Columbia Sportswear 2014 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2014 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

59

Euro Overnight Index Average plus 75 basis points, respectively. There was no balance outstanding under either line at

December 31, 2014 or 2013.

The Company’s Japanese subsidiary has two separate unsecured and uncommitted lines of credit guaranteed by the

parent company providing for borrowing up to a maximum of US$7,000,000 and ¥300,000,000, respectively (combined

US$9,505,000), at December 31, 2014. These lines accrue interest at JPY LIBOR plus 100 basis points and the Bank of

Tokyo Prime Rate, respectively. There was no balance outstanding under either line at December 31, 2014 or 2013.

The Company’s Korean subsidiary has available an unsecured and uncommitted line of credit agreement providing

for borrowing up to a maximum of US$20,000,000. The revolving line accrues interest at the Korean three-month CD rate

plus 220 basis points. There was no balance outstanding under this line at December 31, 2014 or 2013.

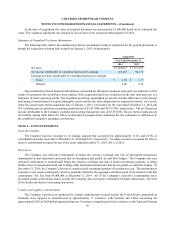

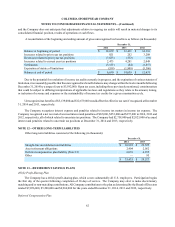

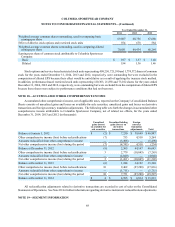

NOTE 10—ACCRUED LIABILITIES

Accrued liabilities consisted of the following (in thousands):

December 31,

2014 2013

Accrued salaries, bonus, vacation and other benefits $ 74,068 $ 68,046

Accrued import duties 10,318 10,594

Product warranties 11,148 10,768

Other 48,754 30,989

$ 144,288 $ 120,397

A reconciliation of product warranties is as follows (in thousands):

Year Ended December 31,

2014 2013 2012

Balance at beginning of period $ 10,768 $ 10,209 $ 10,452

Provision for warranty claims 4,675 5,644 4,905

Warranty claims (3,906) (5,054) (5,272)

Other (389) (31) 124

Balance at end of period $ 11,148 $ 10,768 $ 10,209

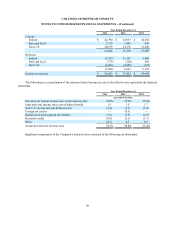

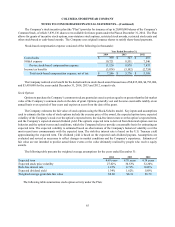

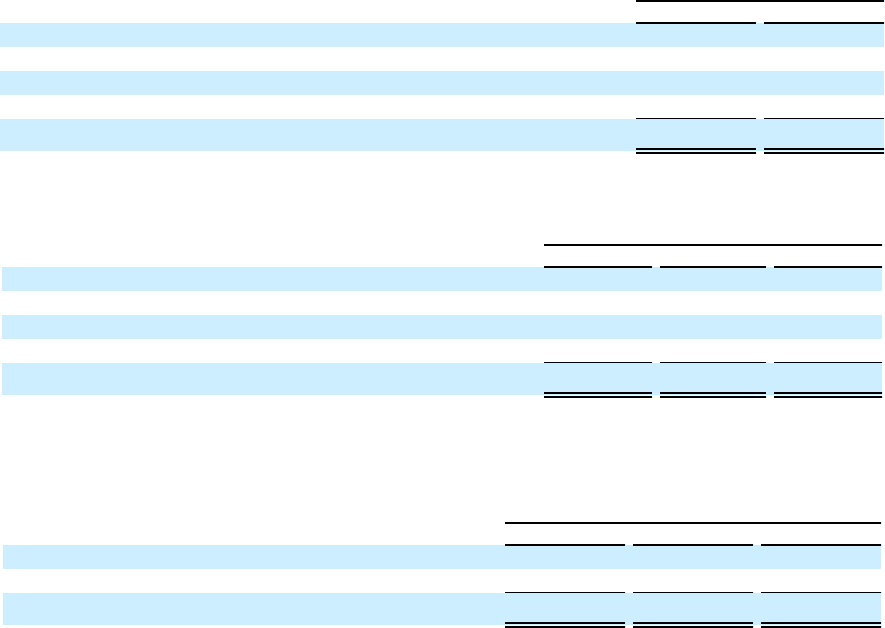

NOTE 11—INCOME TAXES

Consolidated income from continuing operations before income taxes consisted of the following (in thousands):

Year Ended December 31,

2014 2013 2012

U.S. operations $ 118,743 $ 88,561 $ 73,625

Foreign operations 79,778 42,865 60,282

Income before income tax $ 198,521 $ 131,426 $ 133,907

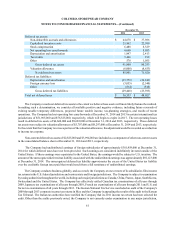

The components of the provision (benefit) for income taxes consisted of the following (in thousands):