Dell 2011 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2011 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

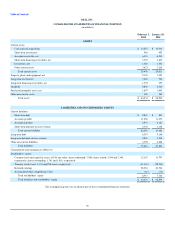

Table of Contents DELL INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

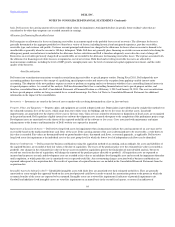

basis, Dell assesses the carrying amount of its recorded residual values for impairment. Anticipated declines in specific future residual values that are

considered to be other-than-temporary are recorded currently in earnings.

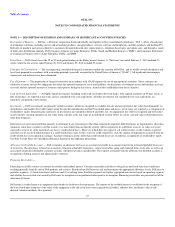

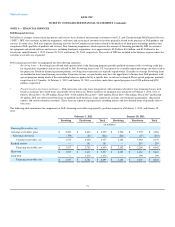

Allowance for Financing Receivables Losses

Dell recognizes an allowance for losses on financing receivables in an amount equal to the probable losses net of recoveries. The allowance for losses is

generally determined at the aggregate portfolio level based on a variety of factors, including historical and anticipated experience, past due receivables,

receivable type, and customer risk profile. Customer account principal and interest are charged to the allowance for losses when an account is deemed to be

uncollectible or generally when the account is 180 days delinquent. While Dell does not generally place financing receivables on non-accrual status during the

delinquency period, accrued interest is included in the allowance for loss calculation and Dell is therefore adequately reserved in the event of charge off.

Recoveries on receivables previously charged off as uncollectible are recorded to the allowance for financing receivables losses. The expense associated with

the allowance for financing receivables losses is recognized as cost of net revenue. Both fixed and revolving receivable loss rates are affected by

macroeconomic conditions, including the level of GDP growth, unemployment rates, the level of commercial capital equipment investment, and the credit

quality of the borrower.

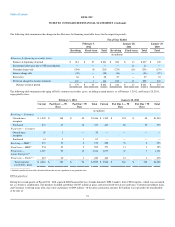

Asset Securitization

Dell enters into securitization transactions to transfer certain financing receivables to special purpose entities. During Fiscal 2011, Dell adopted the new

accounting guidance that removes the concept of a qualifying special purpose entity and removes the exception from applying variable interest entity

accounting. The adoption of the new guidance requires an entity to perform an ongoing analysis to determine whether it has a controlling financial interest in

its special purpose entities. As a result of this analysis, Dell has determined that it has a controlling financial interest in its special purpose entities, and

therefore, consolidated them into Dell's Consolidated Statements of Financial Position as of February 3, 2012 and January 28, 2011. The asset securitizations

in these special purpose entities are being accounted for as secured borrowings. See Note 4 of Notes to Consolidated Financial Statements for additional

information on the impact of the consolidation.

Inventories — Inventories are stated at the lower of cost or market with cost being determined on a first-in, first-out basis.

Property, Plant, and Equipment — Property, plant, and equipment are carried at depreciated cost. Depreciation is provided using the straight-line method over

the estimated economic lives of the assets, which range from ten to thirty years for buildings and two to five years for all other assets. Leasehold

improvements are amortized over the shorter of five years or the lease term. Gains or losses related to retirements or disposition of fixed assets are recognized

in the period incurred. Dell capitalizes eligible internal-use software development costs incurred subsequent to the completion of the preliminary project stage.

Development costs are amortized over the shorter of the expected useful life of the software or five years. Costs associated with maintenance and minor

enhancements to the features and functionality of Dell's website are expensed as incurred.

Impairment of Long-Lived Assets — Dell reviews long-lived assets for impairment when circumstances indicate the carrying amount of an asset may not be

recoverable based on the undiscounted future cash flows of the asset. If the carrying amount of the asset is determined not to be recoverable, a write-down to

fair value is recorded. Fair values are determined based on quoted market values, discounted cash flows, or external appraisals, as applicable. Dell reviews

long-lived assets for impairment at the individual asset or the asset group level for which the lowest level of independent cash flows can be identified.

Business Combinations — Dell accounts for business combinations using the acquisition method of accounting, and accordingly, the assets and liabilities of

the acquired business are recorded at their fair values at the date of acquisition. The excess of the purchase price over the estimated fair values is recorded as

goodwill. Any changes in the estimated fair values of the net assets recorded for acquisitions prior to the finalization of more detailed analysis, but not to

exceed one year from the date of acquisition, will change the amount of the purchase prices allocable to goodwill. All acquisition costs are expensed as

incurred and in-process research and development costs are recorded at fair value as an indefinite-lived intangible asset and assessed for impairment thereafter

until completion, at which point the asset is amortized over its expected useful life. Any restructuring charges associated with a business combination are

expensed subsequent to the acquisition date. The results of operations of acquired businesses are included in the Consolidated Financial Statements from the

acquisition date.

Intangible Assets Including Goodwill— Identifiable intangible assets with finite lives are amortized over their estimated useful lives. They are generally

amortized on a non-straight-line approach based on the associated projected cash flows in order to match the amortization pattern to the pattern in which the

economic benefits of the assets are expected to be consumed. Intangible assets are reviewed for impairment if indicators of potential impairment exist.

Goodwill and indefinite-lived intangible assets are tested for impairment on an annual basis in the second fiscal quarter, or sooner if an indicator of

64