Dell 2011 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2011 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents DELL INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

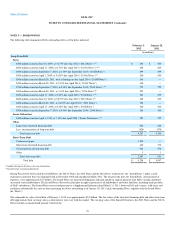

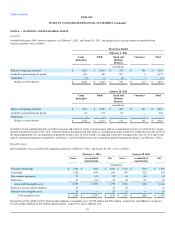

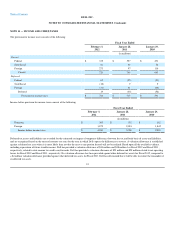

NOTE 7 — ACQUISITIONS

Fiscal 2012 Acquisitions

During Fiscal 2012, Dell completed several acquisitions, including acquisitions of Compellent Technologies, Inc. ("Compellent"), SecureWorks Inc.

("SecureWorks"), DFS Canada, and Force10 Networks, Inc. ("Force10"). The total purchase consideration was approximately $2.7 billion in cash for all of

the outstanding shares for all acquisitions completed during the period. Compellent is a provider of virtual storage solutions for enterprise and cloud

computing environments, and SecureWorks is a global provider of information security services. Force10 is a global technology company that provides

datacenter networking solutions. Compellent, SecureWorks, and Force10 will be integrated into Dell's Commercial segments. DFS Canada enables expansion

of Dell's direct finance model into Canada for all of Dell's segments. See Note 4 of the Notes to Consolidated Financial Statements for further discussion on

Dell's acquisition of DFS Canada.

Dell has recorded these acquisitions using the acquisition method of accounting and recorded their respective assets and liabilities at fair value at the date of

acquisition. The excess of the purchase prices over the estimated fair values was recorded as goodwill. Any changes in the estimated fair values of the net

assets recorded for these acquisitions prior to the finalization of more detailed analyses, but not to exceed one year from the date of acquisition, will change

the amount of the purchase prices allocable to goodwill. Any subsequent changes to any purchase price allocations that are material to Dell's consolidated

financial results will be adjusted retroactively.

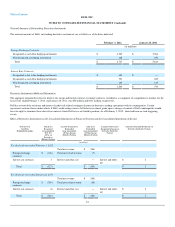

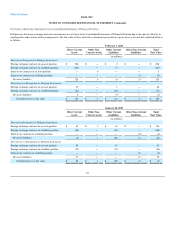

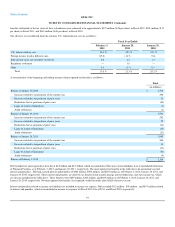

Dell recorded $1.5 billion in goodwill related to acquisitions during the fiscal year ended February 3, 2012. This amount primarily represents synergies

associated with combining these companies with Dell to provide Dell's customers with a broader range of IT solutions or, in the case of DFS Canada, to

extend Dell's financial services capabilities. This goodwill is not deductible for tax purposes. Dell also recorded $753 million in intangible assets related to

these acquisitions, which consist primarily of purchased technology and customer relationships. The intangible assets have weighted-average useful lives

ranging from 3 to 11 years. In conjunction with these acquisitions, Dell will incur approximately $150 million in compensation-related expenses that will be

expensed over a period of up to four years. There was no contingent consideration related to these acquisitions.

Dell has not presented pro forma results of operations for Fiscal 2012 acquisitions because these acquisitions are not material to Dell's consolidated results of

operations, financial position, or cash flows on either an individual or an aggregate basis.

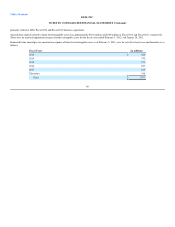

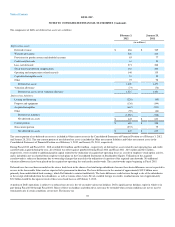

Fiscal 2011 Acquisitions

Dell completed five acquisitions during Fiscal 2011, Kace Networks, Inc. (“KACE”), Ocarina Networks Inc. (“Ocarina”), Scalent Systems Inc. (“Scalent”),

Boomi, Inc. (“Boomi”), and InSite One, Inc. (“InSite”), for a total purchase consideration of approximately $413 million in cash. KACE is a systems

management appliance company with solutions tailored to the requirements of mid-sized businesses. KACE is being integrated primarily into Dell's SMB and

Public segments. Ocarina is a provider of de-duplication solutions and content-aware compression across storage product lines. Scalent is a provider of

scalable and efficient data center infrastructure software. Boomi is a provider of on-demand integration technology. Ocarina, Scalent, and Boomi will be

integrated into all of Dell's Commercial segments. InSite provides cloud-based medical data archiving, storage, and disaster-recovery solutions to the health

care industry. InSite will be integrated into Dell's Public segment.

Dell has recorded these acquisitions using the acquisition method of accounting and recorded their respective assets and liabilities at fair value at the date of

acquisition. The excess of the purchase prices over the estimated fair values were recorded as goodwill. Any changes in the estimated fair values of the net

assets recorded for these acquisitions prior to the finalization of more detailed analyses, but not to exceed one year from the date of acquisition, will change

the amount of the purchase prices allocable to goodwill. Any subsequent changes to the purchase price allocations that are material to Dell's consolidated

financial results will be adjusted retroactively. Dell recorded approximately $284 million in goodwill and $141 million in intangible assets related to these

acquisitions. The goodwill related to these acquisitions is not deductible for tax purposes. In conjunction with these acquisitions, Dell will incur $56 million in

compensation-related expenses that will be expensed over a period of one to three years. There was no contingent consideration related to these acquisitions.

Dell has not presented pro forma results of operations for the Fiscal 2011 acquisitions because these acquisitions are not material to Dell's consolidated results

of operations, financial position, or cash flows on either an individual or an aggregate

83