Costco 2013 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2013 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68

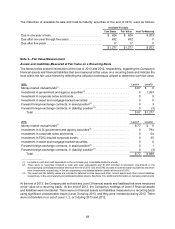

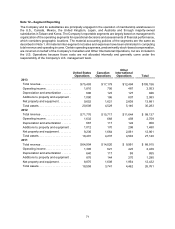

Note 10—Net Income per Common and Common Equivalent Share

The following table shows the amounts used in computing net income per share and the effect on net income

and the weighted average number of shares of potentially dilutive common shares outstanding (shares in

000’s):

2013 2012 2011

Net income available to common stockholders after assumed

conversions of dilutive securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2,039 $ 1,710 $ 1,463

Weighted average number of common shares used in basic net

income per common share . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 435,741 433,620 436,119

RSUs and stock options . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,552 4,906 6,063

Conversion of convertible notes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 219 847 912

Weighted average number of common shares and dilutive potential

of common stock used in diluted net income per share . . . . . . . . . . . 440,512 439,373 443,094

Note 11—Commitments and Contingencies

Legal Proceedings

The Company is involved in a number of claims, proceedings and litigation arising from its business and

property ownership. In accordance with applicable accounting guidance, the Company establishes an accrual

for legal proceedings if and when those matters reach a stage where they present loss contingencies that

are both probable and reasonably estimable. In such cases, there may be a possible exposure to loss in

excess of any amounts accrued. The Company monitors those matters for developments that would affect

the likelihood of a loss and the accrued amount, if any, thereof, and adjusts the amount as appropriate. If

the loss contingency at issue is not both probable and reasonably estimable, the Company does not establish

an accrual, but will continue to monitor the matter for developments that will make the loss contingency both

probable and reasonably estimable. As of the date of this report, the Company has not recorded an accrual

with respect to any matter described below. In each case, there is a reasonable possibility that a loss may

be incurred, including a loss in excess of the applicable accrual. For matters where no accrual has been

recorded, the possible loss or range of loss (including any loss in excess of our accrual) cannot in our view

be reasonably estimated because, among other things, (i) the remedies or penalties sought are indeterminate

or unspecified, (ii) the legal and/or factual theories are not well developed; and/or (iii) the matters involve

complex or novel legal theories or a large number of parties.

The Company is a defendant in the following matters, among others:

A case brought as a class action on behalf of certain present and former female managers, in which plaintiffs

allege denial of promotion based on gender in violation of Title VII of the Civil Rights Act of 1964 and California

state law. Shirley “Rae” Ellis v. Costco Wholesale Corp., United States District Court (San Francisco), Case

No. C-04-3341-MHP. Plaintiffs seek compensatory damages, punitive damages, injunctive relief, interest

and attorneys’ fees. Class certification was granted by the district court on January 11, 2007. On

September 16, 2011, the United States Court of Appeals for the Ninth Circuit reversed the order of class

certification and remanded to the district court for further proceedings. On September 25, 2012, the district

court certified a class of women in the United States denied promotion to warehouse general manager or

assistant general manager since January 3, 2002. Currently the class is believed to be approximately 1,150

people. A trial has been set for March 2014. In October 2013 the parties reached an agreement in principle

on a settlement, which is subject to the execution of definitive documentation and court approval. Any

payments to class members would be contingent upon proof of liability in individual hearings. Payments

under the settlement would be immaterial to the Company’s operations or financial position.