Dell 2011 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2011 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents DELL INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

impairment occurs.

Foreign Currency Translation — The majority of Dell's international sales are made by international subsidiaries, most of which have the U.S. dollar as their

functional currency. Dell's subsidiaries that do not have the U.S. dollar as their functional currency translate assets and liabilities at current rates of exchange

in effect at the balance sheet date. Revenue and expenses from these international subsidiaries are translated using the monthly average exchange rates in

effect for the period in which the items occur. These translations resulted in cumulative foreign currency translation gains (losses) of $(35) million , $39

million, and $(40) million as of February 3, 2012, January 28, 2011, and January 29, 2010, respectively, and are included as a component of accumulated

other comprehensive income (loss) in stockholders’ equity.

Local currency transactions of international subsidiaries that have the U.S. dollar as the functional currency are remeasured into U.S. dollars using current

rates of exchange for monetary assets and liabilities and historical rates of exchange for non-monetary assets and liabilities. Gains and losses from

remeasurement of monetary assets and liabilities are included in Interest and other, net. See Note 6 of Notes to Consolidated Financial Statements for

additional information.

Hedging Instruments — Dell uses derivative financial instruments, primarily forwards, options, and swaps, to hedge certain foreign currency and interest rate

exposures. The relationships between hedging instruments and hedged items, as well as the risk management objectives and strategies for undertaking hedge

transactions, are formally documented. Dell does not use derivatives for speculative purposes.

All derivative instruments are recognized as either assets or liabilities on the Consolidated Statements of Financial Position and are measured at fair value.

Hedge accounting is applied based upon the criteria established by accounting guidance for derivative instruments and hedging activities. Derivatives are

assessed for hedge effectiveness both at the onset of the hedge and at regular intervals throughout the life of the derivative. Any hedge ineffectiveness is

recognized currently in earnings as a component of Interest and other, net. Dell's hedge portfolio includes derivatives designated as both cash flow and fair

value hedges.

For derivative instruments that are designated as cash flow hedges, hedge ineffectiveness is measured by comparing the cumulative change in the fair value of

the hedge contract with the cumulative change in the fair value of the hedged item, both of which are based on forward rates. Dell records the effective portion

of the gain or loss on the derivative instrument in accumulated other comprehensive income (loss) (“OCI”), as a separate component of stockholders' equity

and reclassifies the gain or loss into earnings in the period during which the hedged transaction is recognized in earnings.

For derivatives that are designated as fair value hedges, hedge ineffectiveness is measured by calculating the periodic change in the fair value of the hedge

contract and the periodic change in the fair value of the hedged item. To the extent that these fair value changes do not fully offset each other, the difference is

recorded as ineffectiveness in earnings as a component of Interest and other, net.

For derivatives that are not designated as hedges or do not qualify for hedge accounting treatment, Dell recognizes the change in the instrument's fair value

currently in earnings as a component of interest and other, net.

Cash flows from derivative instruments are presented in the same category on the Consolidated Statements of Cash Flows as the cash flows from the

underlying hedged items. See Note 6 of the Notes to Consolidated Financial Statements for a description of Dell's derivative financial instrument activities.

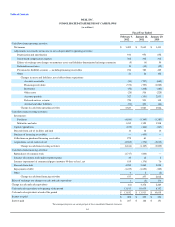

Revenue Recognition — Net revenues include sales of hardware, software and peripherals, and services. Dell recognizes revenue for these products and

services when it is realized or realizable and earned. Revenue is considered realized and earned when persuasive evidence of an arrangement exists; delivery

has occurred or services have been rendered; Dell's fee to its customer is fixed and determinable; and collection of the resulting receivable is reasonably

assured.

Dell classifies revenue and cost of revenue related to stand-alone software sold with Post Contract Support ("PCS") in the same line item as services on the

Consolidated Statements of Income. Services revenue and cost of services revenue captions on the Consolidated Statements of Income include Dell's services

and software from Dell's software and peripherals product category. This software revenue and related costs include software license fees and related PCS that

is sold separately from computer systems through Dell's software and peripherals product category.

65