Costco 2013 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2013 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66

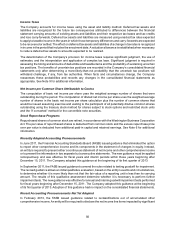

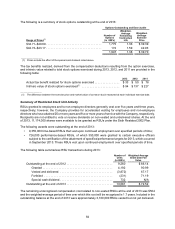

The provisions for income taxes for 2013, 2012, and 2011 are as follows:

2013 2012 2011

Federal:

Current . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $572 $ 591 $409

Deferred . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16 12 74

Total federal . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 588 603 483

State:

Current . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 109 100 78

Deferred . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 2 14

Total state . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 113 102 92

Foreign:

Current . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 302 312 270

Deferred . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (13) (17) (4)

Total foreign . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 289 295 266

Total provision for income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $990 $1,000 $841

Tax benefits associated with the exercise of employee stock options and other employee stock programs

were allocated to equity attributable to Costco in the amount of $59, $65, and $59, in 2013, 2012, and 2011,

respectively.

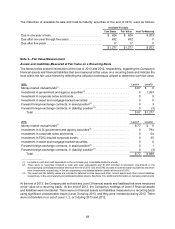

The reconciliation between the statutory tax rate and the effective rate for 2013, 2012, and 2011 is as follows:

2013 2012 2011

Federal taxes at statutory rate . . . . . . . . . $1,068 35.0% $ 969 35.0% $834 35.0%

State taxes, net . . . . . . . . . . . . . . . . . . . . 66 2.1 59 2.1 55 2.4

Foreign taxes, net. . . . . . . . . . . . . . . . . . . (87) (2.8) (61) (2.2) (66) (2.8)

Employee stock ownership plan (ESOP) . (65) (2.1) (7) (0.3) (6) (0.3)

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . 80.2 40 1.5 24 1.0

Total . . . . . . . . . . . . . . . . . . . . . . . . . . $ 990 32.4% $1,000 36.1% $841 35.3%

The Company’s provision for income taxes for 2013 was favorably impacted by a $62 nonrecurring tax benefit

in connection with the special cash dividend of $7.00 per share paid by the Company to employees, who

through the Company's 401(k) Retirement Plan owned 22,600,000 shares of Company stock through an

ESOP. Dividends paid on these shares are deductible for U.S. income tax purposes.

The Company’s provision for income taxes for 2012 was adversely impacted by nonrecurring net tax expense

of $25 relating primarily to the following items: the adverse impact of an audit of Costco Mexico by the

Mexican tax authority; the tax effects of the cash dividend declared by Costco Mexico (included in Other in

the table above); and the tax effects of nondeductible expenses for the Company’s contribution to an initiative

reforming alcohol beverage laws in Washington State.

The components of the deferred tax assets (liabilities) are as follows:

2013 2012

Equity compensation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 80 $ 79

Deferred income/membership fees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 130 148

Accrued liabilities and reserves . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 530 461

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42 55

Property and equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (558) (522)

Merchandise inventories . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (190) (182)

Net deferred tax assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 34 $ 39