Costco 2013 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2013 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65

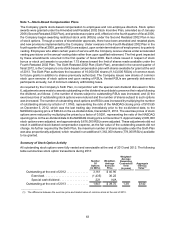

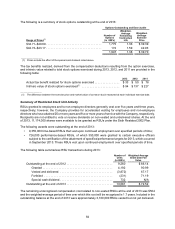

Summary of Stock-Based Compensation

The following table summarizes stock-based compensation expense and the related tax benefits under the

Company’s plans:

2013 2012 2011

Stock-based compensation expense before income taxes . . . . . . . . . . . . . $285 $241 $207

Less recognized income tax benefit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (94) (79) (67)

Stock-based compensation expense, net of income taxes . . . . . . . . . . . . . $191 $162 $140

Note 8—Retirement Plans

The Company has a 401(k) Retirement Plan available to all U.S. employees who have completed 90 days

of employment. For all U.S. employees, with the exception of California union employees, the plan allows

pre-tax deferrals, which the Company matches (50% of the first one thousand dollars of employee

contributions). In addition, the Company provides each eligible participant an annual discretionary

contribution based on salary and years of service.

California union employees are allowed to make pre-tax deferrals into the 401(k) plan, which the Company

matches (50% of the first five hundred dollars of employee contributions) and provides each eligible participant

a contribution based on hours worked and years of service.

California union employees participate in a defined benefit plan sponsored by their union under a multi-

employer plan, and the Company makes contributions to this plan based upon its union agreement. The

Company’s contributions to this plan are not material to the Company’s consolidated financial statements.

The Company has a defined contribution plan for Canadian employees and contributes a percentage of

each employee’s salary. Certain Other International operations have defined benefit and defined contribution

plans that are not significant. Amounts expensed under all plans were $409, $382, and $345 for 2013, 2012,

and 2011, respectively, and were included in selling, general and administrative expenses and merchandise

costs in the accompanying consolidated statements of income.

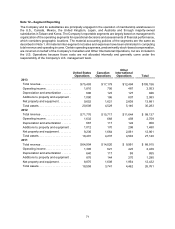

Note 9—Income Taxes

Income before income taxes is comprised of the following:

2013 2012 2011

Domestic (including Puerto Rico) . . . . . . . . . . . . . . . . . . . . . . . . . . . . $2,070 $1,809 $1,526

Foreign . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 981 958 857

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $3,051 $2,767 $2,383