Dollar General 2005 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2005 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28

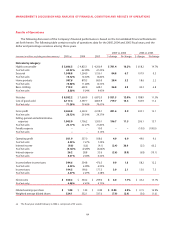

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Effects of Inflation

The Company believes that inflation and/or deflation

had a minimal impact on its overall operations during

2005, 2004 and 2003.

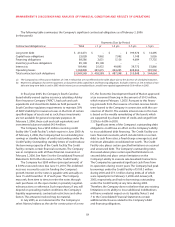

Accounting Pronouncements

In December 2004, the Financial Accounting

Standards Board (“FASB”) issued Statement of Financial

Accounting Standards (“SFAS”) No. 123(R),“Share-Based

Payment,” which will require an entity to measure com-

pensation cost for all share-based payments (including

grants of employee stock options) at fair value. The

Company will adopt SFAS No. 123(R) during the first quar-

ter of 2006 and expects to apply the standard using the

modified prospective method, which requires compensa-

tion expense to be recorded for new and modified awards

and also for unvested portions of previously issued and

outstanding awards.The Company expects to incur incre-

mental Selling,general and administrative expense associ-

ated with the adoption of approximately $5 million in

2006, dependent upon the number of grants and their

related fair market values. See Note 1 to the Consolidated

Financial Statements for disclosure of the pro forma

effects of stock option grants as determined using the

methodology prescribed under SFAS No. 123.

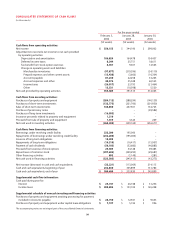

SFAS No. 123(R) also requires the benefits of tax

deductions in excess of recognized compensation cost be

reported as a financing cash flow, rather than as an operat-

ing cash flow as required under current literature.This

requirement will reduce net operating cash flows and

increase net financing cash flows in periods after adop-

tion. While the Company cannot estimate what those

amounts will be in the future (because they depend on,

among other things, when employees exercise stock

options), the amounts of operating cash flows recognized

in the accompanying Consolidated Statements of Cash

Flows for such excess tax deductions were $6.5 million,

$9.7 million and $14.6 million for 2005, 2004 and 2003,

respectively.

On January 24, 2006, the Compensation Committee

(“Committee”) of the Company’s Board of Directors

approved the acceleration of vesting for 6.4 million of the

Company’s outstanding stock options awarded prior to

August 2, 2005. This acceleration was effective on February

3, 2006. Vesting was not accelerated for stock options held

by the CEO and stock options granted in 2005 to the offi-

cers of the Company at the level of Executive Vice

President or higher. In addition, pursuant to that

Committee action, the vesting of all outstanding options

granted on or after August 2, 2005 but prior to January 24,

2006, other than options granted during that time period

to the officers of the Company at the level of Executive

Vice President or higher, accelerated effective as of the

date that is six months after the applicable grant date.

Certain options granted on January 24, 2006 to certain

newly hired officers below the level of Executive Vice

President were granted with a six-month vesting period.

The decision to accelerate the vesting of stock options was

made primarily to reduce non-cash compensation

expense that would have been recorded in future periods

following the adoption of SFAS No. 123(R) in the first quar-

ter of fiscal year 2006. This action is expected to enable

the Company to eliminate approximately $28 million of

expense, before income taxes, over the four year period

during which the stock options would have vested, subject

to the impact of additional adjustments related to the for-

feiture of certain stock options. The Company also believes

this decision benefits employees. In connection with the

acceleration and in accordance with the provisions of APB

25, the Company recorded compensation expense of $0.9

million, before income taxes, during 2005.

In March 2005, the FASB issued FASB Interpretation 47,

“Accounting for Conditional Asset Retirement Obligations”

(“FIN 47”), which is effective no later than the end of fiscal

years ending after December 15, 2005.This Interpretation

clarifies that the term conditional asset retirement obliga-

tion as used in FASB Statement No. 143,“Accounting for

Asset Retirement Obligations,” refers to a legal obligation

to perform an asset retirement activity in which the timing

and (or) method of settlement are conditional on a future

event that may or may not be within the control of the

entity. The obligation to perform the asset retirement

activity is unconditional even though uncertainty exists

about the timing and (or) method of settlement. Thus, the

timing and (or) method of settlement may be conditional

on a future event. Accordingly, an entity is required to rec-

ognize a liability for the fair value of a conditional asset

retirement obligation if the fair value of the liability can be

reasonably estimated. The fair value of a liability for the

conditional asset retirement obligation should be recog-

nized when incurred—generally upon acquisition, con-

struction, or development and (or) through the normal

operation of the asset. Uncertainty about the timing and

(or) method of settlement of a conditional asset retire-

ment obligation should be factored into the measurement

of the liability when sufficient information exists.

Statement 143 acknowledges that in some cases, sufficient

information may not be available to reasonably estimate

the fair value of an asset retirement obligation. This

Interpretation also clarifies when an entity would have suf-