Columbia Sportswear 2014 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2014 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

63

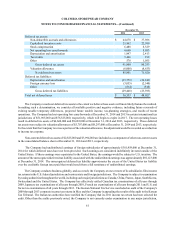

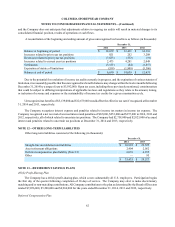

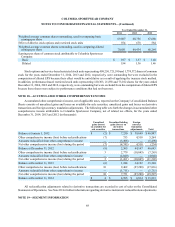

The Company sponsors a nonqualified retirement savings plan for certain senior management employees whose

contributions to the tax qualified 401(k) plan would be limited by provisions of the Internal Revenue Code. This plan allows

participants to defer receipt of a portion of their salary and incentive compensation and to receive matching contributions

for a portion of the deferred amounts. Company matching contributions to the plan totaled $239,000, $483,000 and $259,000

for the years ended December 31, 2014, 2013 and 2012, respectively. Participants earn a return on their deferred compensation

based on investment earnings of participant-selected mutual funds. Deferred compensation, including accumulated earnings

on the participant-directed investment selections, is distributable in cash at participant-specified dates or upon retirement,

death, disability or termination of employment.

The Company has purchased specific mutual funds in the same amounts as the participant-directed investment

selections underlying the deferred compensation liabilities. These investment securities and earnings thereon, held in an

irrevocable trust, are intended to provide a source of funds to meet the deferred compensation obligations, subject to claims

of creditors in the event of the Company’s insolvency. Changes in the market value of the participants' investment selections

are recorded as an adjustment to the investments and as unrealized gains and losses in SG&A expense. A corresponding

adjustment of an equal amount is made to the deferred compensation liabilities and compensation expense, which is included

in SG&A expense.

At December 31, 2014 and 2013, the long-term portion of the liability to participants under this plan was $6,039,000

and $4,855,000, respectively, and was recorded in other long-term liabilities. At December 31, 2014 and 2013, the current

portion of the participant liability was $485,000 and $336,000, respectively, and was recorded in accrued liabilities. At

December 31, 2014 and 2013, the fair value of the long-term portion of the mutual fund investments related to this plan

was $6,039,000 and $4,855,000, respectively, and was recorded in other non-current assets. At December 31, 2014 and

2013, the current portion of the mutual fund investments related to this plan was $485,000 and $336,000, respectively, and

was recorded in short-term investments.

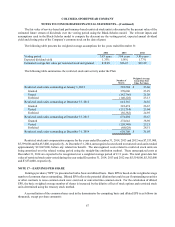

NOTE 14—COMMITMENTS AND CONTINGENCIES

Operating Leases

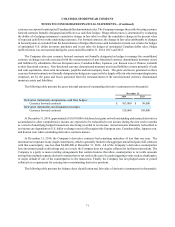

The Company leases, among other things, retail space, office space, warehouse facilities, storage space, vehicles and

equipment. Generally, the base lease terms are between 5 and 10 years. Certain lease agreements contain scheduled rent

escalation clauses in their future minimum lease payments. Future minimum lease payments are recognized on a straight-

line basis over the minimum lease term and the pro rata portion of scheduled rent escalations is included in other long-term

liabilities. Certain retail space lease agreements provide for additional rents based on a percentage of annual sales in excess

of stipulated minimums (“percentage rent”). Certain lease agreements require the Company to pay real estate taxes,

insurance, common area maintenance (“CAM”), and other costs, collectively referred to as operating costs, in addition to

base rent. Percentage rent and operating costs are recognized as incurred in SG&A expense in the Consolidated Statements

of Operations. Certain lease agreements also contain lease incentives, such as tenant improvement allowances and rent

holidays. The Company recognizes the benefits related to the lease incentives on a straight-line basis over the applicable

lease term.

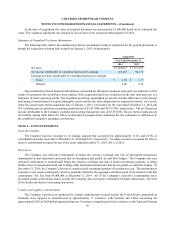

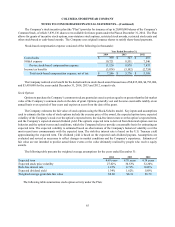

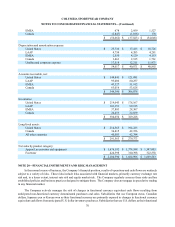

Rent expense, including percentage rent but excluding operating costs for which the Company is obligated, consisted

of the following (in thousands):

Year Ended December 31,

2014 2013 2012

Rent expense included in SG&A expense $ 62,704 $ 53,972 $ 51,853

Rent expense included in cost of sales 1,631 1,592 1,528

$ 64,335 $ 55,564 $ 53,381

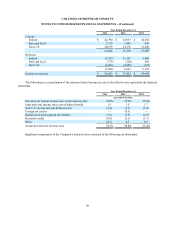

Approximate future minimum payments, including rent escalation clauses and stores that are not yet open, on all lease

obligations at December 31, 2014, are as follows (in thousands). Operating lease obligations listed below do not include