Costco 2013 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2013 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62

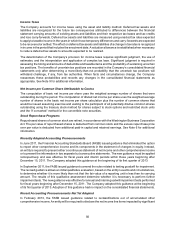

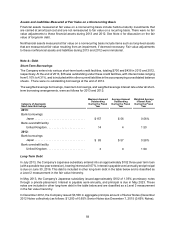

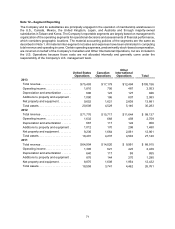

At the end of 2013, future minimum payments, net of sub-lease income of $150 for all years combined, under

non-cancelable operating leases with terms of at least one year and capital leases were as follows:

Operating

Leases Capital

Leases

2014 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 189 $ 17

2015 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 175 17

2016 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 167 16

2017 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 160 16

2018 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 153 16

Thereafter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,753 338

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2,597 420

Less amount representing interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (224)

Net present value of minimum lease payments. . . . . . . . . . . . . . . . . . . . . . . 196

Less current installments(1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (4)

Long-term capital lease obligations less current installments(2) . . . . . . . . . . . $192

_______________

(1) Included in other current liabilities.

(2) Included in deferred income taxes and other liabilities.

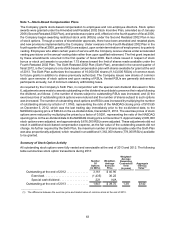

Note 6—Stockholders’ Equity

Dividends

The Company’s current quarterly dividend rate is $0.31 per share. In December 2012, the Company paid a

special cash dividend of $7.00 per share, totaling approximately $3,049.

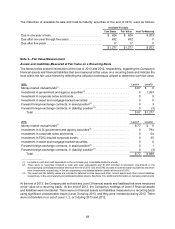

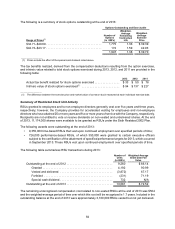

Stock Repurchase Programs

The Company’s stock repurchase program is conducted under a $4,000 authorization by the Board of

Directors approved in April 2011, which expires in April 2015. As of the end of 2013, the total amount

repurchased under this plan was $945. The following table summarizes the Company’s stock repurchase

activity:

Shares

Repurchased

(000’s)

Average

Price per

Share Total Cost

2013 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 357 $ 96.41 $ 34

2012 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7,272 84.75 617

2011 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8,939 71.74 641

These amounts differ from the stock repurchase balances in the accompanying consolidated statements of

cash flows due to changes in unsettled stock repurchases at the end of each fiscal year.

Accumulated Other Comprehensive (Loss) Income

Accumulated other comprehensive (loss) income, net of tax where applicable, was $(122) and $156 at the

end of 2013 and 2012, respectively, and was comprised primarily of unrealized foreign-currency translation

adjustments. In 2012, as part of the acquisition of the noncontrolling interest in Mexico, the Company

reclassified $155 of accumulated unrealized losses on foreign-currency translation adjustments to Costco’s

accumulated other comprehensive income. This balance was previously included as a component of non-

controlling interest.