Columbia Sportswear 2014 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2014 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

65

The Company’s stock incentive plan (the “Plan”) provides for issuance of up to 20,800,000 shares of the Company’s

Common Stock, of which 3,839,136 shares were available for future grants under the Plan at December 31, 2014. The Plan

allows for grants of incentive stock options, non-statutory stock options, restricted stock awards, restricted stock units and

other stock-based or cash-based awards. The Company uses original issuance shares to satisfy share-based payments.

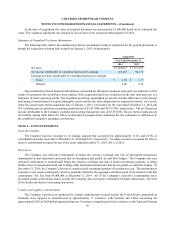

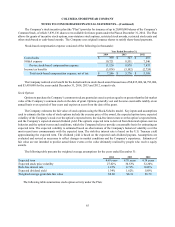

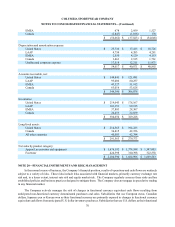

Stock-based compensation expense consisted of the following (in thousands):

Year Ended December 31,

2014 2013 2012

Cost of sales $ 399 $ 347 $ 287

SG&A expense 10,721 8,531 7,546

Pre-tax stock-based compensation expense 11,120 8,878 7,833

Income tax benefits (3,874) (3,102) (2,724)

Total stock-based compensation expense, net of tax $ 7,246 $ 5,776 $ 5,109

The Company realized a tax benefit for the deduction from stock-based award transactions of $8,835,000, $4,793,000,

and $3,410,000 for the years ended December 31, 2014, 2013 and 2012, respectively.

Stock Options

Options to purchase the Company’s common stock are granted at exercise prices equal to or greater than the fair market

value of the Company’s common stock on the date of grant. Options generally vest and become exercisable ratably on an

annual basis over a period of four years and expire ten years from the date of the grant.

The Company estimates the fair value of stock options using the Black-Scholes model. Key inputs and assumptions

used to estimate the fair value of stock options include the exercise price of the award, the expected option term, expected

volatility of the Company’s stock over the option’s expected term, the risk-free interest rate over the option’s expected term,

and the Company’s expected annual dividend yield. The option's expected term is derived from historical option exercise

behavior and the option's terms and conditions, which the Company believes provide a reasonable basis for estimating an

expected term. The expected volatility is estimated based on observations of the Company's historical volatility over the

most recent term commensurate with the expected term. The risk-free interest rate is based on the U.S. Treasury yield

approximating the expected term. The dividend yield is based on the expected cash dividend payouts. Assumptions are

evaluated and revised as necessary to reflect changes in market conditions and the Company’s experience. Estimates of

fair value are not intended to predict actual future events or the value ultimately realized by people who receive equity

awards.

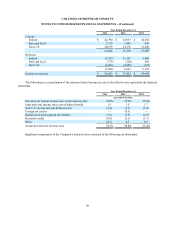

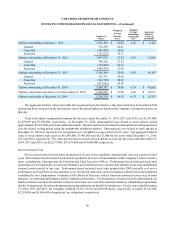

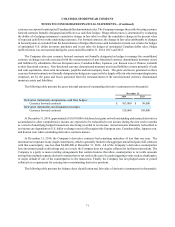

The following table presents the weighted average assumptions for the years ended December 31:

2014 2013 2012

Expected term 4.69 years 4.70 years 4.78 years

Expected stock price volatility 27.62% 30.53% 32.20%

Risk-free interest rate 1.22% 0.71% 0.88%

Expected dividend yield 1.34% 1.62% 1.80%

Weighted average grant date fair value $8.69 $6.18 $5.79

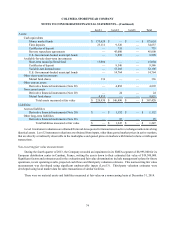

The following table summarizes stock option activity under the Plan: