Columbia Sportswear 2014 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2014 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

70

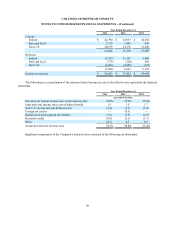

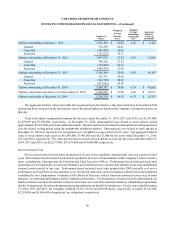

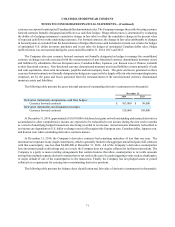

EMEA 678 2,959 1,527

Canada (2,847) (1,018) 178

$(56,662) $ (37,823) $ (34,048)

Depreciation and amortization expense:

United States $ 25,736 $ 17,413 $ 18,726

LAAP 4,750 4,203 4,281

EMEA 2,550 4,129 4,153

Canada 3,463 2,915 1,761

Unallocated corporate expense 17,518 12,211 11,971

$ 54,017 $ 40,871 $ 40,892

Accounts receivable, net:

United States $ 144,841 $ 121,081

LAAP 93,006 80,257

EMEA 43,527 51,912

Canada 63,016 53,628

$ 344,390 $ 306,878

Inventories:

United States $ 219,043 $ 178,167

LAAP 103,351 99,915

EMEA 37,803 28,307

Canada 24,453 22,839

$ 384,650 $ 329,228

Long-lived assets:

United States $ 214,565 $ 194,223

Canada 36,415 42,356

All other countries 40,583 42,794

$ 291,563 $ 279,373

Net sales by product category:

Apparel, accessories and equipment $ 1,676,192 $ 1,374,598 $ 1,347,005

Footwear 424,398 310,398 322,558

$ 2,100,590 $ 1,684,996 $ 1,669,563

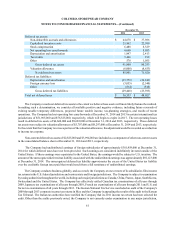

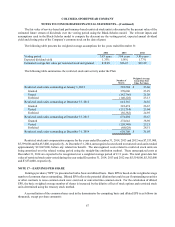

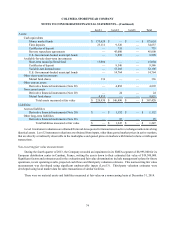

NOTE 20—FINANCIAL INSTRUMENTS AND RISK MANAGEMENT

In the normal course of business, the Company’s financial position, results of operations and cash flows are routinely

subject to a variety of risks. These risks include risks associated with financial markets, primarily currency exchange rate

risk and, to a lesser extent, interest rate risk and equity market risk. The Company regularly assesses these risks and has

established policies and business practices designed to mitigate them. The Company does not engage in speculative trading

in any financial market.

The Company actively manages the risk of changes in functional currency equivalent cash flows resulting from

anticipated non-functional currency denominated purchases and sales. Subsidiaries that use European euros, Canadian

dollars, Japanese yen or Korean won as their functional currency are primarily exposed to changes in functional currency

equivalent cash flows from anticipated U.S. dollar inventory purchases. Subsidiaries that use U.S. dollars as their functional