Dell 2011 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2011 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137

|

|

Table of Contents

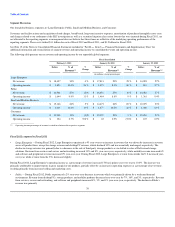

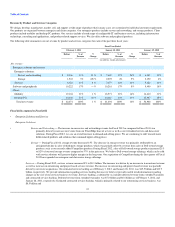

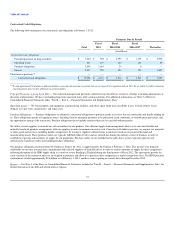

of February 3, 2012, from $6.0 billion as of January 28, 2011.

The year-over-year decrease in other income was primarily due to a $72 million merger termination fee that we received during Fiscal 2011.

Fiscal 2011 compared to Fiscal 2010

During Fiscal 2011 and Fiscal 2010, we maintained a portfolio of instruments with shorter maturities, which typically carry lower market yields. During

Fiscal 2011, our investment income declined slightly, even with higher average balances, primarily due to a continued declined in market yields. Overall

investment yield in Fiscal 2011 declined from approximately 48 basis points during Fiscal 2010 to approximately 35 basis points.

The year-over-year increase in interest expense for Fiscal 2011 was due to higher debt levels, which increased to $6.0 billion as of January 28, 2011, from

$4.1 billion as of January 29, 2010.

The year-over-year change in foreign exchange for Fiscal 2011 was primarily due to gains from revaluation of certain un-hedged foreign currency balances,

the effect of which was partially offset by increases in the costs associated with the hedge program.

Other includes a $72 million merger termination fee that we received during Fiscal 2011.

44