Columbia Sportswear 2014 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2014 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

58

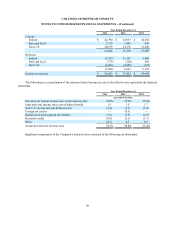

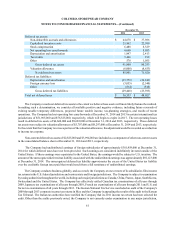

Intangible assets

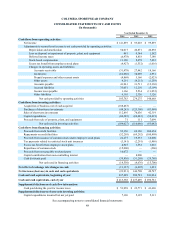

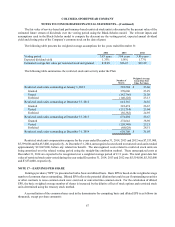

The following table summarizes the Company’s identifiable intangible assets balance (in thousands):

December 31,

2014 2013

Intangible assets subject to amortization:

Patents and purchased technology $ 14,198 $ 14,198

Customer relationships 23,000 —

Gross carrying amount 37,198 14,198

Accumulated amortization:

Patents and purchased technology (6,661) (5,331)

Customer relationships (2,227) —

Accumulated amortization (8,888) (5,331)

Net carrying amount 28,310 8,867

Intangible assets not subject to amortization 115,421 27,421

Intangible assets, net $ 143,731 $ 36,288

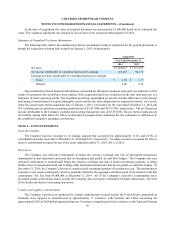

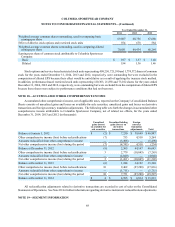

Amortization expense for the years ended December 31, 2014, 2013, and 2012 was $7,057,000, $1,330,000 and

$1,402,000, respectively. Amortization for the year ended December 31, 2014 included $3,500,000 of amortization related

to the prAna order backlog, which was fully amortized during the year. Annual amortization expense for intangible assets

subject to amortization is estimated to be $5,147,000 in 2015 and 2016, $3,883,000 in 2017 and $2,980,000 in 2018 and

2019.

Goodwill

Goodwill was $68,594,000 and $14,438,000 at December 31, 2014 and 2013, respectively. During the year ended

December 31, 2014, goodwill increased $54,156,000, net of a remeasurement period adjustment of $663,000, related to the

prAna acquisition (see Note 3).

At December 31, 2014, 2013 and 2012, the Company determined that its goodwill and intangible assets were not

impaired.

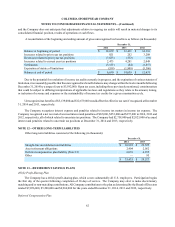

NOTE 9—SHORT-TERM BORROWINGS AND CREDIT LINES

The Company has a domestic credit agreement for an unsecured, committed $125,000,000 revolving line of credit.

The maturity date of this agreement is July 1, 2019. Interest, payable monthly, is based on the Company’s applicable funded

debt ratio, ranging from USD LIBOR plus 87.5 to 162.5 basis points. This line of credit requires the Company to comply

with certain financial covenants covering net income, funded debt ratio, fixed charge coverage ratio and borrowing basis.

If the Company is in default, it is prohibited from paying dividends or repurchasing common stock. At December 31, 2014,

the Company was in compliance with all associated covenants. At December 31, 2014 and 2013, no balance was outstanding

under this line of credit.

The Company’s Canadian subsidiary has available an unsecured and uncommitted line of credit guaranteed by the

parent company providing for borrowing up to a maximum of C$30,000,000 (US$25,815,000) at December 31, 2014. The

revolving line accrues interest at the bank’s Canadian prime rate. At December 31, 2014 and 2013, there was no balance

outstanding under this line of credit.

The Company’s European subsidiary has available two separate unsecured and uncommitted lines of credit guaranteed

by the parent company providing for borrowing up to a maximum of €25,800,000 and €5,000,000, respectively (combined

US$37,261,000), at December 31, 2014, of which US$2,782,000 of the €5,000,000 line is designated as a European customs

guarantee. These lines accrue interest based on the European Central Bank refinancing rate plus 50 basis points and the