Columbia Sportswear 2014 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2014 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

75

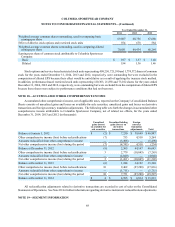

NOTE 22—RELATED PARTY TRANSACTIONS

On January 1, 2014, the Company commenced operations of a majority-owned joint venture in mainland China. Upon

commencement, the joint venture entered into Transition Services Agreements ("TSAs") with Swire, the non-controlling

shareholder in the joint venture, under which Swire renders administrative and information technology services and operates

certain retail stores on behalf of the joint venture. The joint venture incurred service fees, valued under the TSAs at Swire's

cost of $8,638,000 for the year ended December 31, 2014. These fees are included in SG&A expenses on the Consolidated

Statement of Operations. In addition, the joint venture pays Swire sourcing fees related to the purchase of certain inventory.

These sourcing fees are capitalized into Inventories and charged to Cost of sales as the inventories are sold. For the year

ended December 31, 2014, the joint venture incurred sourcing fees of $388,000.

During the three months ended March 31, 2014, both the Company and Swire funded long-term loans to the joint

venture. The Company's loan has been eliminated in consolidation, while the Swire loan is reflected as Note payable to

related party on the Consolidated Balance Sheet as of December 31, 2014. The note with Swire, in the principal amount

of 97,600,000 RMB (US$15,728,000), matures on December 31, 2018 and bears interest at a fixed annual rate of 7%.

Interest expense related to this note was $1,053,000 for the year ended December 31, 2014.

As of December 31, 2014, payables to Swire for service fees and interest expense totaled $3,651,000 and were included

in Accounts payable on the Consolidated Balance Sheets.

In addition to the transactions described above, Swire is also a third-party distributor of the Company's brands in

certain regions outside of mainland China and purchases products from the Company under the Company's normal third-

party distributor terms and pricing.