Dell 2011 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2011 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents DELL INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

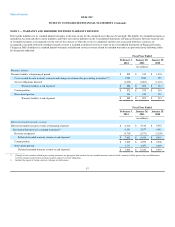

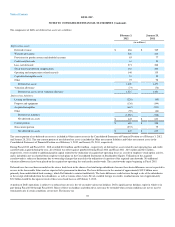

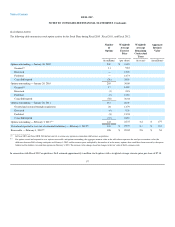

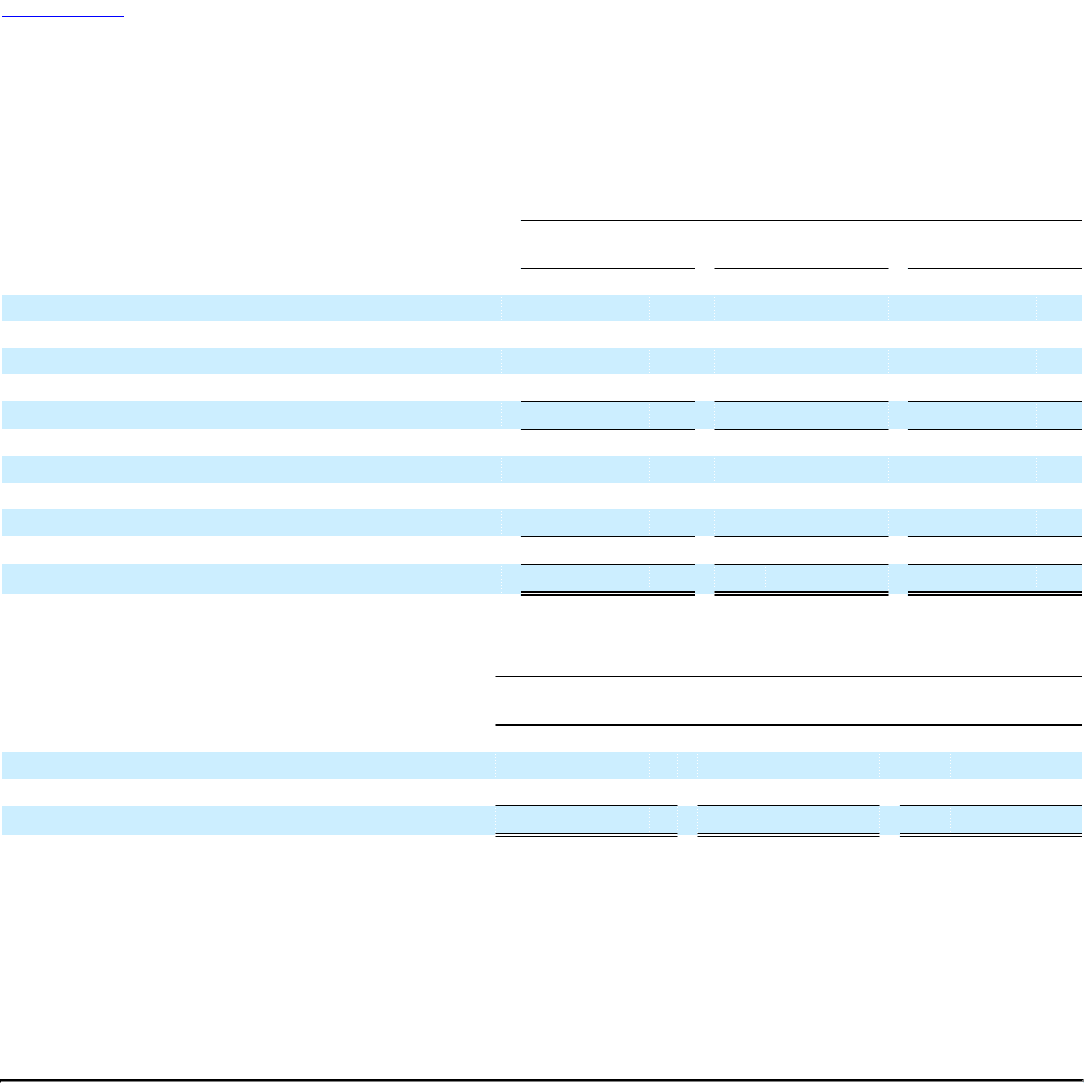

NOTE 11 — INCOME AND OTHER TAXES

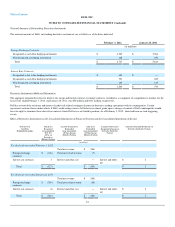

The provision for income taxes consists of the following:

Fiscal Year Ended

February 3,

2012 January 28,

2011 January 29,

2010

(in millions)

Current:

Federal $ 375 $ 597 $ 491

State/Local 81 66 36

Foreign 273 97 116

Current 729 760 643

Deferred:

Federal 62 (95) (21)

State/Local (12) 9 9

Foreign (31) 41 (40)

Deferred 19 (45) (52)

Provision for income taxes $ 748 $ 715 $ 591

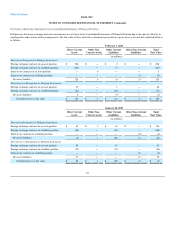

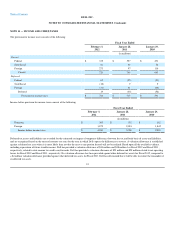

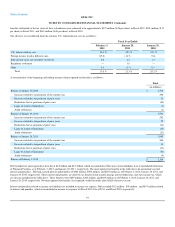

Income before provision for income taxes consists of the following:

Fiscal Year Ended

February 3,

2012 January 28,

2011 January 29,

2010

(in millions)

Domestic $ 365 $ 532 $ 182

Foreign 3,875 2,818 1,842

Income before income taxes $ 4,240 $ 3,350 $ 2,024

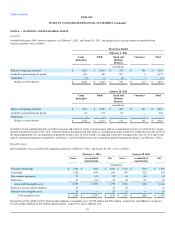

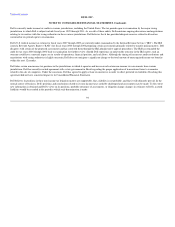

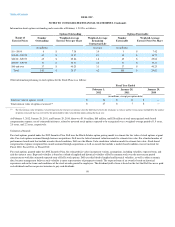

Deferred tax assets and liabilities are recorded for the estimated tax impact of temporary differences between the tax and book basis of assets and liabilities,

and are recognized based on the enacted statutory tax rates for the year in which Dell expects the differences to reverse. A valuation allowance is established

against a deferred tax asset when it is more likely than not that the asset or any portion thereof will not be realized. Based upon all the available evidence,

including expectation of future taxable income, Dell has provided a valuation allowance of $44 million and $48 million f or Fiscal 2012 and Fiscal 2011 ,

respectively, related to state income tax credit carryforwards. Dell has provided a valuation allowance of $29 million and $20 million related to net operating

losses for Fiscal 2012 and Fiscal 2011, respectively. No valuation allowance has been provided against other deferred tax assets for Fiscal 2012, compared to

a $4 million valuation allowance provided against other deferred tax assets for Fiscal 2011. Dell has determined that it will be able to realize the remainder of

its deferred tax assets.

91