Dell 2011 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2011 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents DELL INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

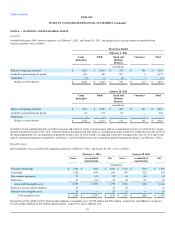

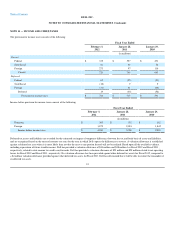

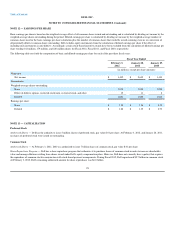

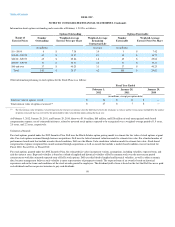

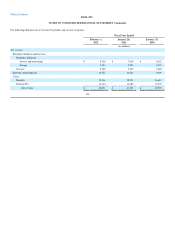

NOTE 12 — EARNINGS PER SHARE

Basic earnings per share is based on the weighted-average effect of all common shares issued and outstanding and is calculated by dividing net income by the

weighted-average shares outstanding during the period. Diluted earnings per share is calculated by dividing net income by the weighted-average number of

common shares used in the basic earnings per share calculation plus the number of common shares that would be issued assuming exercise or conversion of

all potentially dilutive common shares outstanding. Dell excludes equity instruments from the calculation of diluted earnings per share if the effect of

including such instruments is anti-dilutive. Accordingly, certain stock-based incentive awards have been excluded from the calculation of diluted earnings per

share totaling 142 million, 179 million, and 220 million shares for Fiscal 2012, Fiscal 2011, and Fiscal 2010, respectively.

The following table sets forth the computation of basic and diluted earnings per share for each of the past three fiscal years:

Fiscal Year Ended

February 3,

2012 January 28,

2011 January 29,

2010

(in millions, except per share amounts)

Numerator:

Net income $ 3,492 $ 2,635 $ 1,433

Denominator:

Weighted-average shares outstanding:

Basic 1,838 1,944 1,954

Effect of dilutive options, restricted stock units, restricted stock, and other 15 11 8

Diluted 1,853 1,955 1,962

Earnings per share:

Basic $ 1.90 $ 1.36 $ 0.73

Diluted $ 1.88 $ 1.35 $ 0.73

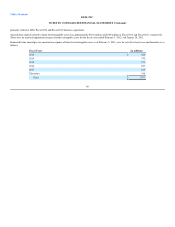

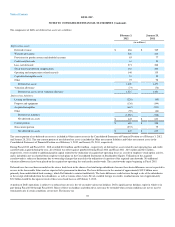

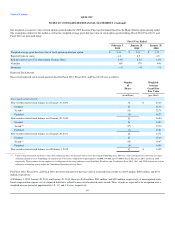

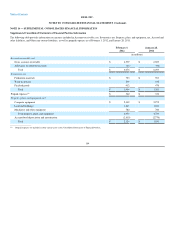

NOTE 13 — CAPITALIZATION

Preferred Stock

Authorized Shares — Dell has the authority to issue 5 million shares of preferred stock, par value $.01 per share. At February 3, 2012, and January 28, 2011,

no shares of preferred stock were issued or outstanding.

Common Stock

Authorized Shares — At February 3, 2012, Dell was authorized to issue 7 billion shares of common stock, par value $.01 per share.

Share Repurchase Program — Dell has a share repurchase program that authorizes it to purchase shares of common stock in order to increase shareholder

value and manage dilution resulting from shares issued under Dell's equity compensation plans. However, Dell does not currently have a policy that requires

the repurchase of common stock in conjunction with stock-based payment arrangements. During Fiscal 2012, Dell repurchased $2.7 billion in common stock.

At February 3, 2012, Dell's remaining authorized amount for share repurchases was $6.0 billion.

95