Columbia Sportswear 2014 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2014 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

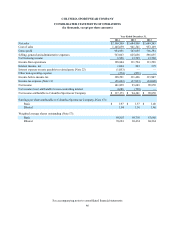

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

51

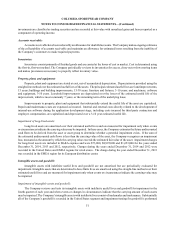

investments are classified as trading securities and are recorded at fair value with unrealized gains and losses reported as a

component of operating income.

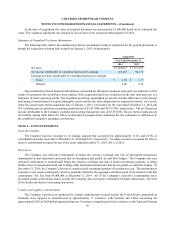

Accounts receivable:

Accounts receivable have been reduced by an allowance for doubtful accounts. The Company makes ongoing estimates

of the collectability of accounts receivable and maintains an allowance for estimated losses resulting from the inability of

the Company’s customers to make required payments.

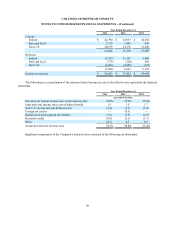

Inventories:

Inventories consist primarily of finished goods and are carried at the lower of cost or market. Cost is determined using

the first-in, first-out method. The Company periodically reviews its inventories for excess, close-out or slow moving items

and makes provisions as necessary to properly reflect inventory value.

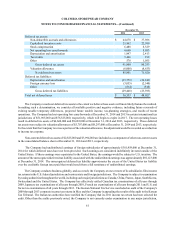

Property, plant, and equipment:

Property, plant and equipment are stated at cost, net of accumulated depreciation. Depreciation is provided using the

straight-line method over the estimated useful lives of the assets. The principal estimated useful lives are: land improvements,

15 years; buildings and building improvements, 15-30 years; furniture and fixtures, 3-10 years; and machinery, software

and equipment, 3-10 years. Leasehold improvements are depreciated over the lesser of the estimated useful life of the

improvement, which is most commonly 7 years, or the remaining term of the underlying lease.

Improvements to property, plant and equipment that substantially extend the useful life of the asset are capitalized.

Repair and maintenance costs are expensed as incurred. Internal and external costs directly related to the development of

internal-use software during the application development stage, including costs incurred for third party contractors and

employee compensation, are capitalized and depreciated over a 3-10 year estimated useful life.

Impairment of long-lived assets:

Long-lived assets are amortized over their estimated useful lives and are measured for impairment only when events

or circumstances indicate the carrying value may be impaired. In these cases, the Company estimates the future undiscounted

cash flows to be derived from the asset or asset group to determine whether a potential impairment exists. If the sum of

the estimated undiscounted cash flows is less than the carrying value of the asset, the Company recognizes an impairment

loss, measured as the amount by which the carrying value exceeds the estimated fair value of the asset. Impairment charges

for long-lived assets are included in SG&A expense and were $73,000, $8,995,000 and $1,653,000 for the years ended

December 31, 2014, 2013 and 2012, respectively. Charges during the years ended December 31, 2014 and 2012 were

recorded in the United States and EMEA regions for retail stores. The charge during the year ended December 31, 2013

was recorded in the EMEA region for its European distribution center.

Intangible assets and goodwill:

Intangible assets with indefinite useful lives and goodwill are not amortized but are periodically evaluated for

impairment. Intangible assets that are determined to have finite lives are amortized using the straight-line method over their

estimated useful lives and are measured for impairment only when events or circumstances indicate the carrying value may

be impaired.

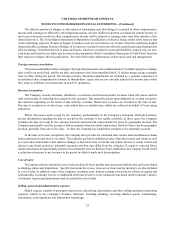

Impairment of intangible assets and goodwill:

The Company reviews and tests its intangible assets with indefinite useful lives and goodwill for impairment in the

fourth quarter of each year and when events or changes in circumstances indicate that the carrying amount of such assets

may be impaired. The Company’s intangible assets with indefinite lives consist of trademarks and trade names. Substantially

all of the Company’s goodwill is recorded in the United States segment and impairment testing for goodwill is performed