Dollar General 2005 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2005 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

items, the 2005 effective tax rate would have been

approximately 36.5%.

The 2004 rate was lower than the 2003 rate primarily

due to the reversal of certain contingent income tax liabili-

ties of approximately $6.2 million in 2004, when the

Company adjusted its tax contingency reserve based upon

the results of two state income tax examinations. The tax

rate in 2003 was negatively impacted by the $10.0 million

penalty expense in 2003, as discussed above, which was

not deductible for income tax purposes.

In 2005, the Company recognized a reduction in its

federal income tax expense of approximately $4.5 million

for federal jobs related tax credits. Of this amount,

approximately $3.9 million relates to the Work

Opportunity Tax Credit (WOTC), the Welfare to Work

Credit (WtW) and the Native American Employment

Credit. The federal law that provided for the WOTC and

WtW credit programs expired on December 31, 2005 for

employees hired after that date. Credits can continue to

be earned in 2006 for eligible employees that were hired

prior to the December 31, 2005 date. The federal law that

provided for the Native American Employment Credit

expired for years beginning after December 31, 2005 (the

Company’s 2006 year) without regard to when the

employee was hired. The Company currently anticipates

that Congress will renew these credit programs on a

retroactive basis; however, renewal cannot currently be

assured. Should these credit programs not be renewed,

the Company currently anticipates a reduction in its 2006

credits of approximately $3.1 million.

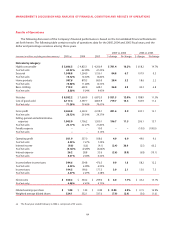

Liquidity and Capital Resources

Current Financial Condition / Recent Developments.

During the past three years, the Company has generated

an aggregate of approximately $1.46 billion in cash flows

from operating activities. During that period, the Company

has expanded the number of stores it operates by approxi-

mately 30% (over 1,800 stores) and has incurred approxi-

mately $713 million in capital expenditures, primarily to

support this growth. Also during this three-year period, the

Company has expended approximately $537 million for

repurchases of its common stock and paid dividends of

approximately $156 million.

The Company’s inventory balance represented

approximately 49% of its total assets as of February 3,

2006.The Company’s proficiency in managing its inventory

balances can have a significant impact on the Company’s

cash flows from operations during a given fiscal year. For

example, in 2005, changes in inventory balances repre-

sented a much less significant use of cash ($97.9 million, as

explained in more detail below), as compared to changes

in inventory balances in 2004 ($219.4 million use of cash).

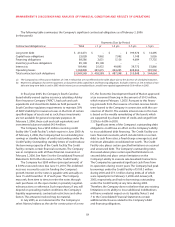

As described in Note 7 to the Consolidated Financial

Statements, the Company is involved in a number of legal

actions and claims, some of which could potentially result

in material cash payments. Adverse developments in

those actions could materially and adversely affect the

Company’s liquidity. The Company also has certain

income tax-related contingencies as more fully described

below under “Critical Accounting Policies and Estimates”.

Estimates of these contingent liabilities are included in the

Company’s Consolidated Financial Statements. However,

future negative developments could have a material

adverse effect on the Company’s liquidity. See Notes 4 and

7 to the Consolidated Financial Statements.

On September 30, 2005, November 30, 2004 and

March 13, 2003, the Board of Directors authorized the

Company to repurchase up to 10 million, 10 million and 12

million shares, respectively, of its outstanding common

stock.These authorizations allow or allowed, as applicable,

for purchases in the open market or in privately negotiat-

ed transactions from time to time, subject to market con-

ditions.The objective of the Company’s share repurchase

initiative is to enhance shareholder value by purchasing

shares at a price that produces a return on investment that

is greater than the Company's cost of capital. Additionally,

share repurchases generally are undertaken only if such

purchases result in an accretive impact on the Company's

fully diluted earnings per share calculation. The 2005

authorization expires September 30, 2006. The 2004

and 2003 authorizations were completed prior to their

expiration dates. During 2005, the Company purchased

approximately 15.0 million shares pursuant to the 2005

and 2004 authorizations at a total cost of $297.6 million.

During 2004, the Company purchased approximately 11.0

million shares pursuant to the 2004 and 2003 authoriza-

tions at a total cost of $209.3 million. During 2003, the

Company purchased approximately 1.5 million shares

pursuant to the 2003 authorization at a total cost of $29.7

million. Share repurchases in 2005 increased diluted

earnings per share by approximately $0.01.