Dell 2011 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2011 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents DELL INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Removing Selected Unwanted Frequencies in Accordance with Altered Settings in a User Interface of a Data Storage Device”). Western Digital and Hitachi

are hard drive suppliers of Dell. The plaintiff sought damages for each product with an allegedly infringing hard drive sold by Dell, plus exemplary damages

for allegedly willful infringement. On July 26, 2011, a jury found that the patents had been infringed and awarded the plaintiff an amount that is not material

to Dell. The jury decision is subject to final approval and entry by the judge.

Other Litigation — The various legal proceedings in which Dell is involved include commercial litigation and a variety of patent suits. In some of these cases,

Dell is the sole defendant. More often, particularly in the patent suits, Dell is one of a number of defendants in the electronics and technology industries. Dell

is actively defending a number of patent infringement suits, and several pending claims are in various stages of evaluation. While the number of patent cases

has grown over time, Dell does not currently anticipate that any of these matters will have a material adverse effect on Dell's business, financial condition,

results of operations, or cash flows.

As of February 3, 2012, Dell does not believe there is a reasonable possibility that a material loss exceeding the amounts already accrued for these or other

proceedings or matters may have been incurred. However, since the ultimate resolution of any such proceedings and matters is inherently unpredictable, Dell's

business, financial condition, results of operations, or cash flows could be materially affected in any particular period by unfavorable outcomes in one or more

of these proceedings or matters. Whether the outcome of any claim, suit, assessment, investigation, or legal proceeding, individually or collectively, could

have a material adverse effect on Dell's business, financial condition, results of operations, or cash flows will depend on a number of variables, including the

nature, timing, and amount of any associated expenses, amounts paid in settlement, damages or other remedies or consequences.

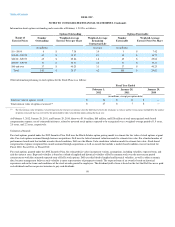

Certain Concentrations — Dell's counterparties to its financial instruments consist of a number of major financial institutions with credit ratings of AA and A

by major credit rating agencies. In addition to limiting the amount of agreements and contracts it enters into with any one party, Dell monitors its positions

with, and the credit quality of the counterparties to, these financial instruments. Dell does not anticipate nonperformance by any of the counterparties.

Dell's investments in debt securities are in high quality financial institutions and companies. As part of its cash and risk management processes, Dell performs

periodic evaluations of the credit standing of the institutions in accordance with its investment policy. Dell's investments in debt securities have stated

maturities of up to three years. Management believes that no significant concentration of credit risk for investments exists for Dell.

As of February 3, 2012, Dell did not have significant concentrations of cash and cash equivalent deposits with its financial institutions.

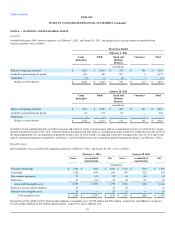

Dell markets and sells its products and services to large corporate clients, governments, and health care and education accounts, as well as to small and

medium-sized businesses and individuals. No single customer accounted for more than 10% of Dell's consolidated net revenue during Fiscal 2012, Fiscal

2011, or Fiscal 2010.

Dell purchases a number of components from single or limited sources. In some cases, alternative sources of supply are not available. In other cases, Dell may

establish a working relationship with a single source or a limited number of sources if Dell believes it is advantageous to do so based on performance, quality,

support, delivery, capacity, or price considerations.

Dell also sells components to certain contract manufacturers who assemble final products for Dell. Dell does not recognize the sale of these components in

net sales and does not recognize the related profits until the final products are sold by Dell to end users. Profits from the sale of these parts are recognized as a

reduction of cost of sales at the time of sale. Dell has net settlement agreements with the majority of these contract manufacturers that allow Dell to offset the

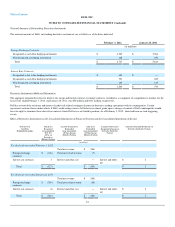

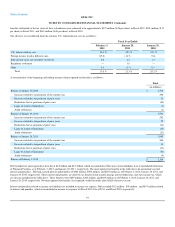

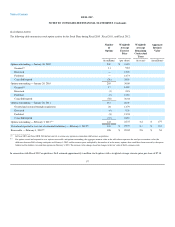

accounts payable to the contract manufacturers from the amounts receivable from them. Gross non-trade receivables as of February 3, 2012, and January 28,

2011 were $3.0 billion and $2.7 billion, respectively, and four contract manufacturers account for the majority of these receivables. Dell has net settlement

agreements with these four contract manufacturers and as of February 3, 2012, and January 28, 2011, the payables to these four contract manufacturers

exceeded the receivables due from them; therefore, the non-trade receivable amounts due from these manufacturers are offset against the corresponding

accounts payable to those manufacturers in the accompanying Consolidated Statements of Financial Position.

90