Dell 2011 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2011 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents DELL INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

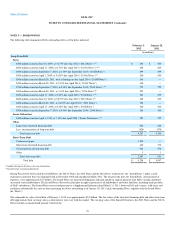

acquisition. Dell also acquired a liquidating portfolio of computer equipment operating leases. The gross amount of the equipment associated with these

operating leases at the date of acquisition was $67 million and is included in Property, plant, and equipment in the Consolidated Statements of Financial

Position. See Note 7 of Notes to Consolidated Financial Statements for additional information about Dell's acquisitions.

In Fiscal 2012 , Dell entered into a definitive agreement to acquire CIT Vendor Finance's Dell-related financing assets portfolio and sales and servicing

functions in Europe. The acquisition of these assets will enable global expansion of Dell's direct finance model. Subject to customary closing, regulatory, and

other conditions, Dell expects to close substantially all of this acquisition in the fiscal year ending February 1, 2013.

Purchased Credit-Impaired Loans

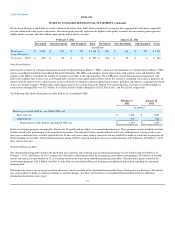

During the third quarter of Fiscal 2011, Dell purchased a portfolio of revolving loan receivables from CIT Group Inc. Prior to the acquisition, it was evident

that Dell would not collect on all contractually required principal and interest payments. As such, these receivables met the definition of Purchased Credit-

Impaired (“PCI”) loans. At February 3, 2012, the outstanding balance of these receivables, including principal and accrued interest, was $419 million and the

carrying amount was $184 million.

The excess of cash flows expected to be collected over the carrying value of PCI loans is referred to as the accretable yield and is accreted into interest income

using the effective yield method based on the expected future cash flows over the estimated lives of the PCI loans. Due to improved expectations of the

amount of expected cash flows and higher post charge-off recoveries, Dell increased the accretable yield associated with these PCI loans in Fiscal 2012. The

increases in accretable yield will be amortized over the remaining life of the loans.

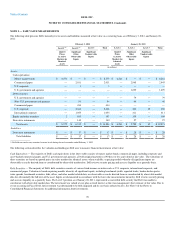

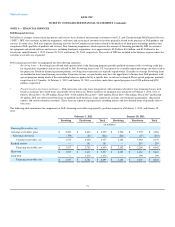

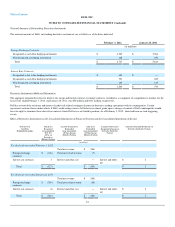

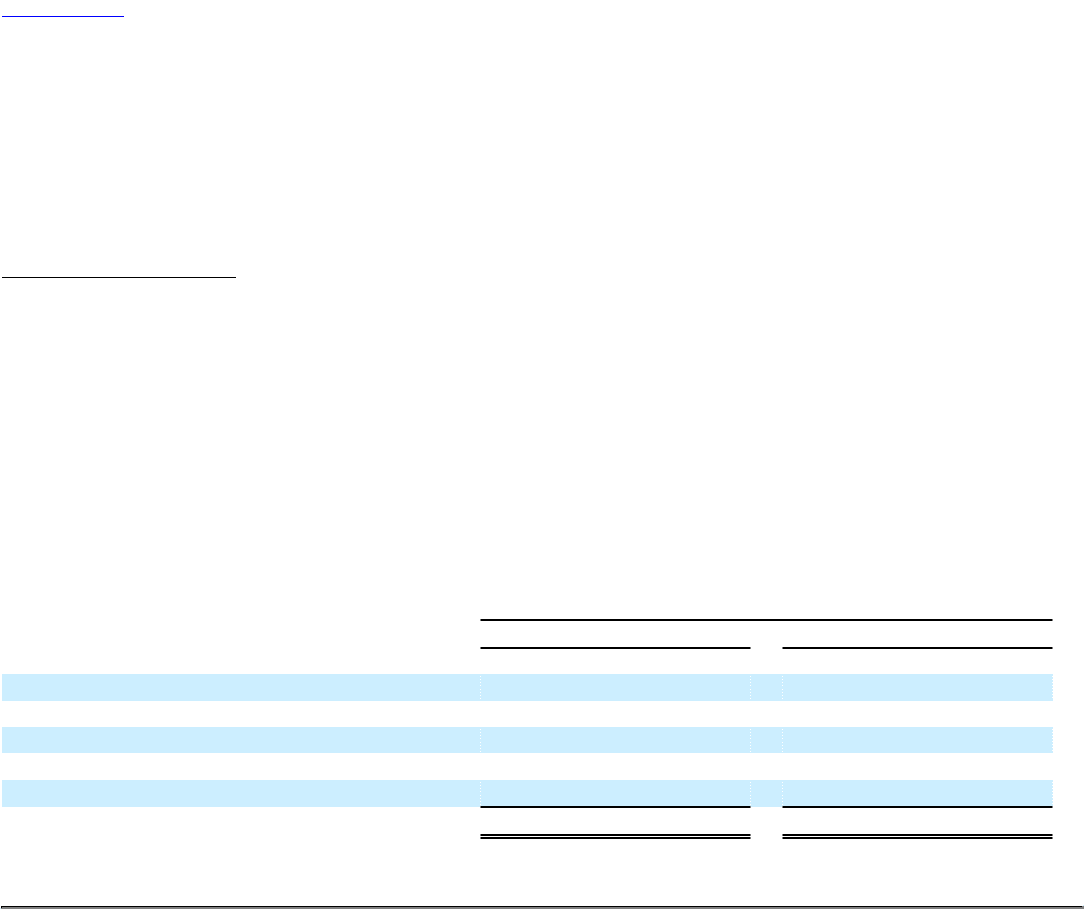

The following table shows activity for the accretable yield on the PCI loans for the fiscal years ended February 3, 2012, and January 28, 2011. We expect the

remaining balance of the accretable yield as of February 3, 2012 to accrete over the next 3 years, using the effective interest method.

Fiscal Year Ended

February 3, 2012 January 28, 2011

(in millions)

Accretable Yield:

Balance at beginning of period $ 137 $ —

Additions/ Purchases — 166

Accretion (88) (29)

Prospective yield adjustment 93 —

Balance at end of period $ 142 $ 137

75