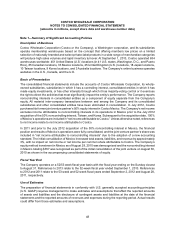

Costco 2013 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2013 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

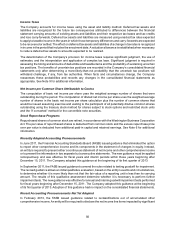

Other Current Liabilities

Other current liabilities consist of the following at the end of 2013 and 2012:

2013 2012

Insurance-related liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 346 $ 308

Deferred sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 204 159

Cash card liability . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 159 133

Other current liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 162 135

Sales return reserve . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 95 86

Tax-related liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 77 88

Vendor consideration liabilities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 46 57

Other current liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1,089 $ 966

Derivatives

The Company is exposed to foreign-currency exchange-rate fluctuations in the normal course of business.

It manages these fluctuations, in part, through the use of forward foreign-exchange contracts, seeking to

economically hedge the impact of fluctuations of foreign exchange on known future expenditures

denominated in a non-functional foreign-currency. The contracts relate primarily to U.S. dollar merchandise

inventory expenditures made by the Company’s international subsidiaries, whose functional currency is not

the U.S. dollar. Currently, these contracts do not qualify for derivative hedge accounting. The Company seeks

to mitigate risk with the use of these contracts and does not intend to engage in speculative transactions.

These contracts do not contain any credit-risk-related contingent features. The aggregate notional amounts

of open, unsettled forward foreign-exchange contracts were $458 and $284 at the end of 2013 and 2012,

respectively. The Company seeks to manage counterparty risk associated with these contracts by limiting

transactions to counterparties with which the Company has an established banking relationship. There can

be no assurance, however, that this practice effectively mitigates counterparty risk. The contracts are limited

to less than one year in duration. See Note 3 for information on the fair value of unsettled forward foreign-

exchange contracts at the end of 2013 and 2012.

The unrealized gains or losses recognized in interest income and other, net in the accompanying consolidated

statements of income relating to the net changes in the fair value of unsettled forward foreign-exchange

contracts were immaterial in 2013, 2012, and 2011.

The Company is exposed to fluctuations in prices for the energy it consumes, particularly electricity and

natural gas, which it seeks to partially mitigate through the use of fixed-price contracts for certain of its

warehouses and other facilities, primarily in the U.S. and Canada. The Company also enters into variable-

priced contracts for some purchases of electricity and natural gas, in addition to fuel for its gas stations, on

an index basis. These contracts meet the characteristics of derivative instruments, but generally qualify for

the “normal purchases or normal sales” exception under authoritative guidance and thus require no mark-

to-market adjustment.

Foreign Currency

The functional currencies of the Company’s international subsidiaries are the local currency of the country

in which the subsidiary is located. Assets and liabilities recorded in foreign currencies are translated at the

exchange rate on the balance sheet date. Translation adjustments resulting from this process are recorded

in accumulated other comprehensive income (loss). Revenues and expenses of the Company’s consolidated

foreign operations are translated at average exchange rates prevailing during the year.

The Company recognizes foreign-currency transaction gains and losses related to revaluing all monetary

assets and revaluing or settling monetary liabilities denominated in currencies other than the functional

currency in interest income and other, net in the accompanying condensed consolidated statements of

income. Generally, this includes the U.S. dollar cash and cash equivalents and the U.S. dollar payables of