth quarter, our

everyday low price model did not

perform well against the height-

ened holiday promotional activity

of other retailers. Same-store sales

dropped by 1.6 percent in the

fourth quarter.

I believe that the poor per-

formance in the fourth quarter

was a short-term misstep resulting

from a number of factors rather

than a sign of long-term weakness

in our basic operating model. First,

we believe the external economic

environment, particularly higher

fuel costs, unemployment and

consumer debt, negatively impact-

ed our consumers, forcing trip

consolidation and deferred discre-

tionary spending. We know the

period was difficult for all retailers

serving the lower income customer,

and the intensified promotional

Fellow Shareholder:

Left to right: Beryl J. Buley, division president of merchandising, marketing and

supply chain; Challis M. Lowe, executive vice president of human resources;

Kathleen R. Guion, division president of store operations and store development;

David A. Perdue, chairman and CEO; Susan S. Lanigan, executive vice

president and general counsel; David M. Tehle, executive vice president and CFO.

* Please see “Non-GAAP disclosures” contained

in Management’s Discussion and Analysis of

Financial Condition and Results of Operations

on page 29.