Cisco 2002 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2002 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

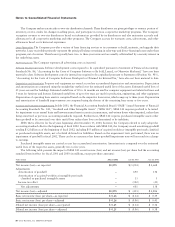

Notes to Consolidated Financial Statements

36 Cisco Systems, Inc. 2002 Annual Report

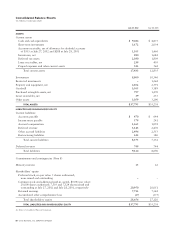

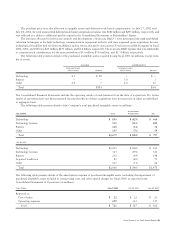

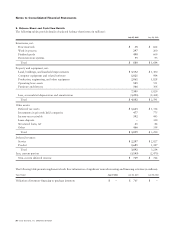

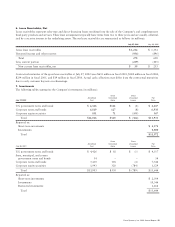

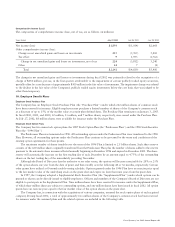

5. Balance Sheet and Cash Flow Details

The following tables provide details of selected balance sheet items (in millions):

July 27, 2002 July 28, 2001

Inventories, net:

Raw materials $38 $ 662

Work in process 297 260

Finished goods 490 669

Demonstration systems 55 93

Total $ 880 $ 1,684

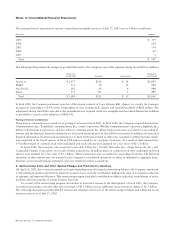

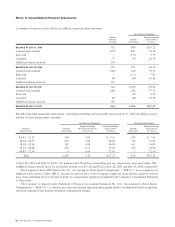

Property and equipment, net:

Land, buildings, and leasehold improvements $ 3,352 $ 1,300

Computer equipment and related software 1,021 984

Production, engineering, and other equipment 2,061 1,828

Operating lease assets 505 551

Furniture and fixtures 366 366

7,305 5,029

Less, accumulated depreciation and amortization (3,203) (2,438)

Total $ 4,102 $ 2,591

Other assets:

Deferred tax assets $ 1,663 $ 1,314

Investments in privately held companies 477 775

Income tax receivable 392 443

Lease deposits –320

Structured loans, net 61 84

Other 466 354

Total $ 3,059 $ 3,290

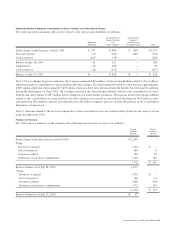

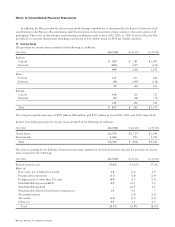

Deferred revenue:

Service $ 2,207 $ 2,027

Product 1,685 1,187

Total 3,892 3,214

Less, current portion (3,143) (2,470)

Non-current deferred revenue $ 749 $ 744

The following table presents supplemental cash flow information of significant noncash investing and financing activities (in millions):

Years Ended July 27, 2002 July 28, 2001 July 29, 2000

Utilization of inventory financing to purchase inventory $– $ 765 $ –