Columbia Sportswear 2014 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2014 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

57

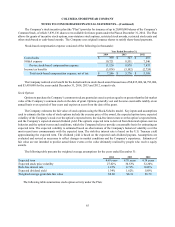

accounting for substantially all of 2014 global footwear production. The five largest apparel factory groups accounted for

approximately 30% of 2014 global apparel production, with the largest factory group accounting for 11% of 2014 global

apparel production. The five largest footwear factory groups accounted for approximately 85% of 2014 global footwear

production, with the largest factory group accounting for 41% of 2014 global footwear production. These companies,

however, have multiple factory locations, many of which are in different countries, thus reducing the risk that unfavorable

conditions at a single factory or location will have a material adverse effect on the Company.

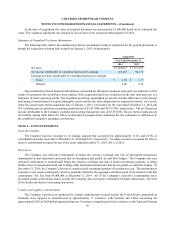

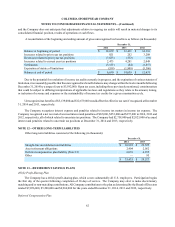

NOTE 5—NON-CONTROLLING INTEREST

The Company owns a 60% controlling interest in a joint venture formed with Swire Resources, Limited ("Swire") to

support the development of the Company's business in China. The joint venture was in a formation and start-up phase

during 2013 and began operations on January 1, 2014. In 2013, Swire made an initial capital contribution of $8,000,000

in cash, and the Company made an initial capital contribution of $12,000,000 in cash. The accounts and operations of the

joint venture are included in the Consolidated Financial Statements as of December 31, 2014 and 2013. Swire's share of

the net income (loss) of the joint venture is included in net income (loss) attributable to non-controlling interest in the

Consolidated Statements of Operations for the years ended December 31, 2014 and 2013. The 40% non-controlling equity

interest in the joint venture is presented separately in the Consolidated Balance Sheets and Consolidated Statements of

Equity for the years ended December 31, 2014 and 2013.

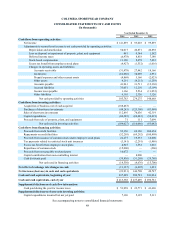

NOTE 6—ACCOUNTS RECEIVABLE, NET

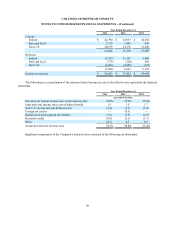

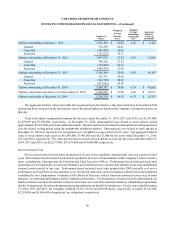

Accounts receivable, net, is as follows (in thousands):

December 31,

2014 2013

Trade accounts receivable $ 353,333 $ 315,160

Allowance for doubtful accounts (8,943) (8,282)

Accounts receivable, net $ 344,390 $ 306,878

NOTE 7—PROPERTY, PLANT, AND EQUIPMENT, NET

Property, plant, and equipment consisted of the following (in thousands):

December 31,

2014 2013

Land and improvements $ 21,049 $ 21,321

Buildings and improvements 160,165 165,582

Machinery, software and equipment 281,132 212,097

Furniture and fixtures 72,292 65,540

Leasehold improvements 93,782 78,631

Construction in progress 8,755 62,582

637,175 605,753

Less accumulated depreciation (345,612) (326,380)

$ 291,563 $ 279,373

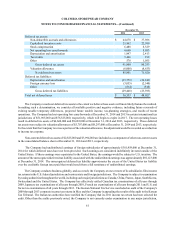

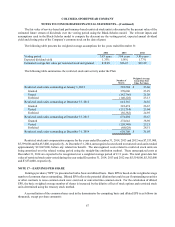

NOTE 8—INTANGIBLE ASSETS, NET AND GOODWILL

Intangible assets that are determined to have finite lives include patents, purchased technology and customer

relationships and are amortized over their estimated useful lives, which range from approximately 3 to 10 years, and are

measured for impairment only when events or circumstances indicate the carrying value may be impaired. Goodwill and

intangible assets with indefinite useful lives, including trademarks and trade names, are not amortized but are periodically

evaluated for impairment.