Costco 2013 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2013 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

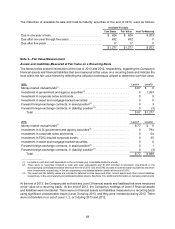

Assets and Liabilities Measured at Fair Value on a Nonrecurring Basis

Financial assets measured at fair value on a nonrecurring basis include held-to-maturity investments that

are carried at amortized cost and are not remeasured to fair value on a recurring basis. There were no fair

value adjustments to these financial assets during 2013 and 2012. See Note 4 for discussion on the fair

value of long-term debt.

Nonfinancial assets measured at fair value on a nonrecurring basis include items such as long-lived assets

that are measured at fair value resulting from an impairment, if deemed necessary. Fair value adjustments

to these nonfinancial assets and liabilities during 2013 and 2012 were immaterial.

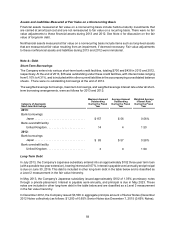

Note 4—Debt

Short-Term Borrowings

The Company enters into various short-term bank credit facilities, totaling $700 and $438 in 2013 and 2012,

respectively. At the end of 2013, $36 was outstanding under these credit facilities, with interest rates ranging

from 0.10% to 4.31%, and is included within other current liabilities in the accompanying consolidated balance

sheets. There were no outstanding borrowings at the end of 2012.

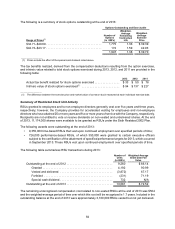

The weighted average borrowings, maximum borrowings, and weighted average interest rate under all short-

term borrowing arrangements, were as follows for 2013 and 2012:

Category of Aggregate

Short-term Borrowings

Maximum Amount

Outstanding

During the Fiscal

Year

Average Amount

Outstanding

During the Fiscal

Year

Weighted Average

Interest Rate

During the Fiscal

Year

2013:

Bank borrowings:

Japan . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $157 $ 56 0.56%

Bank overdraft facility:

United Kingdom . . . . . . . . . . . . . . . . . . . . . . . . 14 4 1.50

2012:

Bank borrowings:

Japan . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 83 $ 57 0.58%

Bank overdraft facility:

United Kingdom . . . . . . . . . . . . . . . . . . . . . . . . 3 0 1.50

Long-Term Debt

In July 2013, the Company’s Japanese subsidiary entered into an approximately $102 three-year term loan

(with a possible two year extension), bearing interest at 0.67%. Interest is payable semi-annually and principal

is due on June 30, 2016. This debt is included in other long-term debt in the table below and is classified as

a Level 2 measurement in the fair value hierarchy.

In May 2013, the Company's Japanese subsidiary issued approximately $102 of 1.05% promissory notes

through a private placement. Interest is payable semi-annually, and principal is due in May 2023. These

notes are included in other long-term debt in the table below and are classified as a Level 3 measurement

in the fair value hierarchy.

In December 2012, the Company issued $3,500 in aggregate principle amount of Senior Notes (December

2012 Notes collectively) as follows: $1,200 of 0.65% Senior Notes due December 7, 2015 (0.65% Notes);