Dell 2011 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2011 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents DELL INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

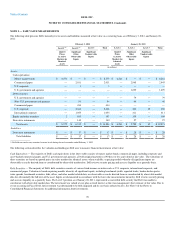

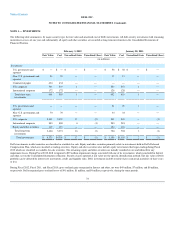

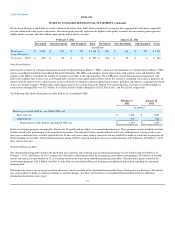

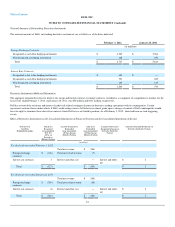

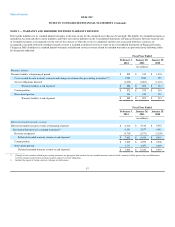

For the Large Enterprise and Public receivables shown in the below table, Dell's internal credit level scoring has been aggregated to their most comparable

external commercial rating agency equivalents. Investment grade generally represents the highest credit quality accounts, non-investment grade represents

middle quality accounts, and sub-standard represents the lowest quality accounts.

February 3, 2012 January 28, 2011

Investment Non-Investment Sub-Standard Total Investment Non-Investment Sub-Standard Total

(in millions)

Fixed-term —

Large Enterprise

$ 1,000 $ 199 $ 135 $ 1,334 $ 806 $ 166 $ 159 $ 1,131

Fixed-term — Public $ 400 $ 40 $ 10 $ 450 $ 438 $ 30 $ 8 $ 476

Asset Securitizations

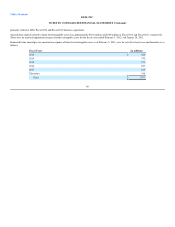

Dell transfers certain U.S. customer financing receivables to Special Purpose Entities (“SPEs”) which meet the definition of a Variable Interest Entity ("VIE")

and are consolidated into Dell's Consolidated Financial Statements. The SPEs are bankruptcy remote legal entities with separate assets and liabilities. The

purpose of the SPEs is to facilitate the funding of customer receivables in the capital markets. These SPEs have entered into financing arrangements with

multi-seller conduits that, in turn, issue asset-backed debt securities in the capital markets. Dell's risk of loss related to securitized receivables is limited to the

amount of Dell's right to receive collections for assets securitized exceeding the amount required to pay interest, principal, and other fees and expenses related

to the asset-backed securities. Dell provides credit enhancement to the securitization in the form of over-collateralization. Customer receivables funded via

securitization through SPEs were $2.3 billion, $1.9 billion, and $0.8 billion, during Fiscal 2012, Fiscal 2011, and Fiscal 2010, respectively.

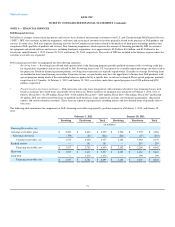

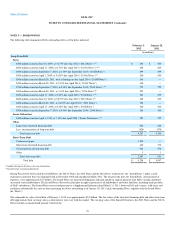

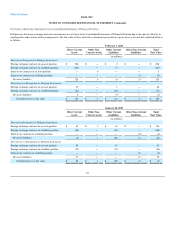

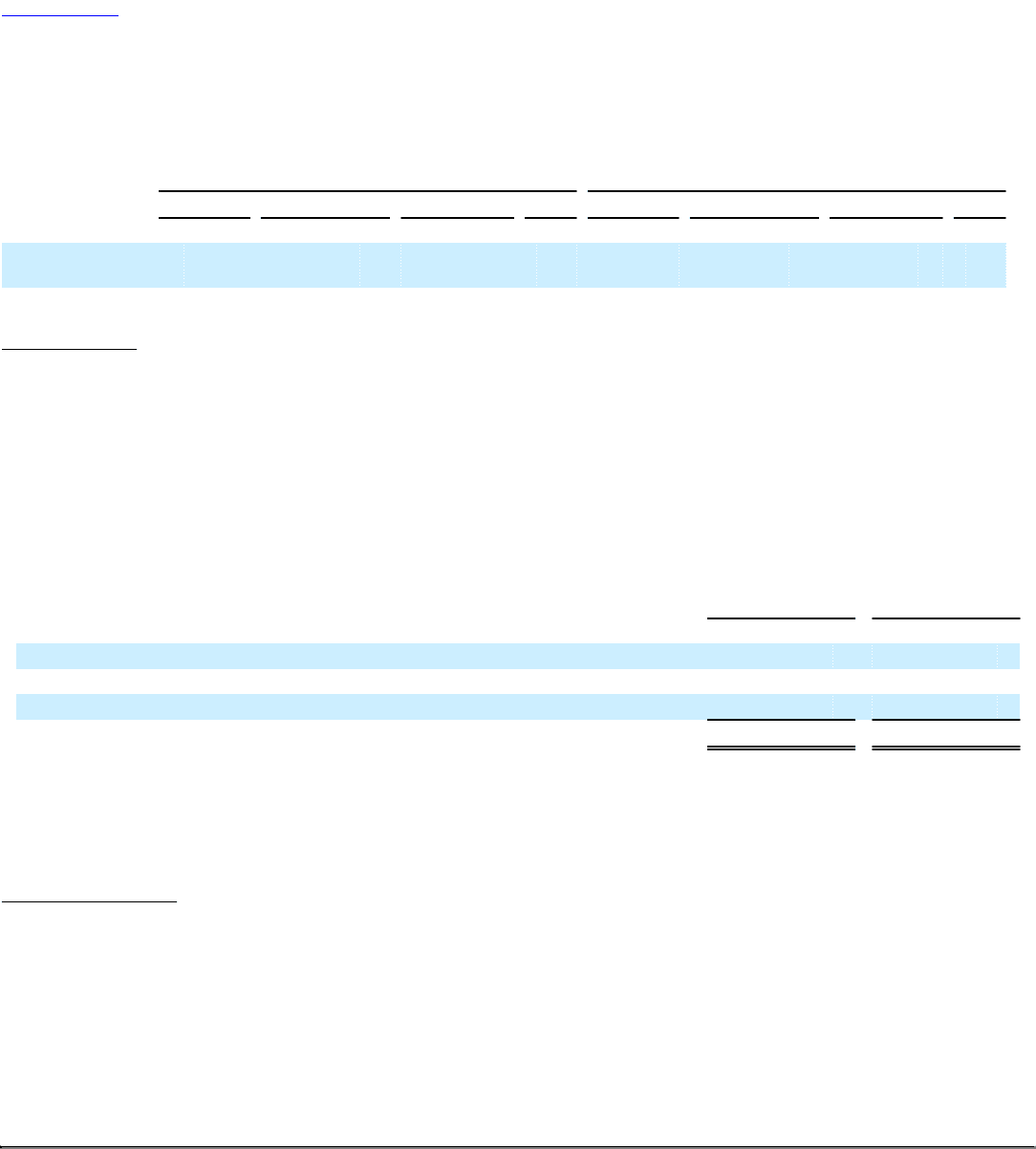

The following table shows financing receivables held by the consolidated VIEs:

February 3,

2012 January 28,

2011

(in millions)

Financing receivables held by consolidated VIEs, net:

Short-term, net $ 1,096 $ 1,087

Long-term, net 429 262

Financing receivables held by consolidated VIEs, net $ 1,525 $ 1,349

Dell's securitization programs are generally effective for 12 months and are subject to an annual renewal process. These programs contain standard structural

features related to the performance of the securitized receivables. The structural features include defined credit losses, delinquencies, average credit scores,

and excess collections above or below specified levels. In the event one or more of these criteria are not met and Dell is unable to restructure the program, no

further funding of receivables will be permitted and the timing of Dell's expected cash flows from over-collateralization will be delayed. At February 3, 2012 ,

these criteria were met.

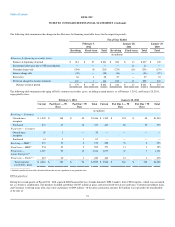

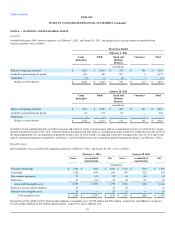

Structured Financing Debt

The structured financing debt related to the fixed-term lease and loan, and revolving loan securitization programs was $1.3 billion and $1.0 billion as of

February 3, 2012, and January 28, 2011, respectively. The debt is collateralized solely by the financing receivables in the programs. The debt has a variable

interest rate and an average duration of 12 to 36 months based on the terms of the underlying financing receivables. The total debt capacity related to the

securitization programs is $1.4 billion. See Note 5 of the Notes to Consolidated Financial Statements for additional information regarding the structured

financing debt.

Dell enters into interest rate swap agreements to effectively convert a portion of the structured financing debt from a floating rate to a fixed rate. The interest

rate swaps qualify for hedge accounting treatment as cash flow hedges. See Note 6 of the Notes to Consolidated Financial Statements for additional

information about interest rate swaps.

77