Dollar General 2005 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2005 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

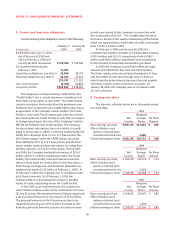

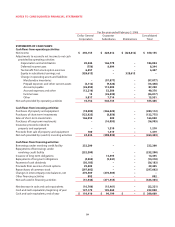

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

As of January 28, 2005

Dollar General Guarantor Consolidated

Corporation Subsidiaries Eliminations Total

BALANCE SHEET:

ASSETS

Current assets:

Cash and cash equivalents $ 127,170 $ 105,660 $ – $ 232,830

Short-term investments 42,425 500 – 42,925

Merchandise inventories – 1,376,537 – 1,376,537

Deferred income taxes 10,024 14,884 – 24,908

Prepaid expenses and other current assets 23,305 1,740,029 (1,709,632) 53,702

Total current assets 202,924 3,237,610 (1,709,632) 1,730,902

Property and equipment, at cost 184,618 1,755,717 – 1,940,335

Less accumulated depreciation and amortization 78,661 780,836 – 859,497

Net property and equipment 105,957 974,881 – 1,080,838

Other assets, net 3,376,578 58,373 (3,405,687) 29,264

Total assets $3,685,459 $4,270,864 $ (5,115,319) $ 2,841,004

LIABILITIES AND SHAREHOLDERS’ EQUITY

Current liabilities:

Current portion of long-term obligations $ 4,399 $ 8,461 $ – $ 12,860

Accounts payable 1,763,024 355,904 (1,709,601) 409,327

Accrued expenses and other 37,378 296,511 – 333,889

Income taxes payable – 69,647 (31) 69,616

Total current liabilities 1,804,801 730,523 (1,709,632) 825,692

Long-term obligations 190,769 1,261,998 (1,194,305) 258,462

Deferred income taxes 5,424 66,961 – 72,385

Shareholders’ equity:

Preferred stock – – – –

Common stock 164,086 23,853 (23,853) 164,086

Additional paid-in capital 421,600 1,243,468 (1,243,468) 421,600

Retained earnings 1,102,457 944,061 (944,061) 1,102,457

Accumulated other comprehensive loss (973) – – (973)

Other shareholders’ equity (2,705) – – (2,705)

Total shareholders’ equity 1,684,465 2,211,382 (2,211,382) 1,684,465

Total liabilities and shareholders’ equity $ 3,685,459 $ 4,270,864 $ (5,115,319) $ 2,841,004