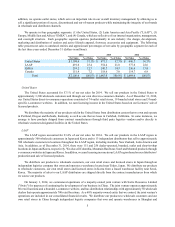

Columbia Sportswear 2014 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2014 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.15

of the joint venture, and to attract new employees as necessary to supplement the skills, knowledge and expertise

of the existing management team and other key personnel. We face intense competition for these individuals

worldwide, including in China. We may not be able to attract qualified new employees or retain existing employees

to operate the joint venture. Additionally, turnover in key management positions in China could impair our ability

to execute our growth strategy, which may negatively affect the value of our investment in the joint venture and

the growth of our sales in China.

• Initially, we are relying in part on the operational skill of our joint venture partner. Additionally, because our

joint venture partner has protective voting rights with respect to specified major business decisions of the joint

venture, we may experience difficulty reaching agreement as to implementation of various changes to the joint

venture’s business. For these reasons, or as a result of other factors, we may not realize the anticipated benefits

of the joint venture, and our participation in the joint venture could adversely affect the results of our operations.

• Continued sales growth in China is an important part of our expectations for our joint venture business. Although

China has experienced significant economic growth in recent years, that growth is slowing. Slowing economic

growth in China could result in reduced consumer discretionary spending, which in turn could result in less

demand for our products, and thus negatively affect the value of our investment in the joint venture and the

growth of our sales in China.

• Although we believe we have achieved a leading market position in China, many of our competitors who are

significantly larger than we are and have substantially greater financial, distribution, marketing and other

resources, more stable manufacturing resources and greater brand strength are also concentrating on growing

their businesses in China. In addition, the number of competitors in the marketplace has increased significantly

in recent years. Increased investment by our competitors in this market could decrease our market share and

competitive position in China.

Our International Operations Involve Many Risks

We are subject to risks generally associated with doing business internationally. These risks include the effects of

foreign laws and regulations, foreign government fiscal and political crises, political and economic disputes and sanctions,

changes in consumer preferences, foreign currency fluctuations, managing a diverse and widespread workforce, political

unrest, terrorist acts, military operations, disruptions or delays in shipments, disease outbreaks, natural disasters and changes

in economic conditions in countries in which we manufacture or sell products. These factors, among others, may affect our

ability to sell products in international markets, our ability to collect accounts receivable, our ability to manufacture products

or procure materials, and our cost of doing business. For example, political and economic uncertainty in certain South

American distributor markets have resulted in currency and import restrictions, limiting our ability to sell products in some

countries in this region. Also, Russia constitutes a significant portion of our non-U.S. sales and operating income and a

significant change in conditions in that market could have a material adverse effect on our financial condition, results of

operations or cash flows. If any of these or other factors make the conduct of business in a particular country undesirable

or impractical, our business may be materially and adversely affected. As we expand our operations in geographic scope

and product categories, we anticipate intellectual property disputes will increase, making it more expensive and challenging

to establish and protect our intellectual property rights and to defend against claims of infringement by others.

In addition, many of our imported products are subject to duties, tariffs or other import limitations that affect the cost

and quantity of various types of goods imported into the United States and other markets. Any country in which our products

are produced or sold may eliminate, adjust or impose new import limitations, duties, anti-dumping penalties or other charges

or restrictions, any of which could have a material adverse effect on our financial condition, results of operations or cash

flows.

We May Have Additional Tax Liabilities

As a global company, we determine our income tax liability in various competing tax jurisdictions based on an analysis

and interpretation of local tax laws and regulations. This analysis requires a significant amount of judgment and estimation

and is often based on various assumptions about the future actions of the local tax authorities. These determinations are the

subject of periodic domestic and foreign tax audits. Although we accrue for uncertain tax positions, our accrual may be

insufficient to satisfy unfavorable findings. Unfavorable audit findings and tax rulings may result in payment of taxes, fines

and penalties for prior periods and higher tax rates in future periods, which may have a material adverse effect on our