Columbia Sportswear 2014 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2014 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

55

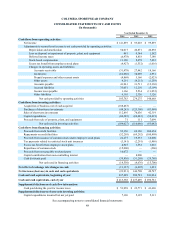

PrAna contributed net sales of $53,715,000 and net loss of $2,434,000 to the Company from May 31, 2014 to December

31, 2014, including amortization of acquired assets of $7,326,000. In addition, the Company incurred transaction costs of

$3,387,000 during the year ended December 31, 2014. These acquisition and integration costs are included in SG&A

expenses in the Consolidated Statements of Operations for the year ended December 31, 2014.

Purchase price allocation

Acquired assets and liabilities were recorded at estimated fair value as of the acquisition date. The excess of the

purchase price over the estimated fair value of identifiable net assets resulted in the recognition of goodwill of $54,156,000,

all of which was assigned to the United States segment, and is attributable to future growth opportunities and any intangible

assets that did not qualify for separate recognition. The goodwill is expected to be deductible for tax purposes.

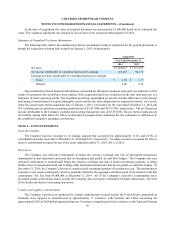

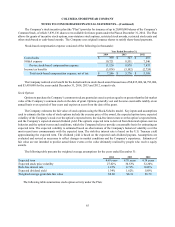

The following table summarizes the fair value of the net assets acquired and liabilities assumed and measurement

period adjustments since May 30, 2014, the acquisition date (in thousands). Measurement period adjustments since the

May 30, 2014 acquisition date were not significant.

Valuation at

December 31,

2014

Cash $ 4,946

Accounts receivable 10,021

Inventories 9,641

Other current assets 2,531

Property, plant and equipment 5,192

Acquired intangible assets 114,500

Other non-current assets 258

Total assets acquired 147,089

Accounts payable 2,803

Other current liabilities 5,029

Total liabilities assumed 7,832

Net identifiable assets acquired 139,257

Goodwill 54,156

Net assets acquired $ 193,413

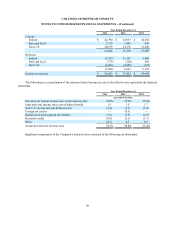

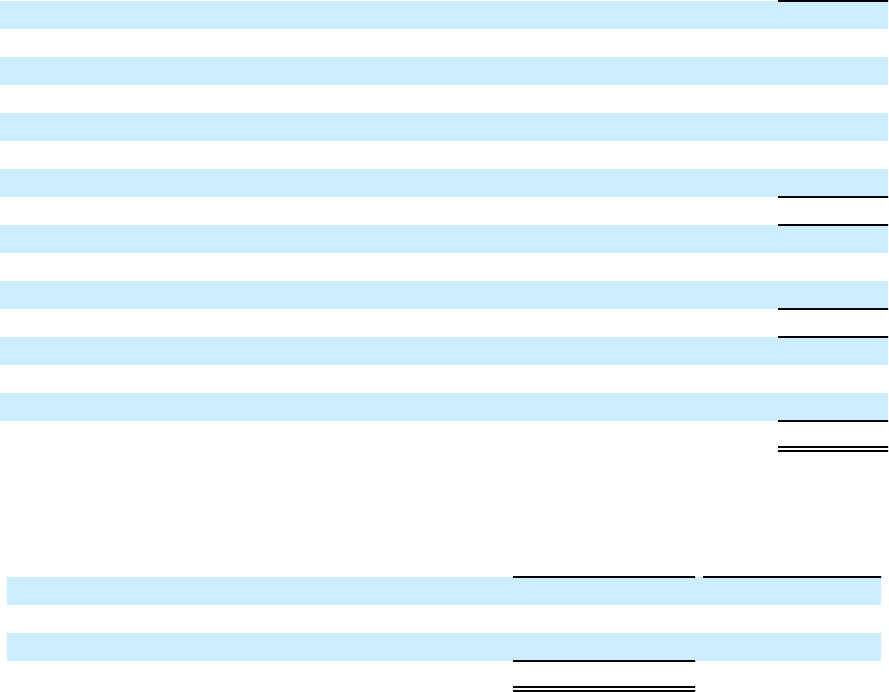

The following table sets forth the components of identifiable intangible assets and their estimated useful lives as of

May 30, 2014, the acquisition date (in thousands, except for estimated useful lives, in years):

Estimated fair value Estimated useful life,

in years

Trade name $ 88,000 Indefinite

Customer relationships 23,000 3-10 years

Order backlog 3,500 Less than 1 year

Total $ 114,500

The order backlog was fully amortized during the year ending December 31, 2014.