Dell 2011 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2011 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents DELL INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

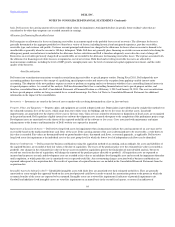

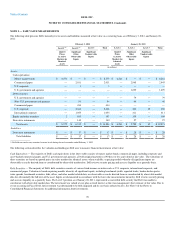

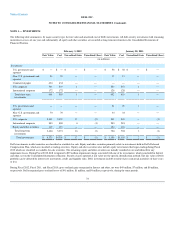

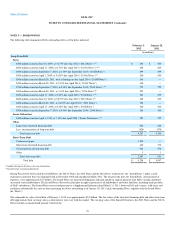

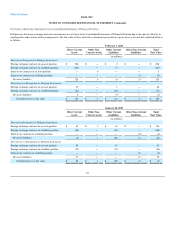

The following table summarizes the changes in the allowance for financing receivable losses for the respective periods:

Fiscal Year Ended

February 3,

2012 January 28,

2011 January 29,

2010

Revolving Fixed- term Total Revolving Fixed- term Total Total

(in millions)

Allowance for financing receivable losses:

Balance at beginning of period $ 214 $ 27 $ 241 $ 224 $ 13 $ 237 $ 149

Incremental allowance due to VIE consolidation — — — — 16 16 —

Principal charge-offs (204) (9) (213) (233) (18) (251) (139)

Interest charge-offs (38) — (38) (46) — (46) (27)

Recoveries 64 4 68 27 — 27 10

Provision charged to income statement 143 1 144 242 16 258 244

Balance at end of period $ 179 $ 23 $ 202 $ 214 $ 27 $ 241 $ 237

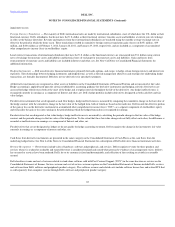

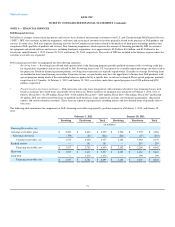

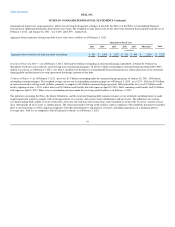

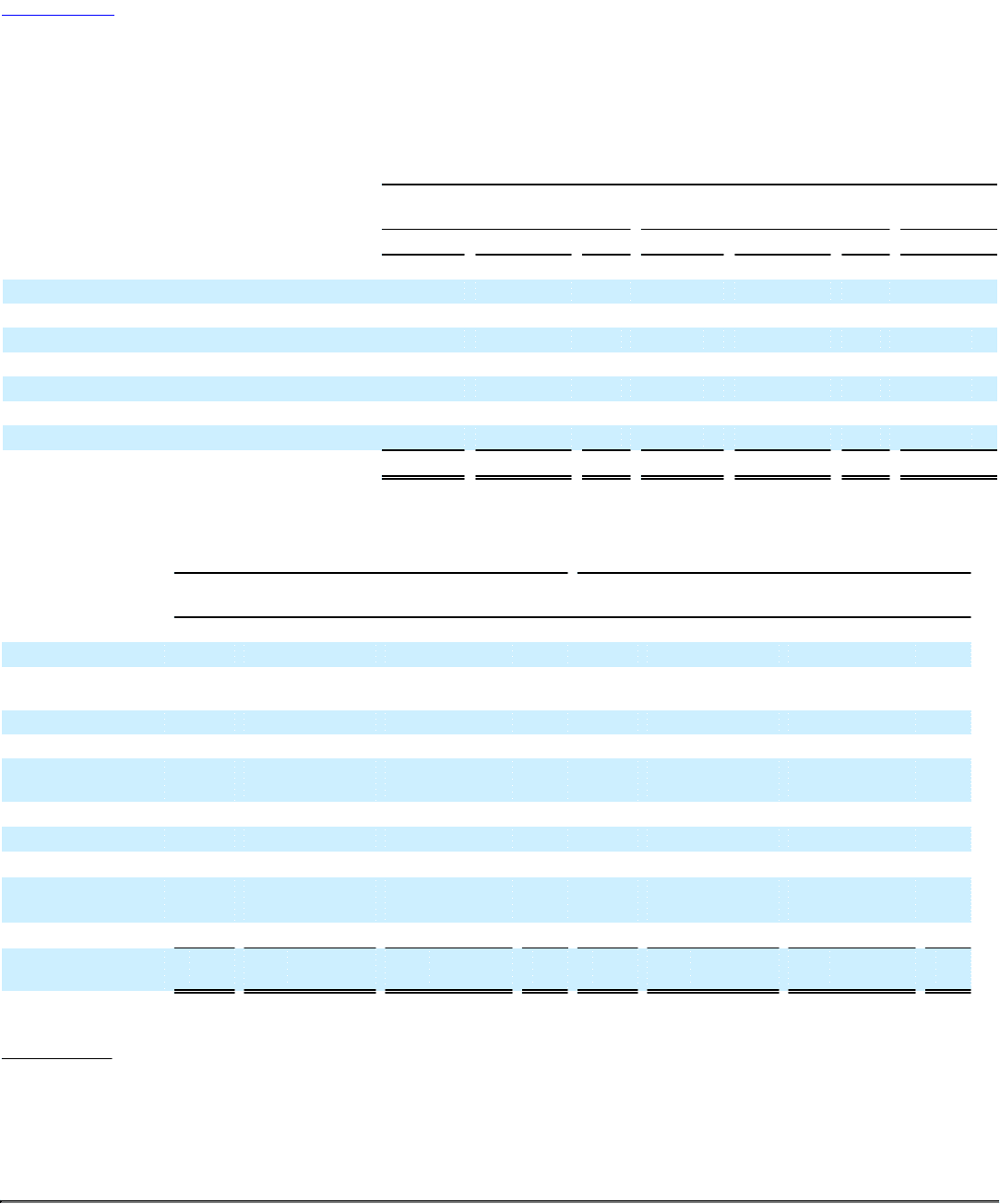

The following table summarizes the aging of Dell's customer receivables, gross, including accrued interest, as of February 3, 2012, and January 28, 2011,

segregated by class:

February 3, 2012 January 28, 2011

Current Past Due 1 — 90

Days Past Due > 90

Days Total Current Past Due 1 — 90

Days Past Due > 90

Days Total

(in millions)

Revolving — Consumer

Owned since

inception

$ 1,249 $ 148 $ 49 $1,446 $ 1,302 $ 153 $ 48 $1,503

Purchased 272 47 18 337 447 88 35 570

Fixed-term — Consumer

Owned since

inception

29 1 — 30 — — — —

Purchased 61 5 1 67 — — — —

Revolving — SMB(a) 272 33 8 313 280 35 8 323

Fixed-term — SMB(a) 534 23 5 562 371 11 3 385

Fixed-term —

Large Enterprise(a)

1,227 95 12 1,334 1,077 47 7 1,131

Fixed-term — Public(a) 419 30 1 450 463 12 1 476

Total customer

receivables, gross

$ 4,063 $ 382 $ 94 $4,539 $ 3,940 $ 346 $ 102 $4,388

____________________

(a) Includes purchased receivables described below that are not significant to any portfolio class.

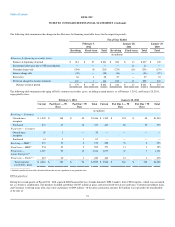

DFS Acquisitions

During the second quarter of Fiscal 2012 , Dell acquired Dell Financial Services Canada Limited ("DFS Canada") from CIT Group Inc., which was accounted

for as a business combination. The purchase included a portfolio of $367 million in gross contractual fixed-term leases and loans, Consumer installment loans,

and Consumer revolving loans with a fair value at purchase of $309 million . Of the gross contractual amounts, $23 million was expected to be uncollectible

at the date of

74