Columbia Sportswear 2014 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2014 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.COLUMBIA SPORTSWEAR COMPANY

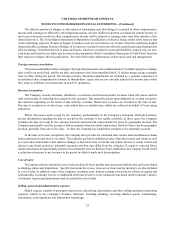

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

54

Shipping and handling costs:

Shipping and handling fees billed to customers and consumers are recorded as revenue. The direct costs associated

with shipping goods to customers and consumers are recorded as cost of sales. Inventory planning, receiving and handling

costs are recorded as a component of SG&A expenses and were $59,561,000, $56,891,000 and $59,212,000 for the years

ended December 31, 2014, 2013 and 2012, respectively.

Stock-based compensation:

Stock-based compensation cost is estimated at the grant date based on the award’s fair value and is recognized as

expense over the requisite service period using the straight-line attribution method. The Company estimates stock-based

compensation for stock options granted using the Black-Scholes option pricing model, which requires various highly

subjective assumptions, including volatility and expected option life. Further, the Company estimates forfeitures for stock-

based awards granted which are not expected to vest. For restricted stock unit awards subject to performance conditions,

the amount of compensation expense recorded in a given period reflects the Company's assessment of the probability of

achieving its performance targets. If any of these inputs or assumptions changes significantly, stock-based compensation

expense may differ materially in the future from that recorded in the current period. Assumptions are evaluated and revised

as necessary to reflect changes in market conditions and the Company’s experience. Estimates of fair value are not intended

to predict actual future events or the value ultimately realized by people who receive equity awards. The fair value of

service-based and performance-based restricted stock units is discounted by the present value of the estimated future stream

of dividends over the vesting period using the Black-Scholes model.

Advertising costs:

Advertising costs are expensed in the period incurred and are included in SG&A expenses. Total advertising expense,

including cooperative advertising costs, was $110,109,000, $78,095,000 and $76,714,000 for the years ended December

31, 2014, 2013 and 2012, respectively.

Through cooperative advertising programs, the Company reimburses its wholesale customers for some of their costs

of advertising the Company’s products based on various criteria, including the value of purchases from the Company and

various advertising specifications. Cooperative advertising costs are included in expenses because the Company receives

an identifiable benefit in exchange for the cost, the advertising may be obtained from a party other than the customer, and

the fair value of the advertising benefit can be reasonably estimated. Cooperative advertising costs were $8,056,000,

$6,032,000 and $7,851,000 for the years ended December 31, 2014, 2013 and 2012, respectively.

Recent Accounting Pronouncement:

In May 2014, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") No.

2014-09, Revenue from Contracts with Customers: Topic 606. This ASU outlines a single comprehensive model for entities

to use in accounting for revenue arising from contracts with customers and supersedes most current revenue recognition

guidance. This accounting standard is effective for annual reporting periods beginning after December 15, 2016, including

interim reporting periods within that reporting period. Early adoption is not permitted. The Company is currently evaluating

the impact this accounting standard will have on the Company's financial position, results of operations or cash flows.

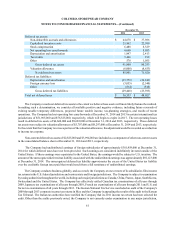

NOTE 3—BUSINESS ACQUISITION

On May 30, 2014, the Company purchased 100% of the equity interest in prAna Living LLC (“prAna”) for

$188,467,000, net of acquired cash of$4,946,000. PrAna is a lifestyle apparel brand sold through approximately 1,400

select specialty and online retailers across North America, as well as through five company-owned retail stores, an e-

commerce site and direct-mail catalogs. The acquisition of prAna strengthens and diversifies the Company's brand portfolio

and generally offsets some of the more seasonal sales effects found within existing Columbia brands. The acquisition was

funded with cash on hand.