Dell 2011 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2011 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents DELL INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

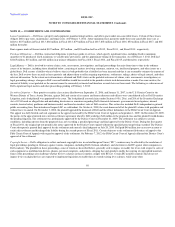

Dell is currently under income tax audits in various jurisdictions, including the United States. The tax periods open to examination by the major taxing

jurisdictions to which Dell is subject include fiscal years 1999 through 2011. As a result of these audits, Dell maintains ongoing discussions and negotiations

relating to tax matters with the taxing authorities in these various jurisdictions. Dell believes that it has provided adequate reserves related to all matters

contained in tax periods open to examination.

Dell's U.S. federal income tax returns for fiscal years 2007 through 2009 are currently under examination by the Internal Revenue Service (“IRS”). The IRS

issued a Revenue Agent's Report (“RAR”) for fiscal years 2004 through 2006 proposing certain assessments primarily related to transfer pricing matters. Dell

disagrees with certain of the proposed assessments and has contested them through the IRS administrative appeals procedures. The IRS has remanded the

audit for tax years 2004 through 2006 back to examination for further review. Should Dell experience an unfavorable outcome in the IRS matter, such an

outcome could have a material impact on its results of operations, financial position, and cash flows. Although the timing of income tax audit resolutions and

negotiations with taxing authorities is highly uncertain, Dell does not anticipate a significant change to the total amount of unrecognized income tax benefits

within the next 12 months.

Dell takes certain non-income tax positions in the jurisdictions in which it operates and has received certain non-income tax assessments from various

jurisdictions. Dell has recently reached agreement with a state government in Brazil regarding the proper application of transactional taxes to warranties

related to the sale of computers. Under the consensus, Dell has agreed to apply certain tax incentives in order to offset potential tax liabilities. Reaching this

agreement did not have a material impact to its Consolidated Financial Statements.

Dell believes its positions in these non-income tax litigation matters are supportable, that a liability is not probable, and that it will ultimately prevail. In the

normal course of business, Dell's positions and conclusions related to its non-income taxes could be challenged and assessments may be made. To the extent

new information is obtained and Dell's views on its positions, probable outcomes of assessments, or litigation change, changes in estimates to Dell's accrued

liabilities would be recorded in the period in which such determination is made.

94