Cisco 2002 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2002 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

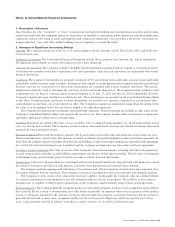

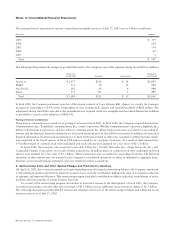

Notes to Consolidated Financial Statements

32 Cisco Systems, Inc. 2002 Annual Report

In July 2002, the FASB issued Statement of Financial Accounting Standards No. 146, “Accounting for Costs Associated with

Exit or Disposal Activities” (“SFAS 146”). SFAS 146 requires that a liability for costs associated with an exit or disposal activity

be recognized and measured initially at fair value only when the liability is incurred. SFAS 146 is effective for exit or disposal

activities that are initiated after December 31, 2002. The Company does not expect the adoption of SFAS 146 to have a material

impact on its operating results or financial position.

Reclassifications Certain reclassifications have been made to prior year balances in order to conform to the current year presentation.

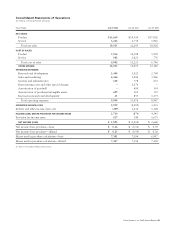

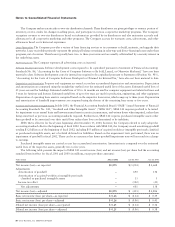

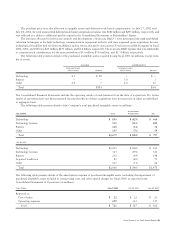

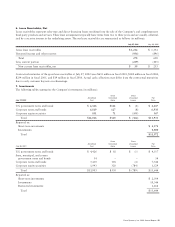

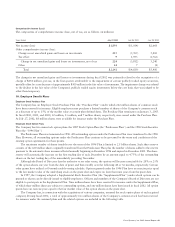

3. Business Combinations

Purchase Combinations

During the year ended July 27, 2002, the Company completed a number of purchase acquisitions which are summarized as follows

(in millions):

Consideration Purchased

Including Assumed In-Process Intangible

Acquired Company Liabilities R&D Expense Goodwill Assets

Allegro Systems, Inc. $ 164 $ 28 $ 19 $ 105

AuroraNetics, Inc. 51 9 16 14

Hammerhead Networks, Inc. 175 27 105 –

Navarro Networks, Inc. 85 1 73 –

Total $ 475 $ 65 $ 213 $ 119

The Company acquired Allegro Systems, Inc. to enhance its existing virtual private network (VPN) and security solutions. The

Company acquired AuroraNetics, Inc. to enhance its development of high-end routing technologies in the metropolitan network

environment. The Company acquired Hammerhead Networks, Inc. to augment its Internet Protocol aggregation portfolio consisting

of cable, broadband, and leased-line products. The Company acquired Navarro Networks, Inc. to complement its continued

development of Ethernet switching solutions.

In connection with the acquisition of AuroraNetics, Inc., the Company may be required to pay certain additional amounts of

up to $100 million, payable in common stock and to be accounted for under the purchase method, contingent upon the company

achieving certain agreed-upon technology and other milestones.

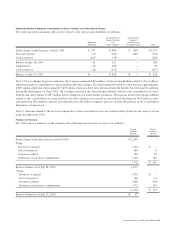

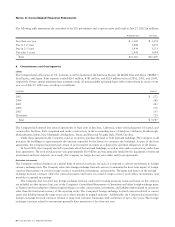

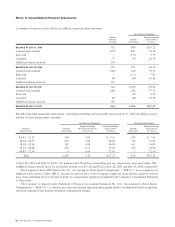

A summary of the purchase transactions completed in fiscal 2001 and 2000 is outlined as follows (in millions):

Consideration Purchased

Including Assumed In-Process Intangible

Acquired Company Liabilities R&D Expense Goodwill Assets

FISCAL 2001

IPmobile, Inc. $ 422 $ 181 $ 144 $ 13

NuSpeed, Inc. 463 164 212 2

IPCell Technologies, Inc. 213 75 73 29

PixStream Incorporated 395 67 170 145

Active Voice Corporation 266 37 151 99

Radiata, Inc. 211 29 71 99

Other 903 302 150 237

Total $2,873 $ 855 $ 971 $624

FISCAL 2000

Monterey Networks, Inc. $ 517 $ 354 $ 102 $ 52

The optical systems business of Pirelli S.p.A. 2,018 245 1,426 291

Aironet Wireless Communications, Inc. 835 243 400 189

JetCell, Inc. 203 88 67 70

Qeyton Systems 887 260 540 27

Other 509 183 245 90

Total $4,969 $ 1,373 $ 2,780 $719