Cisco 2002 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2002 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

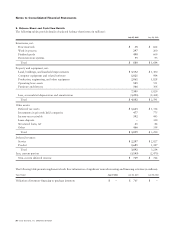

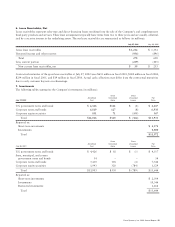

Notes to Consolidated Financial Statements

38 Cisco Systems, Inc. 2002 Annual Report

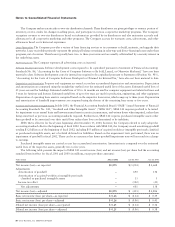

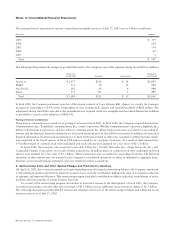

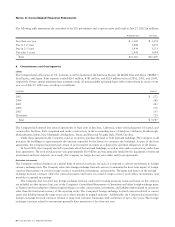

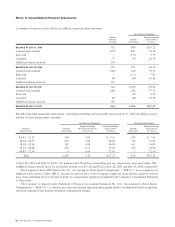

The following table summarizes the maturities of the U.S. government and corporate notes and bonds at July 27, 2002 (in millions):

Amortized Cost Fair Value

Less than one year $ 3,160 $ 3,172

Due in 1-2 years 1,608 1,636

Due in 2-5 years 3,439 3,553

Due after 5 years 2,958 3,044

Total $11,165 $11,405

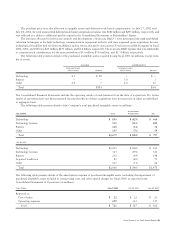

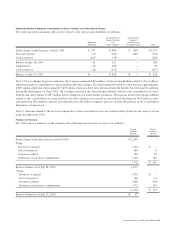

8. Commitments and Contingencies

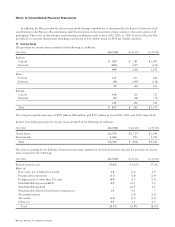

Leases

The Company leases office space in U.S. locations, as well as locations in the Americas; Europe, the Middle East, and Africa (“EMEA”);

Asia Pacific; and Japan. Rent expense totaled $265 million, $381 million, and $229 million in fiscal 2002, 2001, and 2000,

respectively. Future annual minimum lease payments under all noncancelable operating leases with an initial term in excess of one

year as of July 27, 2002 were as follows (in millions):

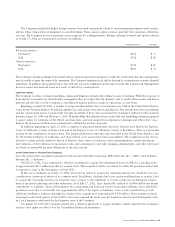

Fiscal Year Amount

2003 $ 272

2004 260

2005 221

2006 170

2007 135

Thereafter 729

Total $ 1,787

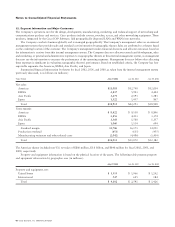

The Company had entered into several agreements to lease sites in San Jose, California, where its headquarters is located, and

certain other facilities, both completed and under construction, in the surrounding areas of San Jose, California; Boxborough,

Massachusetts; Salem, New Hampshire; Richardson, Texas; and Research Triangle Park, North Carolina.

Under these agreements, the Company could, at its option, purchase the land or both land and buildings. The Company could

purchase the buildings at approximately the amount expended by the lessors to construct the buildings. As part of the lease

agreements, the Company had restricted certain of its investment securities as collateral for specified obligations of the lessors.

In fiscal 2002, the Company elected to purchase all of the land and buildings, as well as sites under construction, under these

lease agreements. The total purchase price was approximately $1.9 billion and was primarily funded by the liquidation of restricted

investments and lease deposits. As a result, the Company no longer has any sites under such lease agreements.

Derivative Instruments

The Company conducts business on a global basis in several currencies. As such, it is exposed to adverse movements in foreign

currency exchange rates. The Company enters into foreign exchange forward contracts to minimize the short-term impact of foreign

currency fluctuations on certain foreign currency receivables, investments, and payables. The gains and losses on the foreign

exchange forward contracts offset the transaction gains and losses on certain foreign currency receivables, investments, and

payables recognized in earnings.

The Company does not enter into foreign exchange forward contracts for trading purposes. Gains and losses on the contracts

are included in other income (loss), net, in the Company’s Consolidated Statements of Operations and offset foreign exchange gains

or losses from the revaluation of intercompany balances or other current assets, investments, and liabilities denominated in currencies

other than the functional currency of the reporting entity. The Company’s foreign exchange forward contracts related to current

assets and liabilities generally range from one to three months in original maturity. Additionally, the Company has entered into

foreign exchange forward contracts related to long-term customer financings with maturities of up to two years. The foreign

exchange contracts related to investments generally have maturities of less than one year.