Cisco 2002 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2002 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Cisco Systems, Inc. 2002 Annual Report 47

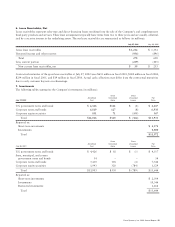

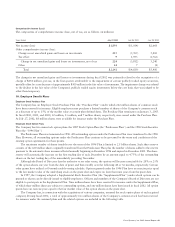

The following table presents net sales for groups of similar products and services (in millions):

Years Ended July 27, 2002 July 28, 2001 July 29, 2000

Net sales:

Routers $ 5,607 $ 7,179 $ 6,801

Switches 7,560 8,979 6,791

Access 980 1,855 2,205

Other 1,522 1,546 1,205

Product 15,669 19,559 17,002

Service 3,246 2,734 1,926

Total $18,915 $22,293 $18,928

The majority of the Company’s assets at July 27, 2002 and July 28, 2001 were attributable to its U.S. operations. In fiscal 2002,

2001, and 2000, no single customer accounted for 10% or more of the Company’s net sales.

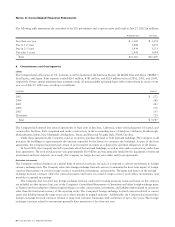

13. Net Income (Loss) per Share

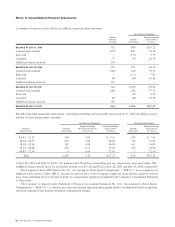

The following table presents the calculation of basic and diluted net income (loss) per share (in millions, except per-share amounts):

Years Ended July 27, 2002 July 28, 2001 July 29, 2000

Net income (loss) $ 1,893 $ (1,014) $ 2,668

Weighted-average shares—basic 7,301 7,196 6,917

Effect of dilutive potential common shares 146 – 521

Weighted-average shares—diluted 7,447 7,196 7,438

Net income (loss) per share—basic $ 0.26 $ (0.14) $ 0.39

Net income (loss) per share—diluted $ 0.25 $ (0.14) $ 0.36

Dilutive potential common shares consist of employee stock options and restricted common stock. The weighted-average

dilutive potential common shares, which were antidilutive for fiscal 2001, amounted to 348 million shares. Employee stock

options to purchase approximately 712 million shares in fiscal 2002 and 426 million shares in fiscal 2001 were outstanding,

but were not included in the computation of diluted earnings per share because the exercise price of the stock options was greater

than the average share price of the common shares and, therefore, the effect would have been antidilutive. The antidilutive

employee stock options were not material in fiscal 2000.

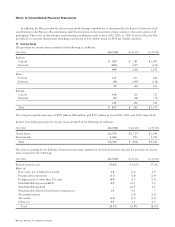

14. Subsequent Event

On August 19, 2002, Cisco entered into a definitive agreement to acquire privately held Andiamo Systems, Inc. (“Andiamo”). As

disclosed in Note 8, Cisco entered into agreements with Andiamo under which Cisco was granted the right to acquire Andiamo.

This definitive agreement represented Cisco’s exercise of this right. The acquisition of Andiamo is expected to close in the third

quarter of fiscal year 2004 (February to April 2004), but no later than July 31, 2004.

Under the terms of the agreement, common stock of Cisco will be exchanged for all outstanding shares and options of Andiamo

not owned by Cisco at the closing of the acquisition. The amount of the purchase price for the remaining equity interests in

Andiamo not then held by Cisco is not determinable at this time, but will be based primarily upon a valuation of Andiamo to

be determined by applying a multiple to the actual, annualized revenue generated from sales by Cisco of products attributable to

Andiamo during a three-month period shortly preceding the closing. Under its agreements with Andiamo, Cisco is the exclusive

manufacturer and distributor of all Andiamo products. The multiple will be equal to Cisco’s average market capitalization during

a specified period divided by Cisco’s annualized revenue for a three-month period prior to closing, subject to adjustment as follows:

(i) if the multiple so calculated is less than 10, then the multiple to be used for purposes of determining the transaction price shall

be the midpoint between 10 and the multiple so calculated; (ii) if the multiple so calculated is greater than 15, then the multiple

to be used for purposes of determining the transaction price shall be the midpoint between 15 and the multiple so calculated. There

is no minimum purchase price, and the maximum purchase price is limited to approximately $2.5 billion in shares of Cisco common

stock valued at the time of closing.

The acquisition has received the required approvals from both companies and is subject to various closing conditions and

approvals, including stockholder approval by Andiamo. In connection with this acquisition, Cisco filed a Current Report on Form 8-K.