Cisco 2002 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2002 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

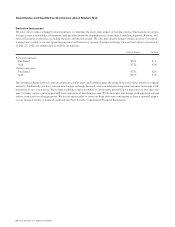

Management’s Discussion and Analysis of Financial Condition and Results of Operations

22 Cisco Systems, Inc. 2002 Annual Report

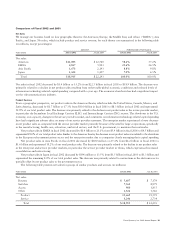

In the case of Andiamo, as of July 27, 2002, we had an option to acquire the remaining interests not owned by us for consideration

consisting of shares of our common stock. In addition, Andiamo had a put option enabling them to require us to acquire the

remaining interests not owned by us, subject to the fulfillment of various conditions, including the achievement of specified

technology and other milestones. As of July 27, 2002, we funded $63 million of our $84 million investment commitment to Andiamo.

Upon full funding of the commitment and based on certain terms and conditions, we will hold a promissory note that is convertible

into approximately 44% of the equity of Andiamo. We are also committed to provide additional funding to Andiamo through the

closing of the acquisition of approximately $100 million. Since making our initial investment in the third quarter of fiscal 2001,

we have expensed the entire amount funded as R&D costs, as if such expenses constituted our development costs.

On August 19, 2002, we entered into a definitive agreement to acquire Andiamo, which represented the exercise of our rights

(see Note 14 to the Consolidated Financial Statements).

Purchase Commitments with Contract Manufacturers and Suppliers We use several contract manufacturers and suppliers to provide

manufacturing services for our products. During the normal course of business, in order to reduce manufacturing lead times and

ensure adequate component supply, we enter into agreements with certain contract manufacturers and suppliers that allow them

to procure inventory based upon criteria as defined by us. As of July 27, 2002, we have purchase commitments for inventory of

approximately $800 million.

Other Commitments In fiscal 2001, we entered into an agreement to invest approximately $1.0 billion in venture funds managed

by SOFTBANK Corp. and its affiliates (“SOFTBANK”). These venture funds are required to be funded upon demand by SOFTBANK.

As of July 27, 2002, we have funded $100 million of this investment commitment.

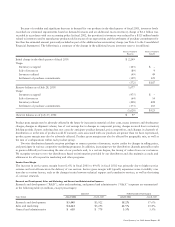

We provide structured financing to certain qualified customers to be used for the purchase of equipment and other needs

through our wholly-owned subsidiary, Cisco Systems Capital Corporation. At July 27, 2002, the outstanding loan commitments

were approximately $948 million, subject to the customers achieving certain financial covenants, of which approximately

$209 million was eligible for draw down. These loan commitments may be funded over a two- to three-year period, provided

that these customers achieve specific business milestones and financial covenants.

We have entered into several agreements to purchase or construct real estate, subject to the satisfaction of certain conditions.

As of July 27, 2002, the total amount of commitments, if certain conditions are met, was approximately $491 million.

At July 27, 2002, we have a commitment of approximately $190 million to purchase the remaining portion of the minority

interest of Cisco Systems, K.K. (Japan).

We also have certain other funding commitments of approximately $152 million at July 27, 2002 related to our privately

held investments.

Stock Repurchase Program

In September 2001, the Board of Directors authorized a stock repurchase program to acquire outstanding common stock in the

open market or negotiated transactions. Under the program, up to $3 billion of our common stock could be reacquired over two

years. In August 2002, the Board of Directors increased our stock repurchase program by $5 billion to a total of $8 billion of

our common stock available for repurchase through September 12, 2003.

During fiscal 2002, we repurchased and retired approximately 124 million shares of our common stock for an aggregate

purchase price of approximately $1.9 billion. Including the amount approved by the Board of Directors in August 2002 as discussed

above, the remaining authorized amount for stock repurchase is $6.1 billion.

Based on past performance and current expectations, we believe that our cash and cash equivalents, short-term investments, and

cash generated from operations will satisfy our working capital needs, capital expenditures, investment requirements, stock

repurchases, commitments (see Note 8 to the Consolidated Financial Statements), future customer financings, and other liquidity

requirements associated with our existing operations through at least the next 12 months. In addition, there are no transactions,

arrangements, and other relationships with unconsolidated entities or other persons that are reasonably likely to materially affect

liquidity or the availability of our requirements for capital resources.