Costco 2013 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2013 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

reclassifications out of accumulated other comprehensive income if the item is reclassified in its entirety. For

other amounts that are not required to be reclassified in their entirety to net income cross-references to other

disclosures required under U.S. GAAP are required to provide additional detail about those amounts. The

new guidance is effective for fiscal years, and interim periods within those years, beginning after

December 15, 2012. The Company plans to adopt this guidance at the beginning of its first quarter of fiscal

year 2014. Adoption of this guidance is not expected to have a material impact on the Company’s consolidated

financial statements or disclosures.

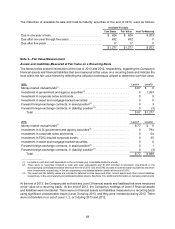

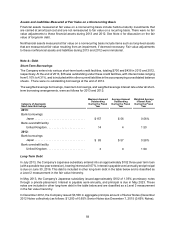

Note 2—Investments

The Company’s investments at the end of 2013 and 2012, were as follows:

2013: Cost

Basis Unrealized

Gains, Net Recorded

Basis

Available-for-sale:

Government and agency securities(1) . . . . . . . . . . . . . . . . . . . . . . $1,263 $ 0 $1,263

Corporate notes and bonds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9 0 9

Asset and mortgage-backed securities . . . . . . . . . . . . . . . . . . . . . 5 0 5

Total available-for-sale . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,277 0 1,277

Held-to-maturity:

Certificates of deposit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 124 124

Bankers' acceptances . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 79 79

Total held-to-maturity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 203 203

Total Short-Term Investments. . . . . . . . . . . . . . . . . . . . . . . . . $1,480 $ 0 $1,480

_______________

(1) Includes U.S. and Canadian government and agency securities.

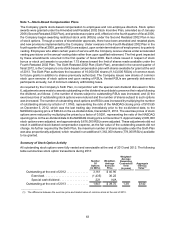

2012: Cost

Basis Unrealized

Gains, Net Recorded

Basis

Available-for-sale:

U.S. government and agency securities . . . . . . . . . . . . . . . . . . . . $ 776 $ 6 $ 782

Corporate notes and bonds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 54 0 54

FDIC-insured corporate bonds . . . . . . . . . . . . . . . . . . . . . . . . . . . 35 0 35

Asset and mortgage-backed securities . . . . . . . . . . . . . . . . . . . . . 8 0 8

Total available-for-sale . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 873 6 879

Held-to-maturity:

Certificates of deposit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 447 447

Total Short-Term Investments. . . . . . . . . . . . . . . . . . . . . . . . . $1,320 $ 6 $1,326

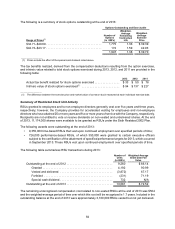

Gross unrealized gains and losses on available-for-sale securities were not material in 2013. At the end of

2013, none of the Company's available-for-sale securities were in a continuous unrealized-loss position,

nor were there any gross unrealized gains and losses on cash equivalents. At the end of 2012 and 2011,

the Company’s available-for-sale securities that were in continuous unrealized-loss position and gross

unrealized gains and losses on cash equivalents were not material.

The proceeds from sales of available-for-sale securities were $244, $482, and $602 during 2013, 2012, and

2011, respectively. Gross realized gains or losses from sales of available-for-sale securities were not material

in 2013, 2012, and 2011.