Columbia Sportswear 2014 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2014 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

66

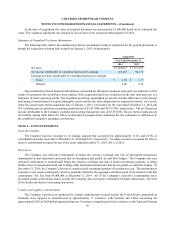

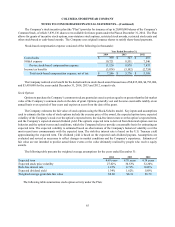

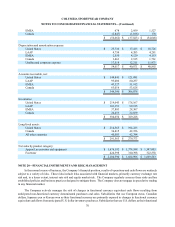

Number of

Shares

Weighted

Average

Exercise

Price

Weighted

Average

Remaining

Contractual

Life

Aggregate

Intrinsic

Value (in

thousands)

Options outstanding at January 1, 2012 3,838,192 $ 23.02 6.25 $ 9,141

Granted 716,338 24.41

Cancelled (344,930) 26.45

Exercised (761,622) 19.17

Options outstanding at December 31, 2012 3,447,978 23.82 6.15 13,001

Granted 708,220 27.33

Cancelled (119,098) 26.67

Exercised (888,836) 21.98

Options outstanding at December 31, 2013 3,148,264 25.02 6.36 45,187

Granted 512,761 39.69

Cancelled (102,598) 28.39

Exercised (917,642) 24.28

Options outstanding at December 31, 2014 2,640,785 $ 28.00 6.50 $ 43,682

Options vested and expected to vest at December 31, 2014 2,548,918 $ 27.80 6.42 $ 42,677

Options exercisable at December 31, 2014 1,290,374 $ 24.15 4.78 $ 26,315

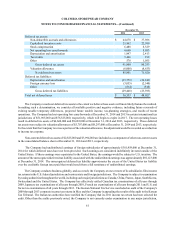

The aggregate intrinsic value in the table above represents pre-tax intrinsic value that would have been realized if all

options had been exercised on the last business day of the period indicated, based on the Company’s closing stock price on

that day.

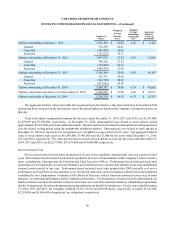

Total stock option compensation expense for the years ended December 31, 2014, 2013 and 2012 was $3,587,000,

$3,479,000 and $3,180,000, respectively. At December 31, 2014, unrecognized costs related to stock options totaled

approximately $5,837,000, before any related tax benefit. The unrecognized costs related to stock options are being amortized

over the related vesting period using the straight-line attribution method. Unrecognized costs related to stock options at

December 31, 2014 are expected to be recognized over a weighted average period of 2.12 years. The aggregate intrinsic

value of stock options exercised was $16,345,000, $7,491,000 and $5,517,000 for the years ended December 31, 2014,

2013 and 2012, respectively. The total cash received as a result of stock option exercises for the years ended December 31,

2014, 2013 and 2012 was $22,277,000, $19,537,000 and $14,600,000, respectively.

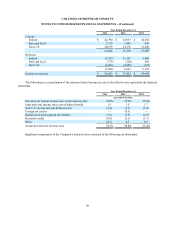

Restricted Stock Units

Service-based restricted stock units are granted at no cost to key employees and generally vest over a period of four

years. Performance-based restricted stock units are granted at no cost to certain members of the Company’s senior executive

team, excluding the Chairman and the President and Chief Executive Officer. Performance-based restricted stock units

granted prior to 2010 generally vest over a performance period of between two and one-half and three years with an additional

required service period of one year. Performance-based restricted stock units granted after 2009 generally vest over a

performance period of between two and three years. Restricted stock units vest in accordance with the terms and conditions

established by the Compensation Committee of the Board of Directors, and are based on continued service and, in some

instances, on individual performance and/or Company performance. For the majority of restricted stock units granted, the

number of shares issued on the date the restricted stock units vest is net of the minimum statutory withholding requirements

that the Company pays in cash to the appropriate taxing authorities on behalf of its employees. For the years ended December

31, 2014, 2013 and 2012, the Company withheld 78,265, 83,366 and 60,598 shares, respectively, to satisfy $3,141,000,

$2,291,000 and $1,486,000 of employees’ tax obligations, respectively.