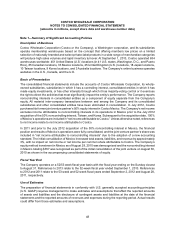

Costco 2013 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2013 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.54

consolidated subsidiaries to their functional currency. Also included are realized foreign-currency gains or

losses from settlements of forward foreign-exchange contracts.

Revenue Recognition

The Company generally recognizes sales, which include shipping fees where applicable, net of estimated

returns, at the time the member takes possession of merchandise or receives services. When the Company

collects payments from customers prior to the transfer of ownership of merchandise or the performance of

services, the amounts received are generally recorded as deferred sales, included in other current liabilities

on the consolidated balance sheets, until the sale or service is completed. The Company reserves for

estimated sales returns based on historical trends in merchandise returns, net of the estimated net realizable

value of merchandise inventories to be returned and any estimated disposition costs. Amounts collected

from members, which under common trade practices are referred to as sales taxes, are recorded on a net

basis.

The Company evaluates whether it is appropriate to record the gross amount of merchandise sales and

related costs or the net amount earned as commissions. Generally, when Costco is the primary obligor, is

subject to inventory risk, has latitude in establishing prices and selecting suppliers, can influence product or

service specifications, or has several but not all of these indicators, revenue and related shipping fees are

recorded on a gross basis. If the Company is not the primary obligor and does not possess other indicators

of gross reporting as noted above, it records the net amounts as commissions earned, which is reflected in

net sales.

The Company accounts for membership fee revenue, net of estimated refunds, on a deferred basis, whereby

revenue is recognized ratably over the one-year membership period. The Company’s Executive Members

qualify for a 2% reward (up to a maximum of $750 per year on qualified purchases), which can be redeemed

at Costco warehouses. The Company accounts for this reward as a reduction in sales. The sales reduction

and corresponding liability (classified as accrued member rewards on the consolidated balance sheets) are

computed after giving effect to the estimated impact of non-redemptions based on historical data. The net

reduction in sales was $970, $900, and $790 in 2013, 2012, and 2011, respectively.

Merchandise Costs

Merchandise costs consist of the purchase price of inventory sold, inbound and outbound shipping charges

and all costs related to the Company’s depot operations, including freight from depots to selling warehouses,

and are reduced by vendor consideration. Merchandise costs also include salaries, benefits, utilities, and

depreciation on production equipment in fresh foods and certain ancillary departments.

Selling, General and Administrative Expenses

Selling, general and administrative expenses consist primarily of salaries, benefits and workers’

compensation costs for warehouse employees, other than fresh foods departments and certain ancillary

businesses, as well as all regional and home office employees, including buying personnel. Selling, general

and administrative expenses also include utilities, bank charges, rent and substantially all building and

equipment depreciation, as well as other operating costs incurred to support warehouse operations.

Marketing and Promotional Expenses

Marketing and promotional costs are expensed as incurred and are included in selling, general and

administrative expenses in the accompanying consolidated statements of income.

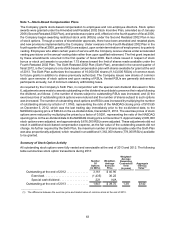

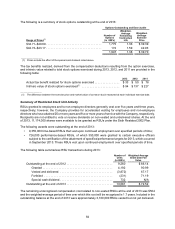

Stock-Based Compensation

Compensation expense for all stock-based awards granted is recognized using the straight-line method.

The fair value of restricted stock units (RSUs) is calculated as the market value of the common stock on the

measurement date less the present value of the expected dividends forgone during the vesting period.