Dell 2011 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2011 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents DELL INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

basis.

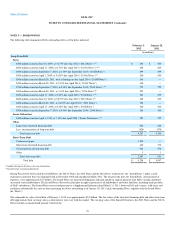

Fiscal 2010 Acquisitions

On November 3, 2009, Dell completed its acquisition of all the outstanding shares of the Class A common stock of Perot Systems, a worldwide provider of

information technology and business solutions, for a purchase consideration of $3.9 billion in cash. This acquisition is expected to provide customers a

broader range of IT services and solutions and better position Dell for its own immediate and long-term growth and efficiency. Perot Systems was primarily

integrated into the Large Enterprise and Public segments for reporting purposes. Perot Systems’ results of operations were included in Dell's results beginning

November 3, 2009.

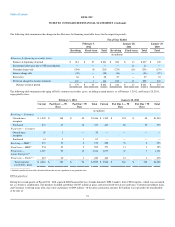

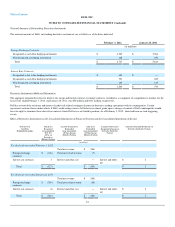

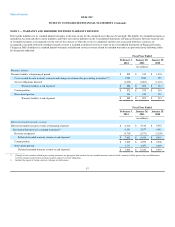

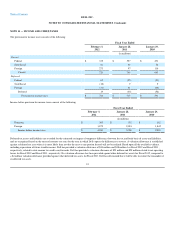

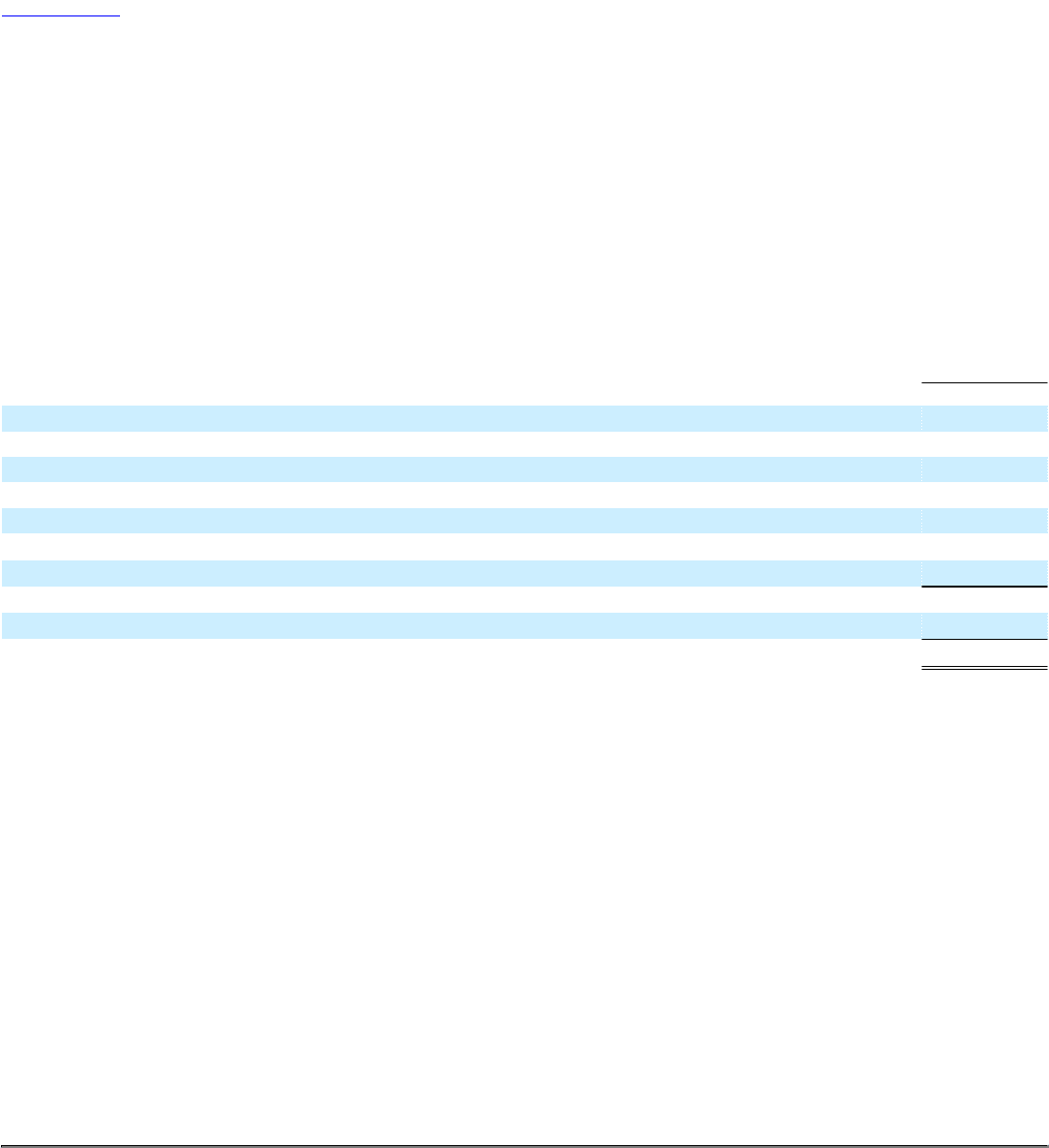

The following table summarizes the consideration paid for Perot Systems and the amounts of assets acquired and liabilities assumed recognized at the

acquisition date:

Total

(in millions)

Cash and cash equivalents $ 266

Accounts receivable, net 410

Other assets 58

Property, plant, and equipment 323

Customer relationships and other intangible assets 1,174

Deferred tax liability, net (a) (424)

Other liabilities (256)

Total identifiable net assets 1,551

Goodwill 2,327

Total purchase price $ 3,878

_____________________

(a) The deferred tax liability, net primarily relates to purchased identifiable intangible assets and property, plant, and equipment and is shown net of associated deferred tax assets.

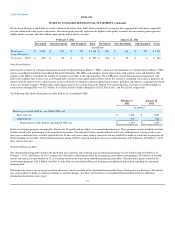

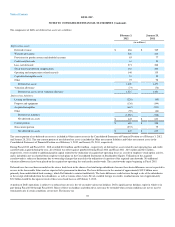

The goodwill of $2.3 billion represents the value from combining Perot Systems with Dell to provide customers with a broader range of IT services and

solutions as well as optimizing how these solutions are delivered. The acquisition has enabled Dell to supply even more Perot Systems customers with Dell

products and extended the reach of Perot Systems' capabilities to Dell customers around the world. Goodwill of $679 million, $1,613 million, and $35 million

was assigned to the Large Enterprise, Public, and SMB segments, respectively.

In conjunction with the acquisition, Dell incurred $93 million in cash compensation payments made to former Perot Systems employees who accepted

positions with Dell related to the acceleration of Perot Systems unvested stock options and other cash compensation payments. These cash compensation

payments were expensed as incurred and are recorded in Selling, general, and administrative expenses in the Consolidated Statements of Income for Fiscal

2010. During Fiscal 2010, Dell incurred $116 million in acquisition-related costs for Perot Systems, including the payments above, and an additional $23

million in other acquisition-related costs such as bankers' fees, consulting fees, other employee-related charges, and integration costs.

There was no contingent consideration related to the acquisition.

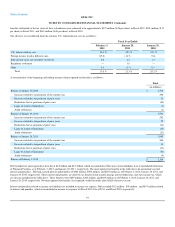

Unaudited pro-forma results for the fiscal year ended January 29, 2010 were pro-forma net sales of $54.7 billion, pro-forma net income of $1.4 billion, and

pro-forma diluted earnings per share of $0.72. The pro forma results were adjusted for intercompany charges, but did not include any anticipated cost

synergies or other effects of the planned integration of Perot Systems. Accordingly, the pro forma results presented are not necessarily indicative of the results

that actually would have occurred had the acquisition been completed on the dates indicated, nor are they indicative of the future operating results of the

combined company.

84