Dollar General 2005 Annual Report Download

Download and view the complete annual report

Please find the complete 2005 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report

for the Year Ended

February 3, 2006

Table of contents

-

Page 1

Annual Report for the Year Ended February 3, 2006 -

Page 2

At , the action is non-stop. On the move with 8,000 stores, eight around-the-clock distribution facilities and a bustling sourcing office in Hong Kong, Dollar General is hard at work for our customers-literally 24-7. We are passionate about Serving Others, completely committed to success and doing ... -

Page 3

...forward, growing to 44 stores by the end of 2005. The Dollar General Markets offer one-stop shopping for general merchandise and groceries, including fresh produce. Our Customers - Dollar General caters to under-served customers, whose options are limited by time, money and access. Our Merchandise... -

Page 4

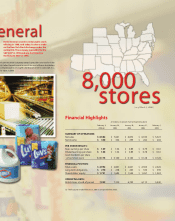

Dollar General issued its initial public stock offering in 1968, and today, its shares trade on the New York Stock Exchange under the symbol DG. The company was added to the S&P 500® in 1998 and was first listed on the Fortune 500® in 1999. ral operates more company-owned stores than any retailer... -

Page 5

... the Company's credit rating to investment grade. • We opened 734 new stores, including 29 new Dollar General Markets. By fiscal year-end, we operated 7,929 stores in 31 states, including 44 Dollar General Markets. • We opened our eighth distribution center in South Carolina in June 2005 and... -

Page 6

... lead our human resources function. Dollar General began accepting electronic benefits transfer cards in 2003, making shopping hassle-free for customers on government assistance. At the same time, we make shopping for all customers more convenient by accepting debit cards and Discover Network cards... -

Page 7

3 -

Page 8

4 -

Page 9

..., home and seasonal items. Customers can also purchase basic refrigerated and frozen foods, including dairy products, eggs and packaged convenience food items in most of our stores. In nearly all of our stores, we now have the ability to process electronic benefits transfer (EBT) cards, assisting... -

Page 10

6 -

Page 11

...expanding needs of our customers, as well as the growing number of new customers, we must grow as well. In 2006, we plan to open approximately 800 new traditional Dollar General stores and 30 Dollar General Markets. We expect to open our ninth distribution center in 2006 in Marion, Ind., and we will... -

Page 12

... to increase our number of stores. In addition, we believe we also can grow by increasing the productivity of our existing stores by adapting to the ever-changing economic pressures and needs of our customers. Your management team, with your board of directors, is working diligently on your behalf... -

Page 13

... store-set team celebrate another major milestone - the grand opening of Dollar General's 8,000th store on March 3, 2006. with our responsibility to you, our shareholders. Thank you for your investment in Dollar General Corporation and your continued support. The first Dollar General Market opened... -

Page 14

... Reporting ...Report of Independent Registered Public Accounting Firm ...Consolidated Balance Sheets ...Consolidated Statements of Income ...Consolidated Statements of Shareholders' Equity ...Consolidated Statements of Cash Flows ...Notes to Consolidated Financial Statements ...Corporate Information... -

Page 15

... of Operations: Net sales Gross profit Penalty expense and litigation settlement (proceeds) Income before income taxes Net income Net income as a % of sales Per Share Results: Basic earnings per share Diluted earnings per share Cash dividends per share of common stock Weighted average diluted shares... -

Page 16

... financial statements as a whole. The Company realizes a significant portion of its net sales and net income during the Christmas selling season in the fourth quarter. In anticipation of this holiday, the Company purchases substantial amounts of seasonal inventory and hires many temporary employees... -

Page 17

...of its distribution centers ("DCs"), and the timely receipt of inventory. The Company relies upon the ability to replenish depleted inventory through deliveries to its DCs from vendors and from the DCs to its stores by various means of transportation, including shipments by air, sea and truck. Labor... -

Page 18

... performance of its employees. The loss of services of key members of the Company's senior management team or of certain other key employees could negatively affect the Company's business. The risk of key employee turnover intensifies as a greater number of public corporations locate in the vicinity... -

Page 19

... its financial statements as a whole. The Company is subject to interest rate risk which could impact profitability. The Company is subject to market risk from exposure to changes in interest rates based on its financing, investing and cash management activities. Changes in interest rates could have... -

Page 20

... inventory flow from distribution centers to consumers as well as improve other areas of store operations, including labor scheduling, hiring and training and product presentation, in 3,825 stores as of year-end; • We completed construction of and opened the Company's eighth DC in South Carolina... -

Page 21

... aged inventory; • We introduced Dollar General gift cards before the Christmas holiday season; • We introduced Fisher-Price® branded children's apparel and Bobbie Brooks® apparel for women in our stores; • We developed and installed new systems to provide enhanced store operating statements... -

Page 22

...and lowering rent as a percentage of sales in new and existing stores; and • Continued investment in the Company's infrastructure, including increasing global sourcing, further developing our information technology capabilities, and opening the Company's ninth distribution center thereby expanding... -

Page 23

... per share amounts) 2005 (a) 2004 2003 Net sales by category: Highly consumable % of net sales Seasonal % of net sales Home products % of net sales Basic clothing % of net sales Net sales Cost of goods sold % of net sales Gross profit % of net sales Selling, general and administrative expenses... -

Page 24

... product costs with several key suppliers, selective price increases, and an increase in various performance-based vendor rebates; and higher average mark-ups on the Company's beginning inventory in 2004 as compared to 2003, which represents the cumulative impact of higher margin purchases over time... -

Page 25

...increase in sales: store occupancy costs (increased 17.4%), primarily due to rising average monthly rentals associated with the Company's leased store locations; purchased services (increased 54.6%), due primarily to fees associated with the increased customer usage of debit cards; professional fees... -

Page 26

...open market or in privately negotiated transactions from time to time, subject to market conditions. The objective of the Company's share repurchase initiative is to enhance shareholder value by purchasing shares at a price that produces a return on investment that is greater than the Company's cost... -

Page 27

... annualized basis, would have equaled approximately $0.6 million in 2005. In fiscal year 2005, the Company's South Carolinabased wholly owned captive insurance subsidiary, Ashley River Insurance Company ("ARIC"), had cash and cash equivalents and investments balances held pursuant to South Carolina... -

Page 28

... new DCs in South Carolina and Indiana. Net sales of short-term investments in 2005 of $34.1 million primarily reflect the Company's investment activities in tax-exempt auction market securities. Purchases of longterm investments are related to the Company's captive insurance subsidiary. Cash flows... -

Page 29

...'s new DC in South Carolina as well as costs associated with the expansion of the Ardmore, Oklahoma and South Boston, Virginia DCs. Net sales of short-term investments in 2004 of $25.8 million primarily reflect the Company's investment activities in tax-exempt auction market securities. Cash flows... -

Page 30

... the inventory balance include: • applying the RIM to a group of products that is not fairly uniform in terms of its cost and selling price relationship and turnover; • applying the RIM to transactions over a period of time that include different rates of gross profit, such as those relating to... -

Page 31

... in the Company's financial statements and SEC filings, management's view of the Company's exposure. The Company reviews outstanding claims and proceedings with external counsel to assess probability and estimates of loss. These assessments are re-evaluated each quarter or as new information becomes... -

Page 32

... 15, 2005. This Interpretation clarifies that the term conditional asset retirement obligation as used in FASB Statement No. 143,"Accounting for Asset Retirement Obligations," refers to a legal obligation to perform an asset retirement activity in which the timing and (or) method of settlement are... -

Page 33

... with liquid markets. The Company has cash flow exposure relating to variable interest rates associated with its revolving line of credit and tax increment financing, and may periodically seek to manage this risk through the use of interest rate derivatives. The primary interest rate exposure on... -

Page 34

MANAGEMENT'S ANNUAL REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING The management of Dollar General prepared and is responsible for the consolidated financial statements and all related financial information contained in this document. This responsibility includes establishing and maintaining ... -

Page 35

... INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM ON INTERNAL CONTROL OVER FINANCIAL REPORTING To the Board of Directors and Shareholders of Dollar General Corporation Goodlettsville, Tennessee We have audited management's assessment, included in the accompanying Management's Annual Report on Internal... -

Page 36

... PUBLIC ACCOUNTING FIRM To the Board of Directors and Shareholders of Dollar General Corporation Goodlettsville, Tennessee We have audited the accompanying consolidated balance sheets of Dollar General Corporation and subsidiaries as of February 3, 2006 and January 28, 2005, and the related... -

Page 37

CONSOLIDATED BALANCE SHEETS (In thousands except per share amounts) February 3, 2006 ASSETS Current assets: Cash and cash equivalents Short-term investments Merchandise inventories Deferred income taxes Prepaid expenses and other current assets Total current assets Net property and equipment Other ... -

Page 38

CONSOLIDATED STATEMENTS OF INCOME (In thousands except per share amounts) February 3, 2006 (53 weeks) Net sales Cost of goods sold Gross profit Selling, general and administrative Penalty expense Operating profit Interest income Interest expense Income before income taxes Income taxes Net income ... -

Page 39

... of net loss on derivatives - - Comprehensive income Cash dividends, $0.16 per common share - - Issuance of common stock under stock incentive plans 2,875 1,437 Tax benefit from stock option exercises - - Repurchases of common stock (11,020) (5,510) Purchase of common stock by employee deferred... -

Page 40

... cash flow information: Cash paid during year for: Interest Income taxes Supplemental schedule of noncash investing and financing activities: Purchases of property and equipment awaiting processing for payment, included in Accounts payable Purchases of property and equipment under capital lease... -

Page 41

...) located primarily in the southern, southwestern, midwestern and eastern United States. The Company has DCs in Scottsville, Kentucky; Ardmore, Oklahoma; South Boston, Virginia; Indianola, Mississippi; Fulton, Missouri; Alachua, Florida; Zanesville, Ohio; and Jonesville, South Carolina. The Company... -

Page 42

... leases its DC in South Boston, Virginia, as discussed in Note 7, has been classified as a held-tomaturity security. Historical cost information pertaining to investments in mutual funds by participants in the Company's supplemental retirement and compensation deferral plans classified as trading... -

Page 43

...808 $ - - 11,932 $ 188,384 On February 3, 2006 and January 28, 2005, these investments were included in the following accounts in the consolidated balance sheets (in thousands): Held-to-Maturity Available-for-Sale Trading Securities Securities Securities $ 44,870 $ 16,300 $ - 8,850 - - - - 14,515... -

Page 44

... sales trends and cash flows at these locations. These charges are included in SG&A expense. Other assets Other assets consist primarily of long-term investments, debt issuance costs which are amortized over the life of the related obligations, utility and security deposits, life insurance policies... -

Page 45

... subsidiary of the Company, charges the operating subsidiary companies premiums to insure the retained workers' compensation and non-property general liability exposures. Pursuant to South Carolina insurance regulations, ARIC has cash and cash equivalents and investment balances that are subject... -

Page 46

...generally not recognized for plans in which the exercise price of the stock options equals the market price of the underlying stock on the date of grant and the number of shares subject to exercise is fixed. Had compensation cost for the Company's stock-based compensation plans been determined based... -

Page 47

.... These costs primarily related to targeted circulars supporting new stores and in-store signage. Additionally, beginning in 2005, the Company expanded its marketing and advertising efforts with the sponsorship of a National Association for Stock Car Auto Racing ("NASCAR") team. Capitalized... -

Page 48

... 15, 2005.This Interpretation clarifies that the term conditional asset retirement obligation as used in FASB Statement No. 143,"Accounting for Asset Retirement Obligations" , refers to a legal obligation to perform an asset retirement activity in which the timing and (or) method of settlement are... -

Page 49

... causing the 2005 tax rate to decrease when compared to the 2004 tax rate include the recognition of state tax credits of approximately $2.3 million related to the Company's construction of a distribution center in Indiana and a non-recurring benefit of approximately $2.6 million related to an... -

Page 50

... based on its assessment of probable income tax-related exposures and the anticipated settlement of those exposures translating into actual future liabilities. As of February 3, 2006 and January 28, 2005, the Company's accrual for these contingent liabilities, included in Income taxes payable... -

Page 51

...the base rate plus 12.5 to 62.5 basis points. During 2005 and 2004, the Company had peak borrowings of $100.3 million and $73.1 million, respectively, under the Credit Facility. The Credit Facility contains financial covenants, which include limits on certain debt to cash flow ratios, a fixed charge... -

Page 52

... 2003, the Company purchased two secured promissory notes (the "DC Notes") from Principal Life Insurance Company totaling $49.6 million. The DC Notes represent debt issued by a third party entity from which the Company leases its DC in South Boston, Virginia. The DC Notes are being accounted for as... -

Page 53

... Dollar General Corporation, CV02-C-0673-W ("Brown")). Brown is a collective action against the Company on behalf of current and former salaried store managers claiming that these individuals were entitled to overtime pay and should not have been classified as exempt employees under the Fair Labor... -

Page 54

... adverse effect on the Company's financial statements as a whole. 8. Benefit plans The Dollar General Corporation 401(k) Savings and Retirement Plan became effective on January 1, 1998. Balances in two earlier plans were transferred into this plan. The plan covers all employees subject to certain... -

Page 55

..." in-service lump sum distribution of vested amounts credited to his compensation deferral account. Effective January 1, 2005 for active participants, account balances deemed to be invested in the Mutual Funds Option are payable in cash and account balances deemed to be invested in the Common Stock... -

Page 56

... to be invested in the Common Stock Option are payable in shares of Dollar General common stock and cash in lieu of fractional shares. Prior to January 1, 2005, all account balances were payable in cash. 9. Stock-based compensation The Company has a shareholder-approved stock incentive plan under... -

Page 57

... to receive cash dividends and to vote these shares, but is prohibited from selling or transferring shares prior to vesting. Also during the first quarter of 2003, the Company awarded the CEO, as a material inducement to employment, an option to purchase 500,000 shares at an exercise price of $12... -

Page 58

... applicable, for purchases in the open market or in privately negotiated transactions from time to time, subject to market conditions. The objective of the Company's share repurchase initiative is to enhance shareholder value by purchasing shares at a price that produces a return on investment that... -

Page 59

... 2005, which was a 14-week accounting period, each quarter listed below was a 13-week accounting period. The sum of the four quarters for any given year may not equal annual totals due to rounding. Amounts are in thousands except per share data. Quarter 2005: Net sales Gross profit Operating profit... -

Page 60

... Subsidiaries Eliminations Dollar General Corporation BALANCE SHEET: ASSETS Current assets: Cash and cash equivalents Short-term investments Merchandise inventories Deferred income taxes Prepaid expenses and other current assets Total current assets Property and equipment, at cost Less accumulated... -

Page 61

... FINANCIAL STATEMENTS Dollar General Corporation BALANCE SHEET: ASSETS Current assets: Cash and cash equivalents Short-term investments Merchandise inventories Deferred income taxes Prepaid expenses and other current assets Total current assets Property and equipment, at cost Less accumulated... -

Page 62

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Dollar General Corporation STATEMENTS OF INCOME: Net sales Cost of goods sold Gross profit Selling, general and administrative Operating profit Interest income Interest expense Income before income taxes Income taxes Equity in subsidiaries' earnings, net ... -

Page 63

... payable Accrued expenses and other Income taxes Other Net cash provided by operating activities Cash flows from investing activities: Purchases of property and equipment Purchases of short-term investments Sales of short-term investments Purchases of long-term investments Insurance proceeds related... -

Page 64

...CONSOLIDATED FINANCIAL STATEMENTS Dollar General Corporation STATEMENTS OF CASH FLOWS: Cash flows from operating activities: Net income Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization Deferred income taxes Tax benefit from stock option... -

Page 65

...other current assets Accounts payable Accrued expenses and other Income taxes Other Net cash provided by (used in) operating activities Cash flows from investing activities: Purchases of property and equipment Purchases of short-term investments Sales of short-term investments Purchase of promissory... -

Page 66

...Store Support Center / Corporate Headquarters Dollar General Corporation 100 Mission Ridge Goodlettsville, Tennessee 37072 (615) 855-4000 www.dollargeneral.com 62 Direct Stock Purchase/Dividend Reinvestment Plan The Dollar General Direct Stock Purchase Plan is administered by the Company's transfer... -

Page 67

..., Human Resources Gayle Aertker Senior Vice President, Real Estate and Store Development J. Bruce Ash Senior Vice President and Chief Information Officer Rita F. Branham Senior Vice President and General Merchandise Manager, Consumables Lloyd Davis Senior Vice President, Global Supply Chain Anita... -

Page 68

... area by supporting local programs that offer the life-changing gift of literacy. In 2005 alone, we touched more than 88,000 lives through Dollar General Literacy Foundation grants and our in-store learn-to-read referral program. Dollar General Corporation 100 Mission Ridge Goodlettsville, TN 37072...