Columbia Sportswear 2014 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2014 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

72

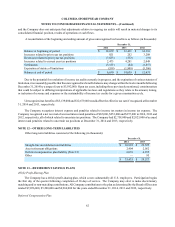

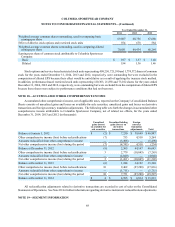

December 31,

Balance Sheet Classification 2014 2013

Derivative instruments designated as cash

flow hedges:

Derivative instruments in asset positions:

Currency forward contracts Prepaid expenses and other current assets $ 9,993 $ 1,936

Currency forward contracts Other non-current assets — 24

Derivative instruments in liability

positions:

Currency forward contracts Accrued liabilities — 872

Currency forward contracts Other long-term liabilities — 95

Derivative instruments not designated as

hedges:

Derivative instruments in asset positions:

Currency forward contracts Prepaid expenses and other current assets 2,754 2,956

Derivative instruments in liability

positions:

Currency forward contracts Accrued liabilities 924 280

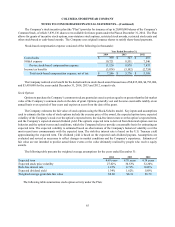

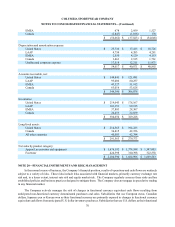

The following table presents the effect and classification of derivative instruments for the years ended December 31,

2014, 2013 and 2012 (in thousands):

For the Year Ended

December 31,

Statement Of Operations

Classification 2014 2013 2012

Currency Forward Contracts:

Derivative instruments designated as cash flow

hedges:

Gain recognized in other comprehensive

income, net of tax — $9,462 $2,779 $ 753

Gain reclassified from accumulated other

comprehensive income to income for the

effective portion Cost of sales 2,727 5,721 5,908

Gain reclassified from accumulated other

comprehensive income to income as a

result of cash flow hedge discontinuance Cost of sales — — 441

Loss recognized in income for amount

excluded from effectiveness testing and

for the ineffective portion Net sales (27) — —

Loss recognized in income for amount

excluded from effectiveness testing and

for the ineffective portion Cost of sales (353)(71)(40)

Derivative instruments not designated as hedges:

Gain recognized in income Other non-operating expense 7,111 8,824 —

Loss recognized in income Selling, general and

administrative expense — — (1,841)

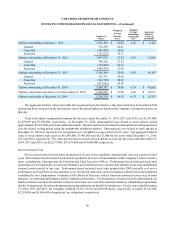

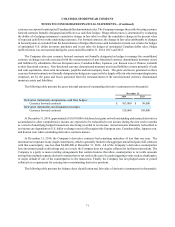

NOTE 21—FAIR VALUE MEASURES

Certain assets and liabilities are reported at fair value on either a recurring or nonrecurring basis. Fair value is defined

as an exit price, representing the amount that would be received to sell an asset or paid to transfer a liability in an orderly

transaction between market participants, under a three-tier fair value hierarchy that prioritizes the inputs used in measuring

fair value as follows: