Columbia Sportswear 2014 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2014 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

61

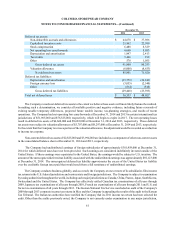

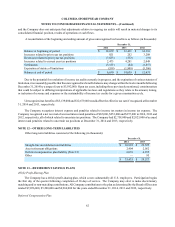

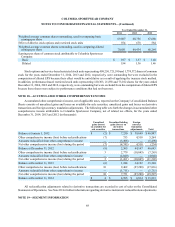

December 31,

2014 2013

Deferred tax assets:

Non-deductible accruals and allowances $ 44,678 $ 37,986

Capitalized inventory costs 25,962 22,589

Stock compensation 6,488 6,329

Net operating loss carryforwards 6,660 9,683

Depreciation and amortization 1,947 2,413

Tax credits 5,496 198

Other 578 1,055

Gross deferred tax assets 91,809 80,253

Valuation allowance (6,008) (8,633)

Net deferred tax assets 85,801 71,620

Deferred tax liabilities:

Depreciation and amortization (25,579) (20,243)

Foreign currency loss (3,055) (2,540)

Other (814) (810)

Gross deferred tax liabilities (29,448)(23,593)

Total net deferred taxes $ 56,353 $ 48,027

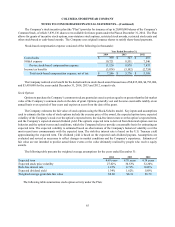

The Company records net deferred tax assets to the extent we believe these assets will more likely than not be realized.

In making such a determination, we consider all available positive and negative evidence, including future reversals of

existing taxable temporary differences, projected future taxable income, tax-planning strategies, and results of recent

operations. The Company had net operating loss carryforwards at December 31, 2014 and 2013 in certain international tax

jurisdictions of $51,965,000 and $76,525,000, respectively, which will begin to expire in 2017. The net operating losses

result in deferred tax assets of $6,660,000 and $9,683,000 at December 31, 2014 and 2013, respectively. These deferred

tax assets were subject to valuation allowances of $5,707,000 and $8,297,000 at December 31, 2014 and 2013, respectively.

To the extent that the Company reverses a portion of the valuation allowance, the adjustment would be recorded as a reduction

to income tax expense.

Non-current deferred tax assets of $2,825,000 and $3,994,000 are included as a component of other non-current assets

in the consolidated balance sheet at December 31, 2014 and 2013, respectively.

The Company had undistributed earnings of foreign subsidiaries of approximately $381,959,000 at December 31,

2014 for which deferred taxes have not been provided. Such earnings are considered indefinitely invested outside of the

United States. If these earnings were repatriated to the United States, the earnings would be subject to U.S. taxation. The

amount of the unrecognized deferred tax liability associated with the undistributed earnings was approximately $92,123,000

at December 31, 2014. The unrecognized deferred tax liability approximates the excess of the United States tax liability

over the creditable foreign taxes paid that would result from a full remittance of undistributed earnings.

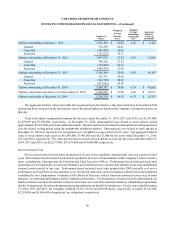

The Company conducts business globally, and as a result, the Company or one or more of its subsidiaries files income

tax returns in the U.S. federal jurisdiction and various state and foreign jurisdictions. The Company is subject to examination

by taxing authorities throughout the world, including such major jurisdictions as Canada, China, France, Japan, South Korea,

Switzerland and the United States. The Company has effectively settled Canadian tax examinations of all years through

2009, Japanese tax examinations of all years through 2010, French tax examinations of all years through 2011 and U.S. and

Swiss tax examinations of all years through 2012. The Korean National Tax Service concluded an audit of the Company's

2009 through 2013 corporate income tax returns in May and the Company is appealing the results of the audit to the Korean

Tax Tribunal. The Italian tax authorities have notified the Company that its 2011 income tax return has been selected for

audit. Other than the audits previously noted, the Company is not currently under examination in any major jurisdiction,