Columbia Sportswear 2014 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2014 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

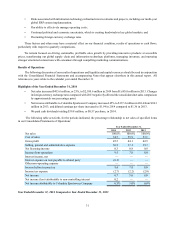

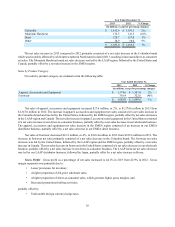

Year Ended December 31,

2014 2013 % Change

(In millions, except for percentage changes)

Columbia $ 1,750.3 $ 1,412.9 24%

Sorel 166.2 128.7 29%

Mountain Hardwear 119.8 132.5 (10)%

prAna 53.7 — —

Other 10.6 10.9 (3)%

$ 2,100.6 $ 1,685.0 25%

The net sales increase in 2014 compared to 2013 was led by the Columbia brand, followed by incremental net sales

from the prAna brand and increased Sorel net sales, partially offset by decreased Mountain Hardwear net sales. The increase

in Columbia brand net sales was primarily the result of incremental net sales by our China joint venture and increased

wholesale and direct-to-consumer net sales in the United States.

Sales by Product Category

Net sales by product category are summarized in the following table:

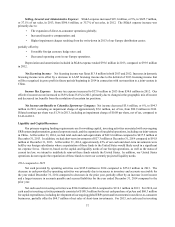

Year Ended December 31,

2014 2013 % Change

(In millions, except for percentage changes)

Apparel, Accessories and Equipment $ 1,676.2 $ 1,374.6 22%

Footwear 424.4 310.4 37%

$ 2,100.6 $ 1,685.0 25%

Net sales of apparel, accessories and equipment increased $301.6 million, or 22%, to $1,676.2 million in 2014 from

$1,374.6 million in 2013. The increase in apparel, accessories and equipment net sales was led by a net sales increase in

the Columbia brand, followed by $53.7 million of incremental prAna brand net sales, and was led by the United States,

followed by the LAAP region, Canada and the EMEA region. The net sales increase in apparel, accessories and equipment

in the United States was led by our direct-to-consumer business, followed by our wholesale business and incremental prAna

brand net sales. The apparel, accessories and equipment net sales increase in the LAAP region consisted of incremental

sales by our China joint venture.

Net sales of footwear increased $114.0 million, or 37%, to $424.4 million in 2014 from $310.4 million in 2013. The

increase in footwear net sales was led by the Columbia brand, followed by the Sorel brand. The footwear net sales increase

was led by the LAAP region, followed by the United States, Canada and the EMEA region. The LAAP footwear net sales

increase primarily consisted of incremental sales by our China joint venture. The net sales increase in footwear in the United

States was led by our wholesale business, followed by our direct-to-consumer business.

Gross Profit: Gross profit as a percentage of net sales increased to 45.5% in 2014 from 44.1% in 2013. Gross

margin expansion was primarily due to:

• Improved direct-to-consumer gross margins driven by a stronger product assortment and less promotional

activity;

• The effect of including in gross profit amounts that were previously recognized as licensing income prior to

commencement of the China joint venture; and

• A higher proportion of full-price wholesale sales;

partially offset by:

• Increased inventory valuation reserves in our Korean business; and

• Unfavorable foreign currency hedge rates.