Costco 2013 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2013 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.60

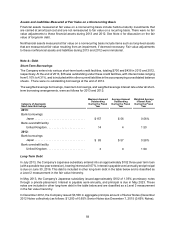

$1,100 of 1.125% Senior Notes due December 15, 2017 (1.125% Notes); and $1,200 of 1.7% Senior Notes

due December 15, 2019 (1.7% Notes). Interest is payable on the 0.65% Notes semi-annually on June 7 and

December 7 of each year until its maturity date. On the 1.125% and 1.7% Notes, interest is due semi-annually

on June 15 and December 15 of each year until its maturity date. The Company, at its option, may redeem

the December 2012 Notes at any time, in whole or in part, at a redemption price plus accrued interest. The

redemption price is equal to the greater of 100% of the principal amount of the December 2012 Notes to be

redeemed or the sum of the present value of the remaining scheduled payments of principal and interest to

maturity. Additionally, the Company will be required to make an offer to purchase the December 2012 Notes

at a price of 101% of the principal amount plus accrued and unpaid interest to the date of repurchase, upon

certain events as defined by the terms of the December 2012 Notes. The discount and issuance costs

associated with the December 2012 Notes are being amortized to interest expense over the terms of the

notes. The December 2012 Notes are classified as a Level 2 measurement in the fair value hierarchy.

In October and December 2011, the Company’s Japanese subsidiary issued two series of 1.18% Yen-

denominated promissory notes through a private placement. For both series, interest is payable semi-

annually, and principal is due in October 2018. These notes are included in other long-term debt in the table

below and are classified as a Level 3 measurement in the fair value hierarchy.

In June 2008, the Company’s Japanese subsidiary entered into a ten-year term loan with a variable rate of

interest of Yen TIBOR (6-month) plus a 0.35% margin (0.68% and 0.78% at the end of 2013 and 2012,

respectively) on the outstanding balance. Interest is payable semi-annually and principal is due in June 2018.

This debt is included in other long-term debt in the table below and is classified as a Level 3 measurement

in the fair value hierarchy.

In October 2007, the Company’s Japanese subsidiary issued promissory notes through a private placement,

bearing interest at 2.695%. Interest is payable semi-annually, and principal is due in October 2017. These

notes are included in other long-term debt in the table below and are classified as a Level 3 measurement

in the fair value hierarchy.

In February 2007, the Company issued $1,100 of 5.5% Senior Notes due March 15, 2017 at a discount of

$6 (the 2007 Senior Note). Interest is payable semi-annually on March 15 and September 15 of each year

until its maturity date. The discount and issuance costs associated with the Senior Note is being amortized

to interest expense over the term of the note. The Company, at its option, may redeem the 2007 Senior Note

at any time, in whole or in part, at a redemption price plus accrued interest. The redemption price is equal

to the greater of 100% of the principal amount of the 2007 Senior Note to be redeemed or the sum of the

present value of the remaining scheduled payments of principal and interest to maturity. Additionally, the

Company will be required to make an offer to purchase the 2007 Senior Note at a price of 101% of the

principal amount plus accrued and unpaid interest to the date of repurchase, upon certain events as defined

by the terms of the 2007 Senior Note. This note is classified as a Level 2 measurement in the fair value

hierarchy.

In August 1997, the Company sold $900 principal amount at maturity 3.5% Zero Coupon Convertible

Subordinated Notes (Zero Coupon Notes) due in August 2017. The Zero Coupon Notes were priced with a

yield to maturity of 3.5%, resulting in gross proceeds to the Company of $450. The remaining Zero Coupon

Notes outstanding are convertible into a maximum of 30,000 shares of Costco Common Stock shares at an

initial conversion price of $22.71. The Company, at its option, may redeem the Zero Coupon Notes (at the

discounted issue price plus accrued interest to date of redemption). At the end of 2013, $899 in principal

amount of Zero Coupon Notes had been converted by note holders into shares of Costco Common Stock.

These notes are included in other long-term debt in the table below and are classified as a Level 2

measurement in the fair value hierarchy.